Gender document not needed for PAN under transgender category: I-T

What's the story

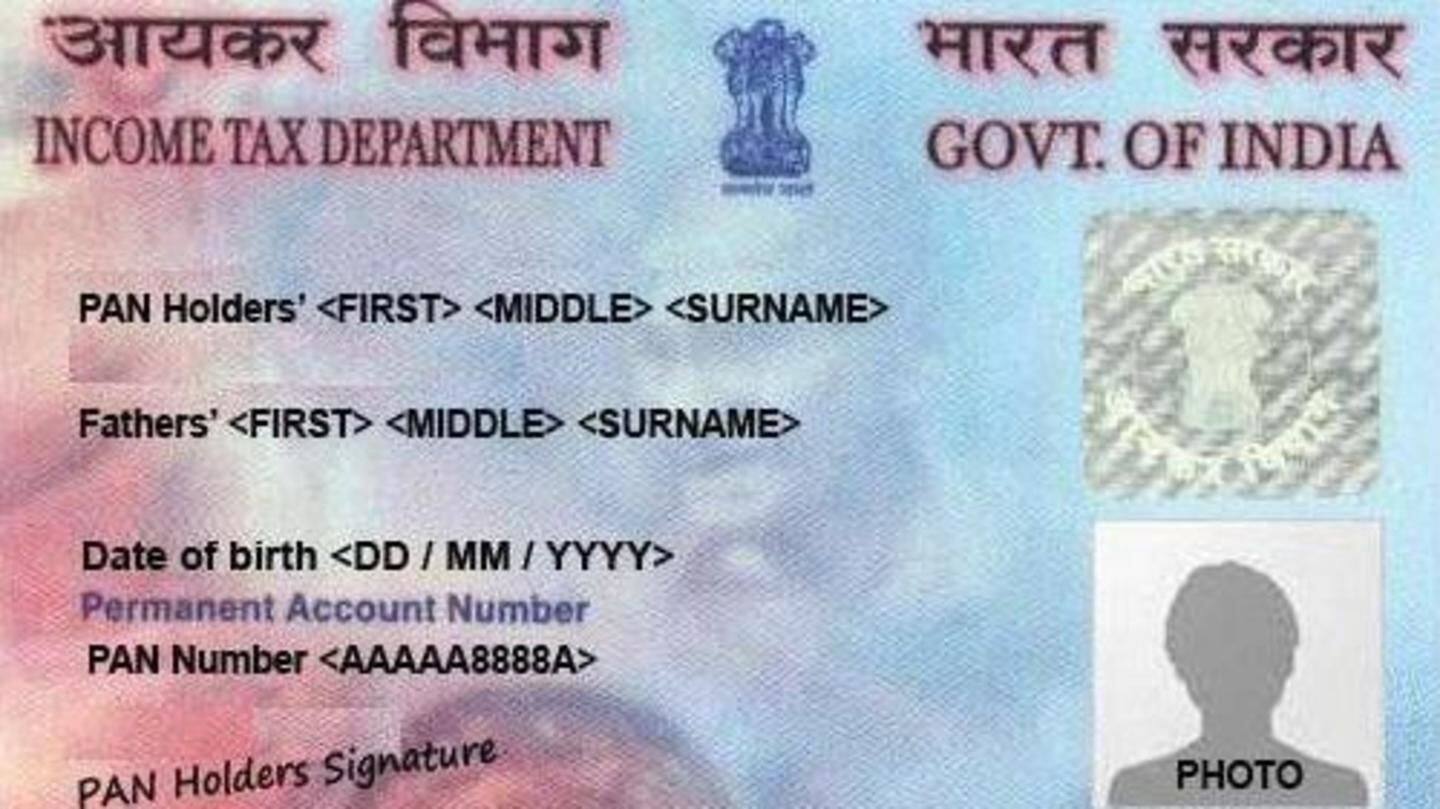

No supporting document for gender is required either in a fresh application or to change an existing card, the Income Tax Department said today. Earlier on April 10, the department had amended the income tax rules to henceforth allow transgenders be recognized as an independent category of applicants for obtaining a Permanent Account Number (PAN) for their tax-related transactions. Here's more.

Information

CBDT made changes as transgenders were facing problems

Till now, only male and female categories were there on the PAN application form. The CBDT had effected the change in view of representations received by it in this context, as transgenders were facing problems in getting new PAN or transacting using their old PANs.

Advisory

New PAN allotment, change requests to be allowed without hassle

"New PAN allotment and change request applications with gender as transgender is allowed without hassle. Also, there is no requirement of depositing any supporting document for change of gender to transgender vide PAN change request application made either through the portal of NSDL or UTIITSL," the department said. PAN is a 10-digit unique alphanumeric number allotted by the I-T department to individuals and entities.