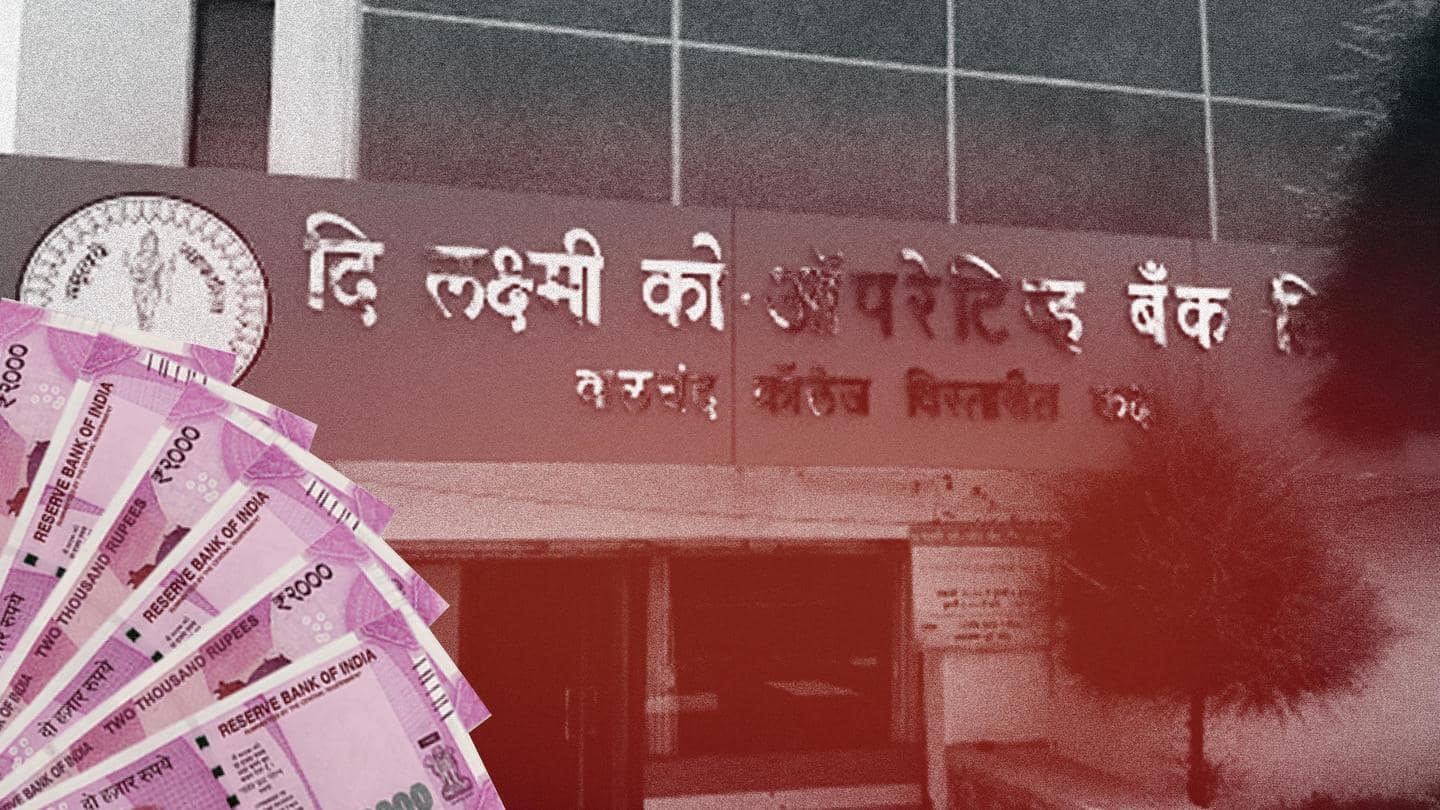

RBI cancels Laxmi Co-operative Bank's license; Rs. 5L withdrawal limit

What's the story

The Reserve Bank of India (RBI) canceled the license of The Laxmi Co-operative Bank Limited in Maharashtra on Thursday.

As per reports, the authority canceled the Solapur-based cooperative's license due to weak financials.

The bank ceases to carry on banking business, with effect from the close of business on September 22, the RBI noted in a press release.

Here's more.

Context

Why does this story matter?

Another cooperative has now turned to dust.

On August 10, the RBI canceled another Rupee Co-operative Bank Limited's license as it did not have earning prospects or capital.

The cooperatives have played an important role in independent India as the 'golden links' between the public and private sectors.

From 2,104 in 2003, India reportedly only has about 1500 co-operative banks now.

Details

What did the RBI say?

According to the finance authority, the cooperative does not have adequate earning prospects or capital and does not comply with several provisions of the Banking Regulation Act, 1949.

In a brief statement, it said that the continuation of the bank is "prejudicial" to the depositor's interests. and in its current condition, the bank will not be able to pay its depositors in full.

Information

Depositors can claim up to Rs. 5 lakh

Ceasing all functions of the bank with immediate effect, the RBI said, "Public interest would be adversely affected if the bank is allowed to carry on its banking business any further."

Notably, the RBI has permitted depositors to claim deposit insurance amount up to a monetary ceiling of Rs. 5 lakh from the Deposit Insurance and Credit Guarantee Corporation (DICGC).

Quote

99% of depositors are entitled for re-claim

On reclaiming the deposit, the RBI said, "About 99% of the depositors are entitled to receive full amount of their deposits from DICGC." However, as of September 13, the DICGC has already credited Rs.193.68 crore of the total insured deposits, the authority informed.