Austrian heiress to give away €25M fortune for this reason

What's the story

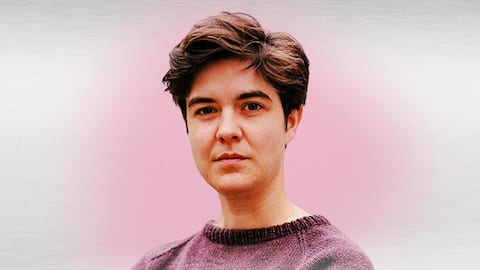

Marlene Engelhorn, an Austrian heiress to chemical company BASF, is challenging the status quo by involving citizens in deciding how to redistribute €25 million ($27 million) of her inheritance. Frustrated with the lack of inheritance tax and political action, she's empowering 50 randomly selected Austrians to form the Good Council for Redistribution. This bold move sparks a dialogue on wealth, politics, and citizen-led change.

Austria's tax quirks

Austria's tax quirks and Engelhorn's dilemma

Austria abolished inheritance tax in 2008, making it one of the few European nations without such levies. Engelhorn's discontent with this tax loophole fuels her unconventional approach. The heiress grapples with the ethical quandary of inheriting immense wealth without contributing to society, prompting her to champion a citizen-led redistribution model amid a political landscape resistant to reinstating inheritance tax.

Redistribution

formation of Good Council for Redistribution

10,000 Austrians have been invited to join the Good Council for Redistribution and those wishing to participate can apply. Then selected group of 50 citizens, spanning ages (above 16), regions, and backgrounds, will collaboratively decide €25 million's fate. Aiming for inclusivity, the initiative offers compensation, covering travel costs and providing €1,200 per weekend, recognizing the value of participants' time and ideas.

Challenges

Challenges and hopes in wealth redistribution

As the Good Council convenes, participants face the task of formulating a widely supported decision on wealth distribution. The initiative aims to bridge societal gaps and spark democratic dialogue. Engelhorn emphasizes her trust in the citizens, emphasizing that if the council fails to reach a consensus, the money reverts to her. This unconventional approach raises questions about the efficacy of such citizen-led initiatives.

Tax debate

Austria's inheritance tax debate reignited

Sixteen years post the abolition of inheritance tax in Austria, the topic remains contentious. Opposition parties, like the Social Democrats, advocate for its reinstatement, while the current government, led by the People's Party, staunchly opposes new taxes. Engelhorn's initiative adds fuel to the ongoing political debate, prompting discussions on wealth, taxation, and the role of citizens in shaping fiscal policies.

Citizen-led initiatives

The future of citizen-led initiatives

Engelhorn's experiment challenges the conventional power structures, placing wealth distribution in the hands of citizens. As Austria heads towards its next general election, the initiative sparks discussions on the role of inheritance tax in shaping the nation's economic landscape. The outcome of this experiment may influence future philanthropic models, encouraging a shift towards more inclusive, citizen-centric approaches to wealth redistribution.