Applying for PAN card offline? Avoid these mistakes

What's the story

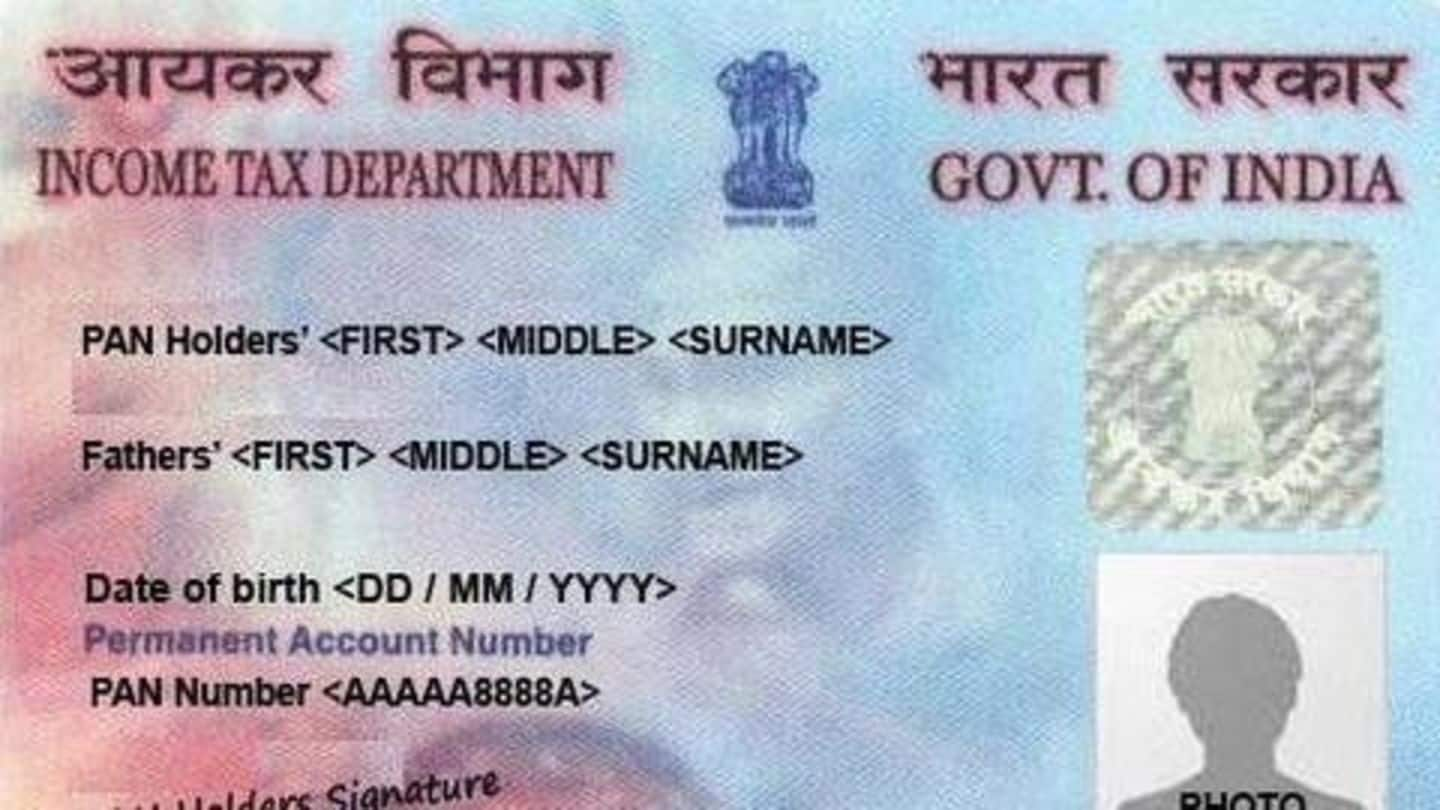

Permanent Account Number (PAN) is a unique, 10-digit alphanumeric identity allotted to all taxpayers in India by the Income Tax department. It is essential for undergoing various financial transactions such as receiving taxable salaries/professional fees, sale or purchase of assets, trading of mutual funds, etc. It also serves as an important proof of identity. If applying offline, here are some mistakes you must avoid.

Mistakes (1)

Don't pin/staple photograph; avoid overwriting; sign properly

Do not pin/staple your photograph on the form. Rather paste it precisely on the box provided. If you make a mistake while filling up the form, do not use whitener or overwrite. Download and print a fresh application form. Sign within the box provided for signature. Be careful and make sure the signature doesn't go across the given box. Don't sign on the photo.

Mistakes (2)

Don't use abbreviations; Don't apply if you already possess PAN

Don't use abbreviations in the first and last name/surname. Avoid adding unnecessary details like date, designation, rank etc. along with the signature. Those already having a PAN cannot apply again, since possessing more than one PAN-card is illegal. However, you can request for changes or update in PAN card by filling 'Request for New PAN Card or/and Changes or Correction in PAN Data' form.

Mistakes (3)

Mail to correct address; mention correct number/Email; mandatory linkage

The application should be sent to the following address: Income Tax PAN Services Unit (Managed by NSDL e-Governance Infrastructure Limited), 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune - 411 016. Mention the correct phone number and Email-ID in the form. Notably, it is mandatory to link PAN-Aadhaar to file I-T returns.