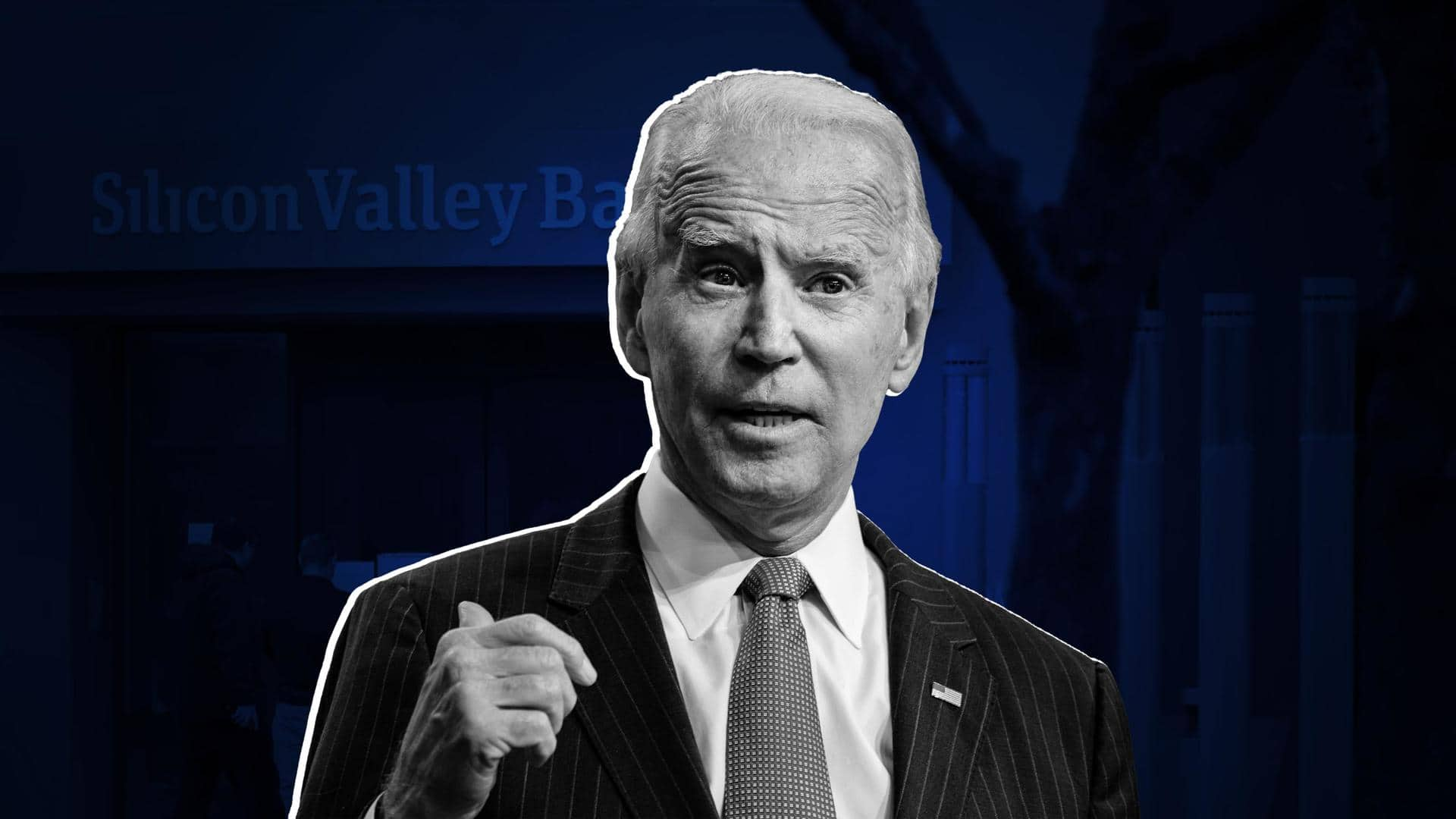

Biden promises to fix 'mess' as second US bank collapses

What's the story

After the recent collapse of the Silicon Valley Bank (SVB) and Signature Bank (SB), United States (US) President Joe Biden has promised to hold everyone responsible for the failure of the banks "fully accountable." The US administration has also released a series of emergency measures to try and boost people's confidence in the banking system in the aftermath of the recent banking crisis.

Context

Why does this story matter?

On Friday, the California banking regulators shut down SVB after a dramatic 48 hours that saw the high-tech lender's share value significantly plunge after a run-on deposit by concerned clients. The company was later taken over by the US Federal Deposit Insurance Corporation (FDIC) to prevent further damage. Biden's comments followed the failures of SVB and the New York-based SB.

Details

Will maintain resilient banking system: Biden

"I am firmly committed to holding those responsible for this mess fully accountable and to continuing our efforts to strengthen oversight and regulation of larger banks so that we are not in this position again," Biden said. "I will deliver remarks on how we will maintain a resilient banking system to protect our historic economic recovery," he was quoted as saying by AFP.

More details

Biden praises Treasury Secretary and NEC director

Biden further revealed that US Treasury Secretary Janet Yellen and National Economic Council (NEC) Director Lael Brainard worked diligently with the banking regulators to address the crisis at the two American banks. The US president then went on to add, "The American people and American businesses can have confidence that their bank deposits will be there when they need them."

Further information

Details on SVB's collapse

The US's 16th largest bank recorded a historic collapse and was officially closed by the California banking regulators on Friday. SVB crumpled after a dramatic 48 hours in which a bank run and capital crisis triggered the second-biggest economic institution collapse in US history. Its decline can partly be attributed to the Federal Reserve's aggressive interest rate hikes over the last year.

More information

Netanyahu warns about consequences of SVB's collapse

On Saturday, Israeli PM Benjamin Netanyahu warned that the implosion of SVB created a big crisis in the tech industry. Netanyahu tweeted, "If necessary, out of responsibility to Israeli high-tech companies and employees, we will take steps to assist the Israeli companies, whose center of activity is in Israel, to weather the cash-flow crisis that has been created for them due to the turmoil."

Know more

More banks likely to fail despite intervention: Expert

"This was not a bailout. During the GFC, the government's injected taxpayer money in the form of preferred stock into banks," Pershing Square Capital Management CEO Bill Ackman tweeted following the banks' collapse. "Bondholders were protected and shareholders were diluted to varying degrees. Taxpayer money was put at great risk...Many people who screwed up suffered minimal to no consequences. Those were bailouts," he added.

Twitter Post

Ackman's Twitter post

This was not a bailout. During the GFC, the gov’t injected taxpayer money in the form of preferred stock into banks. Bondholders were protected and shareholders were diluted to varying degrees. Taxpayer money was put at great risk. Many people who screwed up suffered minimal to… https://t.co/mjwcnVRV9X

— Bill Ackman (@BillAckman) March 13, 2023