A step-by-step guide to using WhatsApp Pay

What's the story

WhatsApp is testing its payment feature in India which will allow users to send and receive money through the chat app. WhatsApp Pay is based on the Indian government's Unified Payments Interface (UPI), a real-time payment system that merges several bank accounts into a single platform. If you are a part of the initial roll-out, here is how you can use the feature.

The Setup

First up, link your bank account to WhatsApp Pay

You will first have to link your bank account to WhatsApp. This can be done by going to Settings > Payments > Bank Accounts. Go through the terms and conditions and add a new account. For successful linking, please make sure that your WhatsApp number and your mobile number linked to your bank account are the same.

The Confirmation

Create a UPI pin for authentication of transactions

Once your mobile number has been verified, you can choose from the list of over 70 Indian banks for the account you want to link to WhatsApp Pay. Finally, enter the last six digits of your debit card and its expiry date, and your bank account addition is done. Next, set up a four-digit UPI pin that will be used to authenticate your transactions.

The Payment

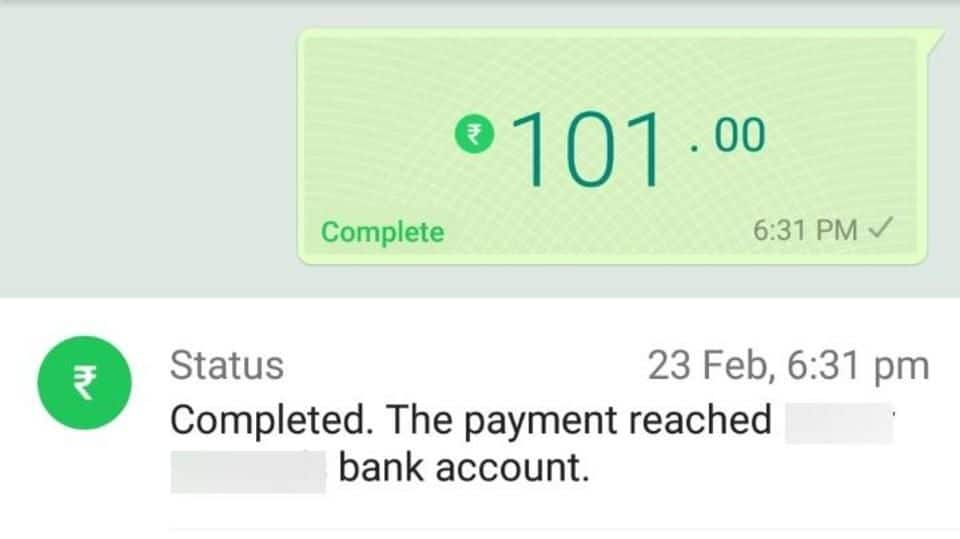

Get ready to settle that pizza bill through WhatsApp Pay

Now you can make your first payment on WhatsApp. To send money, open the chat window of the receiver and tap on 'attachments.' Select the 'Payments' icon, enter the amount you want to send, confirm your UPI pin, and it's done. Simple! Please note that in order for the transaction to be successful, the receiver will also have to activate his WhatsApp Pay.

Information

WhatsApp Pay will compete with Paytm, MobiKwik

WhatsApp Pay will maintain a payment history of all transactions as well. The feature, that won't include merchant payments, is expected to take on popular digital wallets like Paytm, Google Tez, and MobiKwik. Currently, WhatsApp has over 200 million monthly active users in India.