How to apply for PAN using your Aadhaar card

What's the story

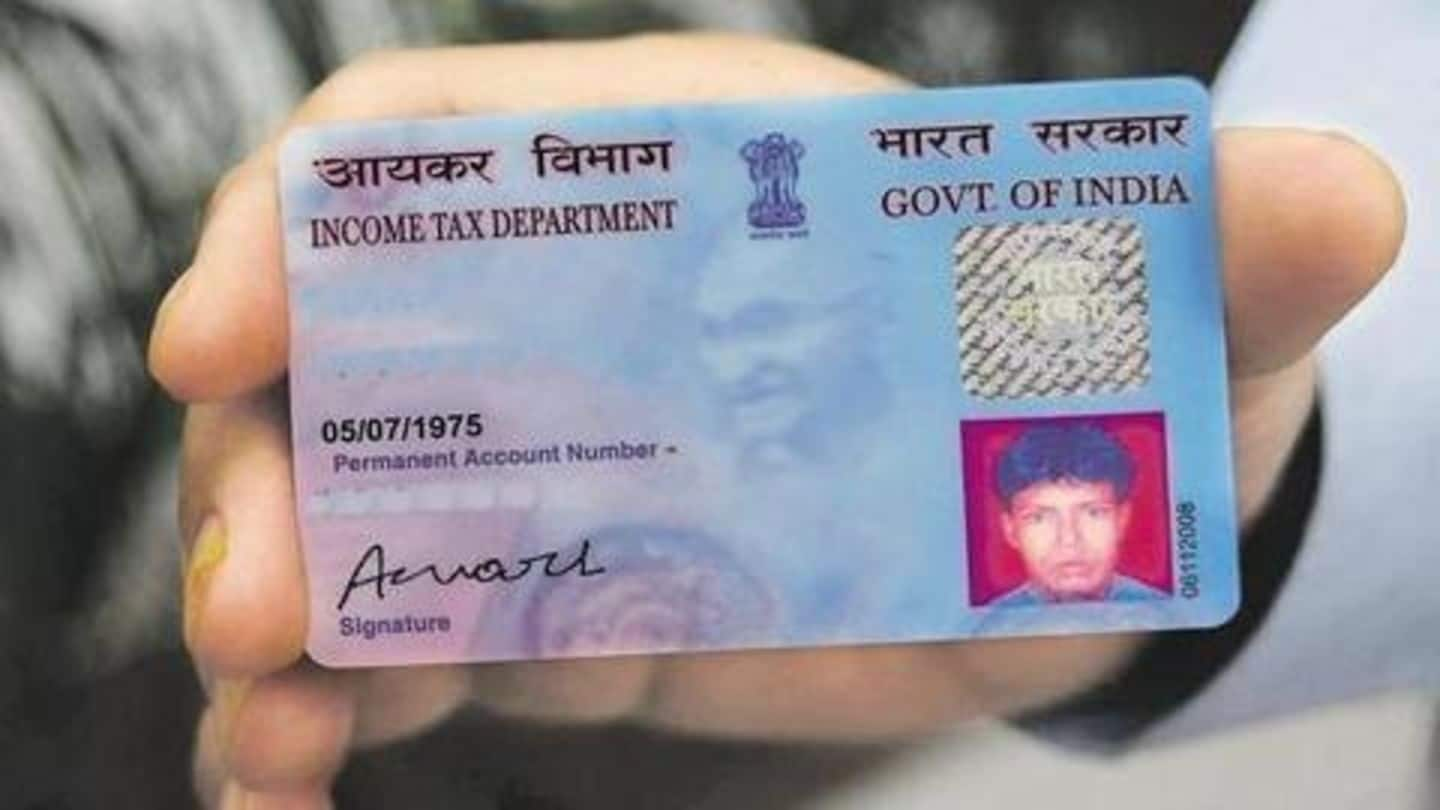

Permanent Account Number (PAN) is a unique, ten-digit alphanumeric identity issued by the Income Tax Department to all taxpayers in India.

PAN facilitates instrumental transactions such as tax payments, entering certain financial contracts, and filing I-T returns.

It also serves as a government-verified proof of identity.

Here's how you can apply for PAN online using your Aadhaar card.

Information

e-PAN application facility via Aadhaar KYC

If you don't have a PAN card, you can easily apply for it online using your Aadhaar card, free of cost. The e-PAN facility launched by the I-T department lets users apply for a digitally-signed PAN using Aadhaar for KYC, for quick and convenient allotment.

Application

Procedure to apply for e-PAN using Aadhaar KYC

Log on to the UTITSL's PANOnline portal, and click on 'Apply as an Indian Citizen/NRI.'

Next, click on 'Apply & Sign using Digital Signature/Aadhaar based e-Sign..' link.

You will be directed to Form 49A.

Check the apt boxes as per your needs, fill the form, and click on 'Submit' button.

Post successful submission, a 15-digit acknowledgment number will be issued to you.

SC verdict

Clearing the air around Aadhaar status

Post the September 26, 2018 Supreme Court verdict relating to authentication of Aadhaar, there has been a lot of confusion with respect to services where Aadhaar is necessary and where not.

Aadhaar is no longer mandatory for services such as bank account, telecom services, and school admissions/entrance tests.

However, it is still necessary for getting a PAN, filing I-T returns, and availing welfare schemes.