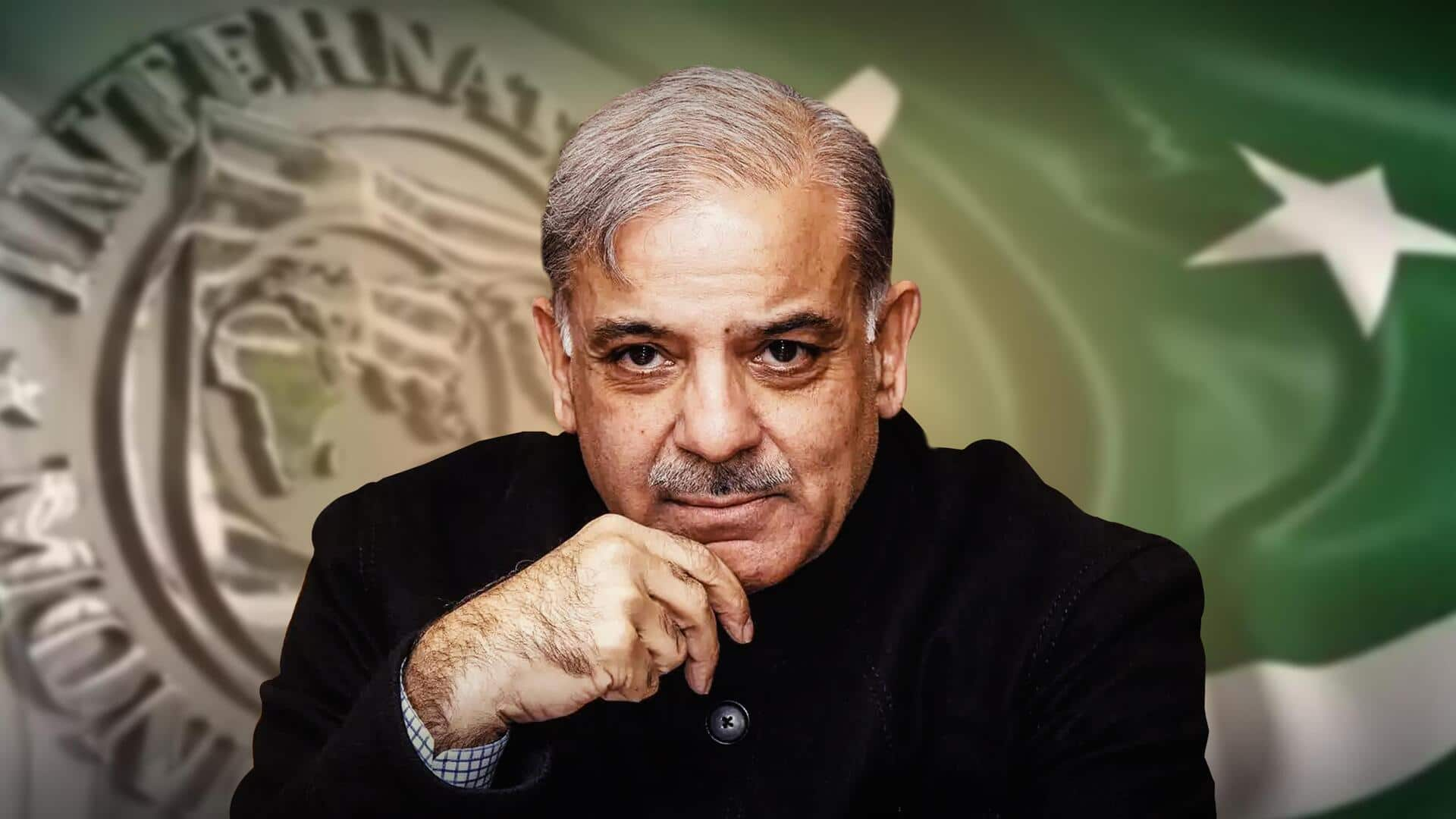

Pakistan's new government to seek $6 billion IMF loan: Reports

What's the story

Pakistan is seeking a new loan of at least US$6 billion from the International Monetary Fund (IMF) to help the incoming government repay billions of dollars in debt due this year. The country plans to negotiate an Extended Fund Facility with the IMF, with discussions expected to begin in March-April. Notably, two days ago, the Pakistan Muslim League-Nawaz (PML-N) and the Pakistan People's Party (PPP) announced to form a coalition government, with the aim to focus on the economic crisis.

Context

Why does this story matter?

The country—where general elections were held on February 8—is experiencing the biggest economic crisis in its history. Pakistan's current US$3 billion grant program from the IMF runs out next month. The country averted a "default" last summer due to a last-minute, short-term IMF bailout. Securing a new and much bigger bailout package is widely seen as the top priority for the incoming administration.

Financial crunch

Addressing debt and economic challenges

With US$25 billion of external debt payments due in the fiscal year starting in July, Pakistan faces a financial challenge that is about three times its foreign exchange reserves. The Extended Fund Facility loans are generally approved for three to four years to support policies that address structural imbalances and are repaid after four-and-a-half to 12 years. The IMF has stated it is "available, if requested, to support the post-election government through a new arrangement to address Pakistan's ongoing challenges."

IMF proceedings

Focus on long-term economic changes

The IMF is currently discussing long-term economic changes with Pakistan. The list encompasses ways to increase government revenues, enhance the energy sector, liberalize the country's exchange rate, revamp state-owned enterprises, and boost its resilience to climate shocks. Shehbaz Sharif, nominated as prime minister, said last week that negotiating a fresh IMF loan will be a priority for the new administration.

Economic crisis

How much is Pakistan's overall debt

At present, the country's total foreign exchange reserves stand at roughly US$8 billion, which barely covers two months of essential imports, as reported by Deccan Herald. The country is also due to pay US$1 billion in bond payments in two months, which will cut them further. The only sign of relief is the injection of US$700 million of already approved IMF money. Pakistan's debt-to-GDP ratio is already above 70%.