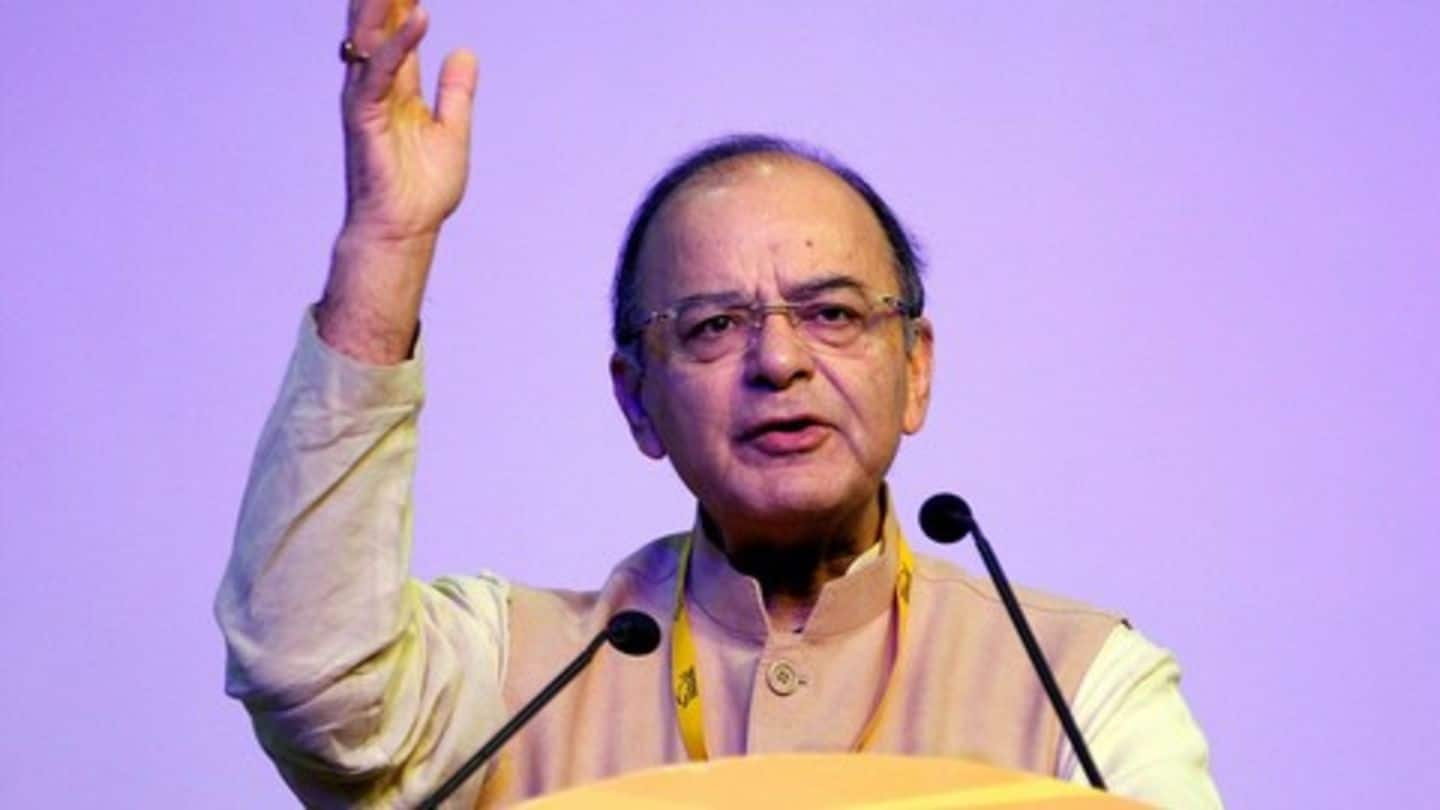

GST implementation not disruptive, best is yet to come: Jaitley

What's the story

On the first anniversary of Goods and Services Tax (GST) roll-out, Union Minister Arun Jaitley stressed that India has been able to implement the major indirect tax reform, GST, in the least disruptive manner. He said the best of GST, which encompasses 17 indirect taxes and a host of cesses, in terms of contribution to the society was yet to come.

Details

Not sure whether I can use 'disruptive' for GST-reform: Jaitley

Observing that countries implementing GST witnessed major disruption, Jaitley said he too felt it would cause disruption in the Indian economy. "But after one year of experience I'm not too sure whether I can use the word disruptive for GST reform," said Jaitley while addressing an event to mark the completion of one year of the new tax reform through video conferencing.

GST changeover

Jaitley claims India's transition to GST was smooth

"The smooth manner in which the changeover has taken place is almost unprecedented anywhere in the world," Jaitley claimed. "I'm sure we have seen the first year where we have seen effective gains this is only the short-term or at best medium term of GST that the best of GST in terms of its contribution to society is yet to come," he added.

Impact

GST's long-term impact on India's GDP growth and other factors

Jaitley said GST would have a long-term impact on India's GDP growth, ease of doing business, expansion of trade and industry, "Make in India" initiative, besides promoting honest business practices. He said, "As the tax collection goes up, the capacity to rationalize the slabs...(and) the rates also will certainly increase. Capacity to rationalize will increase once the total volume of tax collected significantly increases."

Other Details

Efficient tax system ensures that evasion doesn't take place: Jaitley

Stating that the input tax credit is an effective route for ensuring that people make their disclosures faster, Jaitley said, "Once you have a more efficient tax system it will ensure that evasion does not take place." "The E-Way bill has already been implemented and once the invoice matching comes in, evasion and detection of evasion itself will become far simpler itself," he said.