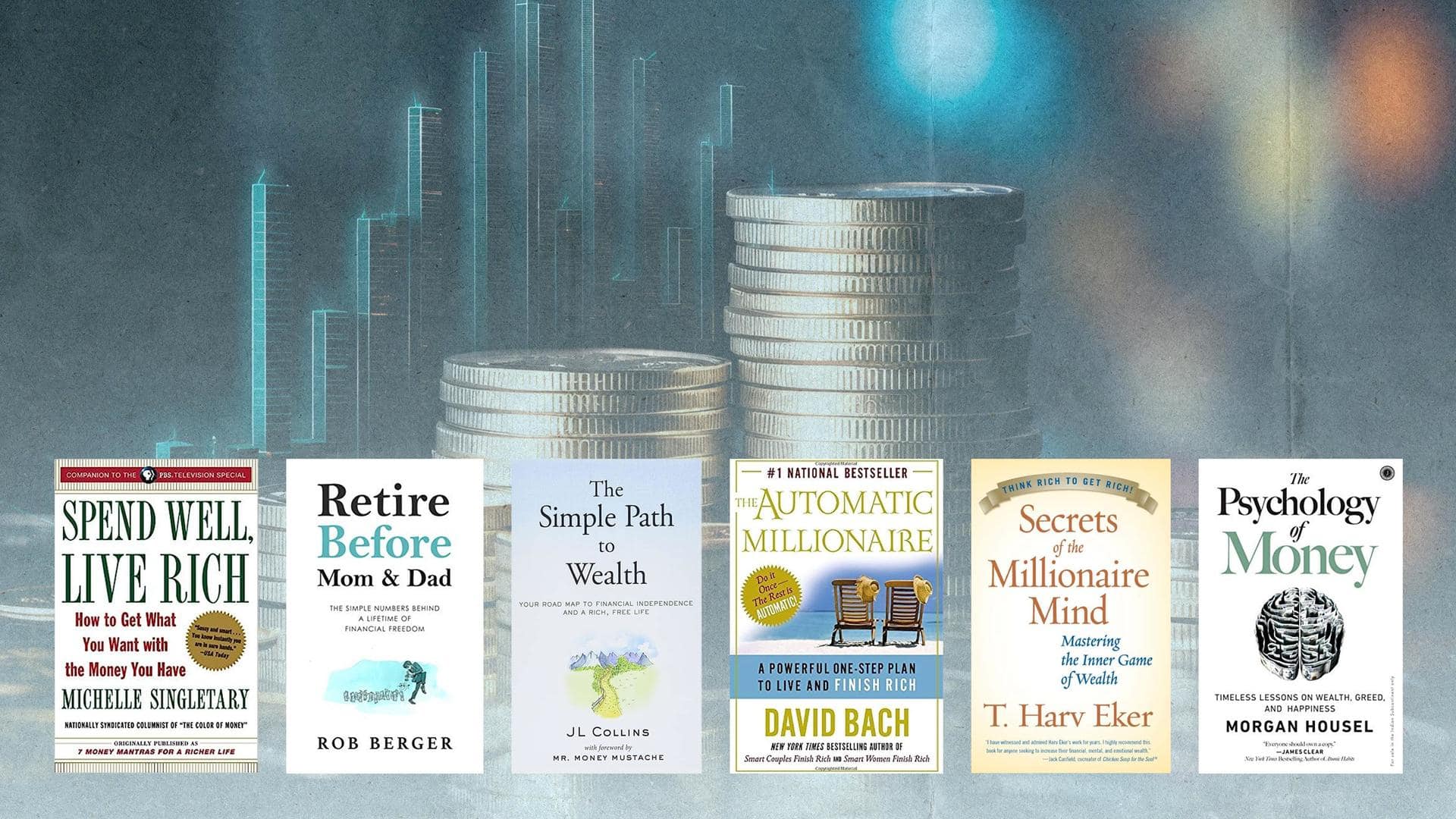

Want to understand personal finance? Read these books

What's the story

Managing personal finances is a fundamental aspect of starting our journey into earning and financial independence. Understanding personal finance is crucial for achieving stability and preparedness in managing savings, expenses, investments, and budgeting, once you start earning. However, navigating these aspects can be challenging, and that's where these books come in, offering effective guidance to overcome potential hurdles effectively.

Book 1

'The Psychology of Money' by Morgan Housel

The Psychology of Money by Morgan Housel includes a set of 19 small chapters that enlighten you on how personal finance isn't something evaluated using math formulae and laid out on spreadsheets. Instead, it is more about your behavior, view of the world, personal experiences, and financial history, offering you unique insights on how you can build your wealth.

Book 2

'Spend Well, Live Rich' by Michelle Singletary

In this book, Singletary reflects on the journey of her grandmother who raised five children on a meager amount of income. She captures the principles her grandmother used to follow to be able to offer a life of quality with what she had. Whether you're new to budgeting or seeking inspiration, this book offers valuable insights and leaves you motivated.

Book 3

'Retire Before Mom and Dad' by Rob Berger

Most of us want to retire early but quickly chuck that thought away owing to unforeseen financial issues that may occur in the future when we may not have a running income in hand. However, this book by Berger gives fundamentals on how you can successfully plan your retirement and stay independent and financially sufficient even during that phase. It's perfect for wealth maximizers.

Book 4

'The Simple Path to Wealth' by JL Collins

The journey through personal finance may not be simple but this book by Collins can definitely simplify it for you. Suitable for investors and those who wish to retire early, this print offers practical advice on how you can generate more wealth, avoid debts, minimize your expenses, neglect financial advisors, step into the world of the stock market, and save more.

Book 5

'The Automatic Millionaire' by David Bach

David Back, in this book, shares how you can create more wealth-generating channels over time. It also talks about how you can safeguard your retirement, understand personal finance, and manage and reduce your debts. With this book, you get some tips on automating your finances, avoiding buying things on credit or rent, and investing in yourself.

Book 6

'Secrets Of The Millionaire Mind' by T. Harv Eker

This book shares how personal finance is not something defined by birth and how one can change their habits and thoughts to manage their finances well. The author has largely focused on the relationship between our mind and finances, with the former having the steering wheel to control the latter. Check out more such book recommendations.