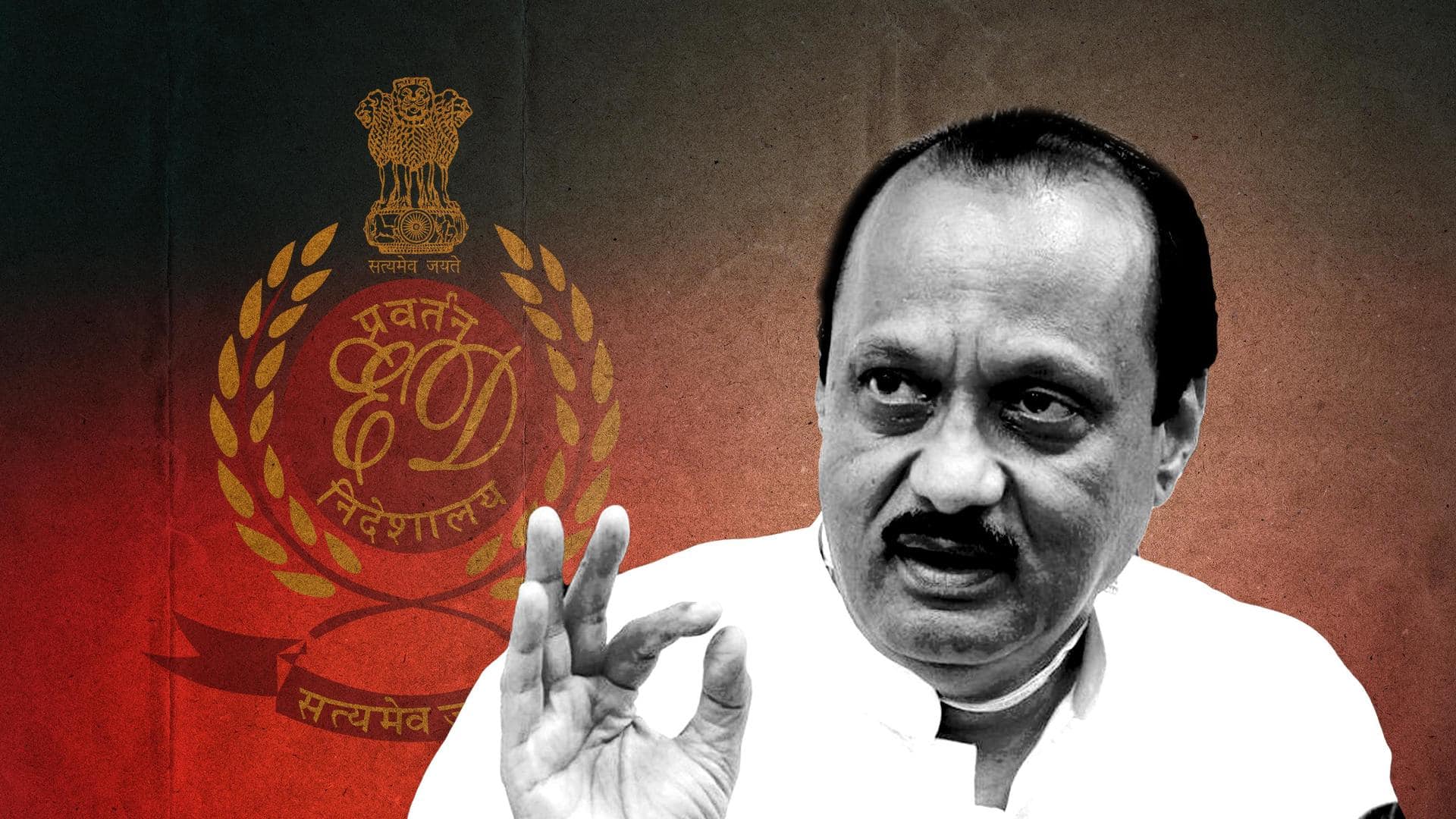

MSC Bank scam: ED chargesheet drops NCP's Ajit Pawar, wife

What's the story

The Enforcement Directorate (ED) has filed a chargesheet against the Maharashtra State Cooperative (MSC) Bank in a multi-crore money laundering case, naming a company linked to former Maharashtra deputy chief minister and Nationalist Congress Party (NCP) leader Ajit Pawar.

However, ED did not name the NCP leader and his wife, Sunetra, among the accused, per ANI.

Details

Special court to hear case on April 19

The ED submitted the chargesheet before a special court, which listed the matter for hearing on April 19.

In July 2021, the probe agency had attached properties of Jarandeshwar Cooperative Sugar Mills worth Rs. 65 crore in this case.

The seizure was made under the Prevention of Money Laundering Act (PMLA), 2002, as part of an investigation into the MSC Bank scam.

Action

ED indicts company linked to Pawar, his wife Sunetra

According to India Today, ED confiscated the assets, which were registered under Guru Commodity Services Pvt Ltd and leased to Jarandeshwar Sugar Mills, as part of the probe.

The ED claimed that during its investigation, it discovered that Sparkling Soil Pvt Ltd, a company associated with Ajit Pawar and his wife Sunetra Pawar, held a significant majority of the shares in the sugar factory.

ED

ED may file separate chargesheet against Pawars: Report

For the time being, ED officials have remained tight-lipped about why they did not charge the Pawar couple. However, they said that the agency will continue its investigation against the "remaining" individuals linked with the enterprises included in the chargesheet, per The Times of India.

This has fueled speculation that the ED may file a separate chargesheet against Pawar and his wife.

Twitter Post

BJP clearly misuses ED, CBI: Sanjay Raut

It clearly means that you (BJP) misused ED and CBI. You started an investigation, harrassed the Pawar family and their relatives and raided their premises. Now you don't find anything against them to name them in the chargesheet. It's clear that ED and CBI were misused in this… pic.twitter.com/cHoEcKRIRx

— ANI (@ANI) April 12, 2023

About

What do we know about the case?

Following the Bombay High Court's judgment, the ED filed a case against Pawar and 75 others in the alleged scam in 2019.

According to the complaint, loans were issued to sugar companies and spinning mills in Maharashtra in violation of banking regulations and Reserve Bank of India (RBI) standards.

Many of those who approved the loans were supposedly connected to the sugar mill owners.