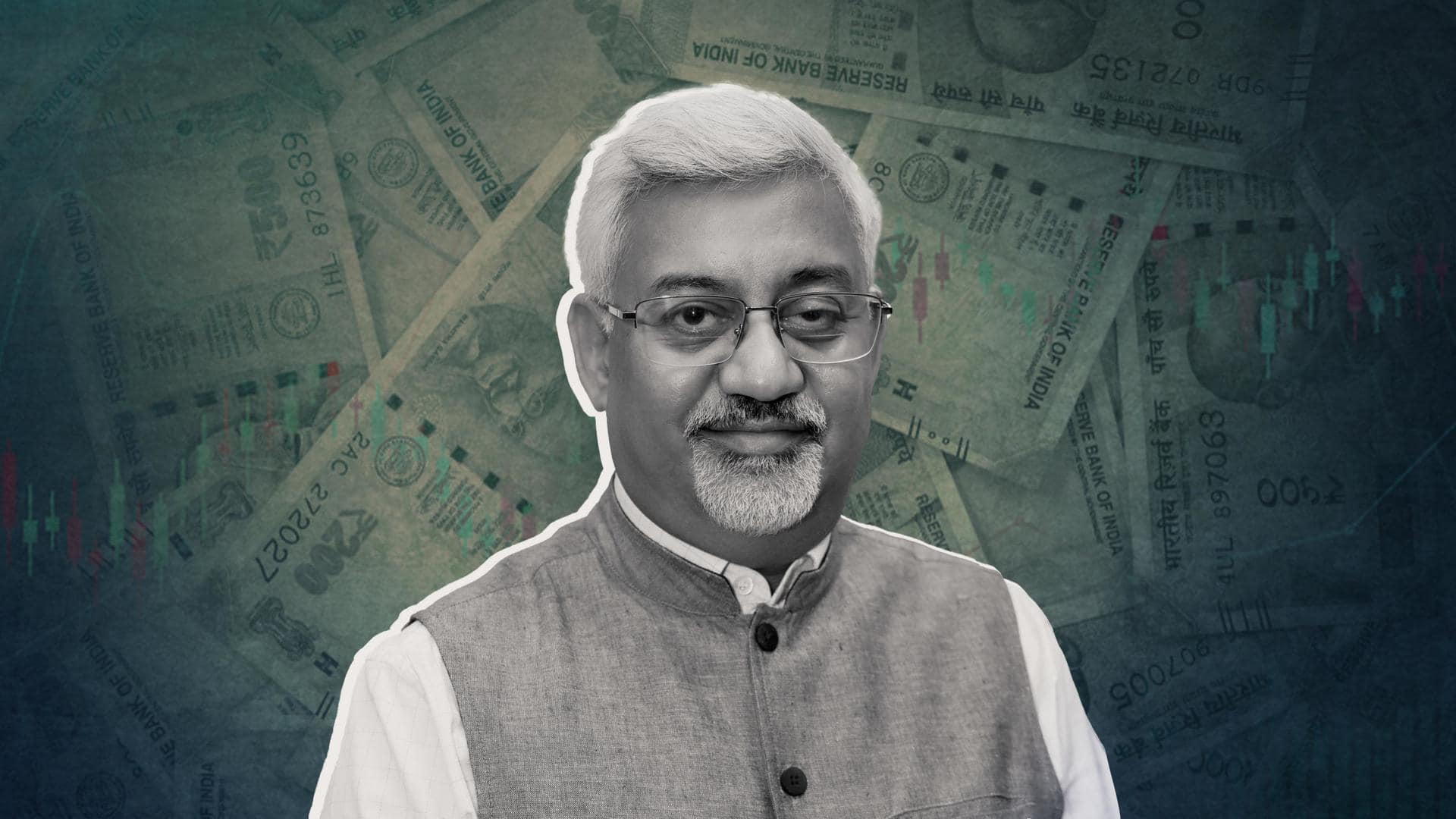

India aiming to make INR global currency: Commerce Secretary Barthwal

What's the story

While unveiling the new Foreign Trade Policy (FTP), Commerce Secretary Sunil Barthwal on Friday revealed that India is set to trade in Indian Rupee (INR) with nations facing currency failure or having a dollar shortage. As per Barthwal, changes to the FTP were made to allow international trade settlement in INR in order to make rupees a global currency.

Context

Why does this story matter?

As per the Director General of Foreign Trade (DGFT), Santosh Sarangi, FTP 2023 has been revealed to provide a responsive framework and policy continuity. The new FTP also introduces an amnesty plan for one-time default settlement of export obligations by Advance Authorization and Export Promotion Capital Goods (EPCG) authorization holders, reported the news agency PTI.

Details

$2 trillion target will be achieved by 2030: Goyal

Speaking at the gathering, Commerce and Industry Minister and Bharatiya Janata Party (BJP) leader Piyush Goyal seeped confidence that the export target of $2 trillion by 2030 will be achieved. Goyal also emphasized that any industry could not succeed only based on crutches or subsidies. In addition, the minister stated that the country's view of exports would change in the coming days.

More details

Details on Export obligation

Meanwhile, pending cases of default in meeting the Export Obligation (EO) of authorizations mentioned, can also be regularized by the authorization holder upon payment of all customs duties exempted in proportion to unfulfilled EO. Furthermore, interest at 100% of such duties is exempted. Notably, no interest is payable on the portion of Special Additional Customs Duty and Additional Customs Duty.

Know more

Know about the changes under SCOMET

In addition, the Special Chemicals, Organisms, Materials, Equipment, and Technologies (SCOMET) export policy for dual-use items has been consolidated in one place to facilitate industry compliance and comprehension. The SCOMET policy emphasizes the country's export control in accordance with its international obligations under numerous export control regimes to regulate the trade in sensitive/dual-use technologies/items.

More information

India's external debt rose as of December-end: Centre

Meanwhile, India's external debt rose 1.2% quarter-on-quarter to $613.1 billion as of end-December, the government confirmed on Friday in a release. The country's external debt-to-GDP ratio stayed at 19.1% in the September quarter. The valuation loss in September-December amid the depreciation of the United States (US) dollar against other major currencies like the euro, yen, and pound (United Kingdom) was $3.8 billion.