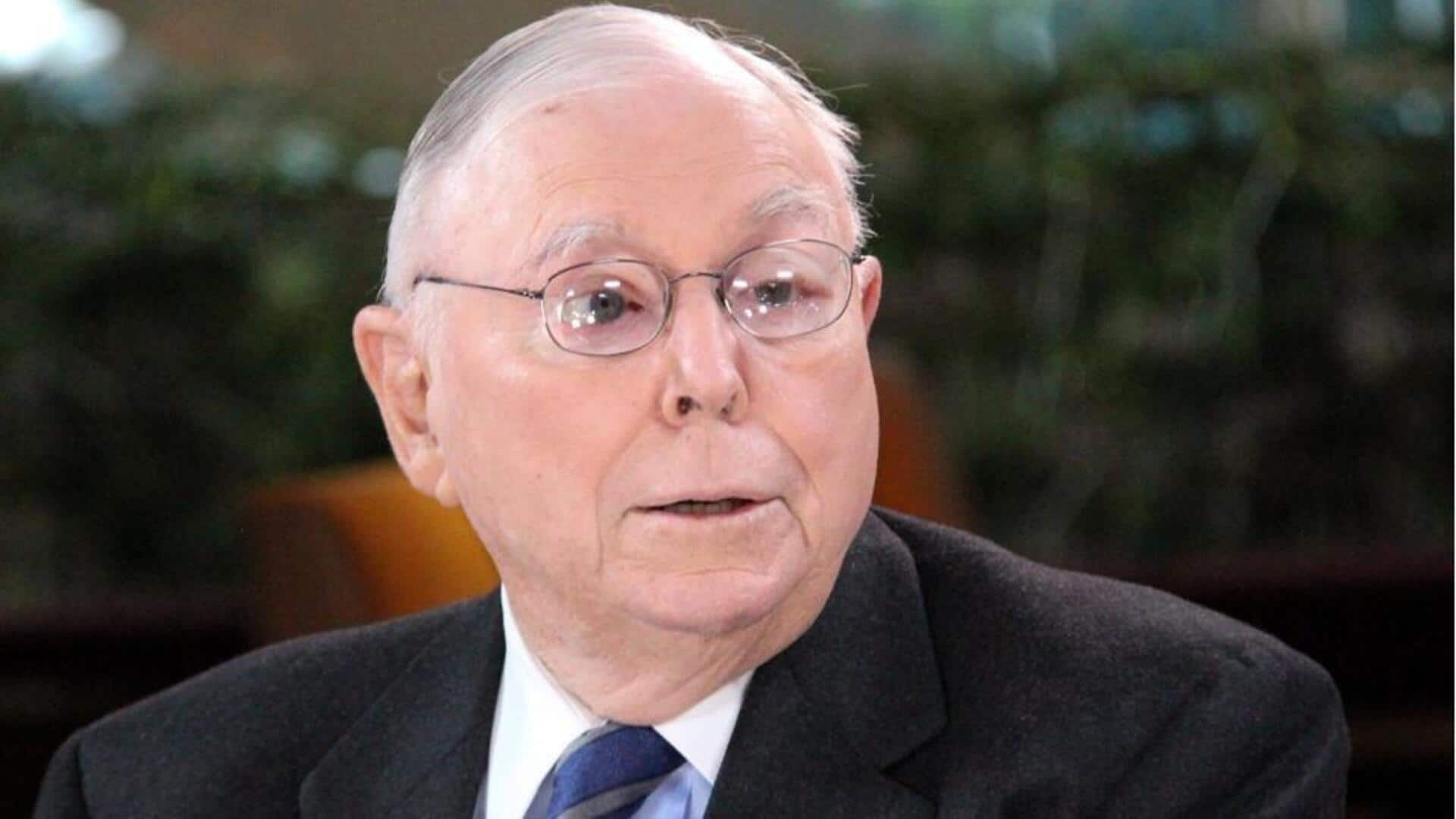

Charlie Munger, Warren Buffett's longtime business partner, dies at 99

What's the story

Billionaire Charlie Munger, Warren Buffett's right-hand man at Berkshire Hathaway, died on Tuesday, aged 99. He would have turned 100 on New Year's Day. "Berkshire Hathaway could not have been built to its present status without Charlie's inspiration, wisdom and participation," Buffett (93) said in the statement. Wall Street mourned his death. The cause of his death was not disclosed.

Details

End of an era in the investment world

Munger's passing marks the end of an era in the investing world, especially corporate America. He helped Buffett create a mantra for long-term investment in companies. Munger was worth $2.7 billion, according to Forbes. He continued commenting on global markets until a few weeks ago, calling Buffett's decision to invest billions of dollars in Japan a "no-brainer" and "awfully easy money."

Background

Served in World War II

Born Charles Thomas Munger in 1924 in Omaha, Nebraska, he served in the US Army in World War II. After the war, he graduated with honors from Harvard Law School in 1948. He once worked in a grocery store owned by Buffett's family, Reuters reported. He met Buffett in 1959 at his father's funeral and officially joined Berkshire Hathaway as a vice-chairman in 1978.

Investment

Munger broadened my investment strategy: Buffett

Buffett credited Munger with enhancing his investment strategy to focus on higher-quality but underpriced companies rather than investing in troubled companies at low prices in hopes of profit. In 1972, he persuaded Buffett to buy See's Candies for $25 million despite the company's pre-tax earnings being $4 million per annum. Since then, it has produced over $2 billion in sales for Berkshire.

Berkshire

Berkshire's shares returned 18% annually since 1978

Berkshire's shares have returned 18% annually since 1978, which is double the Standard and Poor's 500 (S&P 500) index. Though Munger was not involved in Berkshire's everyday functioning, the conglomerate is reportedly unlikely to replace him and has not publicly expressed any such intent. Two other vice-chairmen, Greg Abel and Ajit Jain, will oversee the day-to-day operations of Berkshire's non-insurance and insurance businesses, respectively.

Profile

Munger oversaw a host of companies

Apart from being Berkshire vice-chairman, he was the chairman and publisher of the Daily Journal Corporation, a member of the Costco board, a real estate attorney, a philanthropist, and an architect. He was the chairman and CEO of Wesco Financial from 1984 to 2011 when Berkshire bought the remaining shares of the insurance and investment company it didn't own.