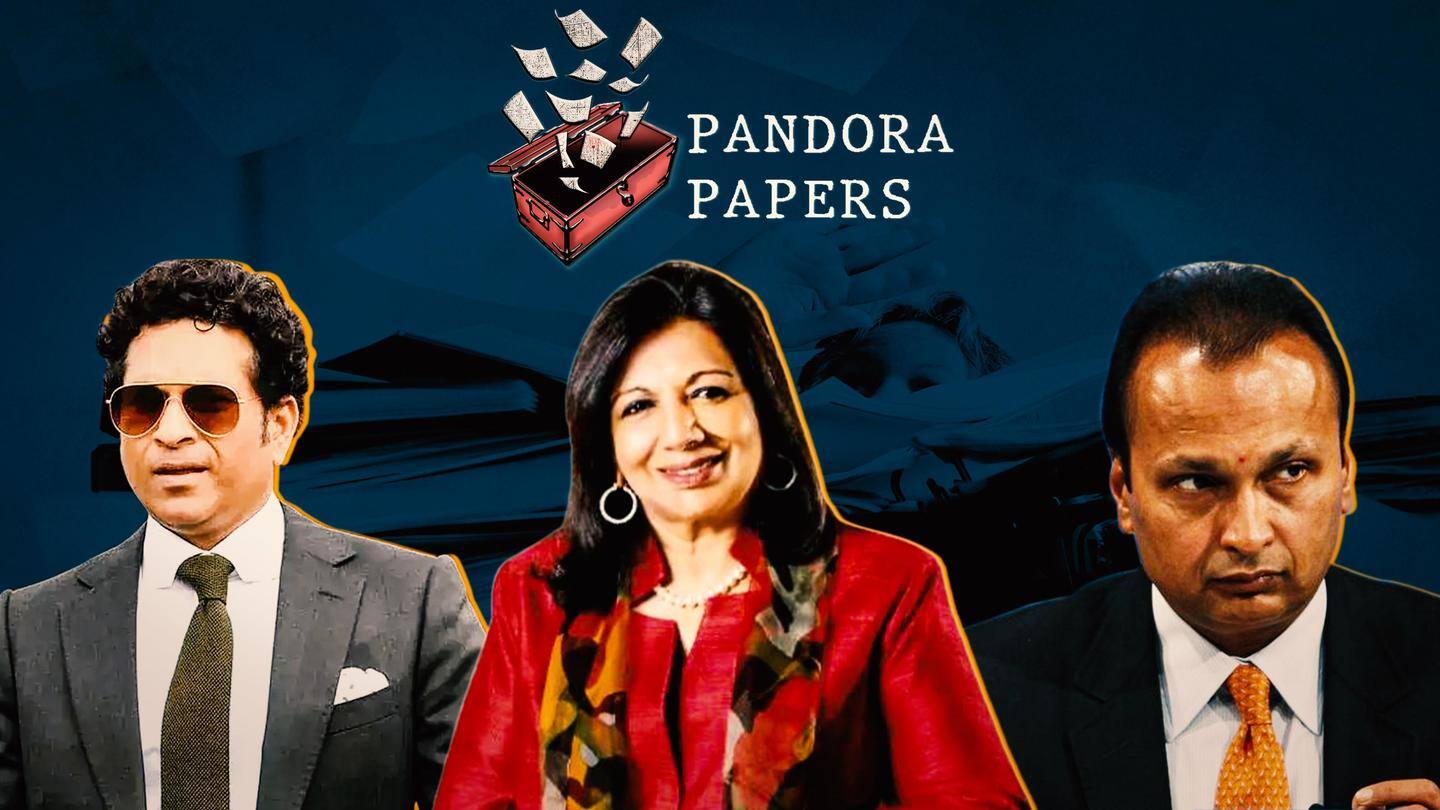

Pandora Papers: Hidden riches of Sachin Tendulkar, Ambani, others exposed

What's the story

Cricketer Sachin Tendulkar, Reliance ADAG chief Anil Ambani, Biocon's Kiran Mazumdar Shaw are among over 300 Indians who have hidden their wealth in offshore accounts, the Pandora Papers leak has found.

The International Consortium of Investigative Journalists (ICIJ) exposed the "Pandora Papers"—the largest offshore data leak—which has reportedly revealed the assets of over 100 billionaires, 30 world leaders, 300 public officials, among others.

Definition

What are the Pandora Papers?

Dubbed the Pandora Papers, the leak includes 11.9 million leaked files from 14 global corporate services firms.

These firms had established as many as 29,000 off-the-shelf companies and private trusts in "tax havens"—including Panama, Dubai, Monaco, Switzerland, and the Cayman Islands—along with countries such as Singapore, New Zealand, and the United States.

The files expose the secret offshore affairs of several global elites.

Details

Who all have been exposed?

According to The Indian Express, around 380 names of Indian nationality feature in the Pandora Papers.

Globally, the list comprises world leaders, including current and former Presidents, heads of state, Prime Ministers, celebrities, billionaires, among others.

Notably, Anil Ambani—who has declared bankruptcy—has 18 asset holding offshore firms.

Reportedly, Nirav Modi's sister had established a trust fund a month before he fled India.

Details

Associates of Putin, suspected of hiding fortune, named

The Pandora Papers also reveal the asset holdings of Jordan's King, Czech Prime Minister, former British PM Tony Blair, and the Presidents of Ukraine, Kenya, Ecuador—some of whom had portrayed themselves as anti-corruption crusaders.

Russian President Vladimir Putin does not appear on the list but several of his close associates do. Putin has been suspected of having a secret fortune by the US.

Legitimacy

Is it illegal?

Although establishing offshore entities is not illegal in itself, it is a loophole often exploited by tax evaders, fraudsters, and money launderers (many have been named in the leak).

The exploitation of such entities for tax evasion costs governments billions in lost revenue.

The leak also exposes the role of London—home to wealth managers, law firms, company formation agents, and accountants—who serve ultra-rich clients.

Quote

'Money lost could've been used for COVID-19 recovery'

"This is the Panama Papers on steroids," ICIJ Director Gerard Ryle said. "It's broader, richer, and has more detail."

Ryle added, "This is money that is being lost to treasuries around the world and money that could be used to recover from COVID-19...We're losing out because some people are gaining. It's as simple as that. It's a very simple transaction that's going on here."

History

How does it compare to Panama and Paradise leaks?

In terms of data volume, the Pandora Papers represent the largest offshore data leak, containing 2.94 terabytes of data.

In comparison, the Panama Papers contained 2.6 terabytes of data leaked from the law firm Mossack Fonseca in 2016.

The following year's Paradise Papers contained 1.4 terabytes of data. This leak mostly comprised data from the offshore provider Appleby.

Concerns

Has anything changed since the previous leaks?

The Pandora Papers also highlight how previous leaks have caused the ultra-rich to shift and mask their offshore entities better.

For instance, Mossack Fonseca's clients have simply shifted to other firms. One customer justified the move saying, "Business decision to exit following the Panama Papers."

Tendulkar himself sought the liquidation of his entity in the British Virgin Islands three months after the Panama leak.