#Budget2019: What are the income-tax changes proposed in Interim Budget?

What's the story

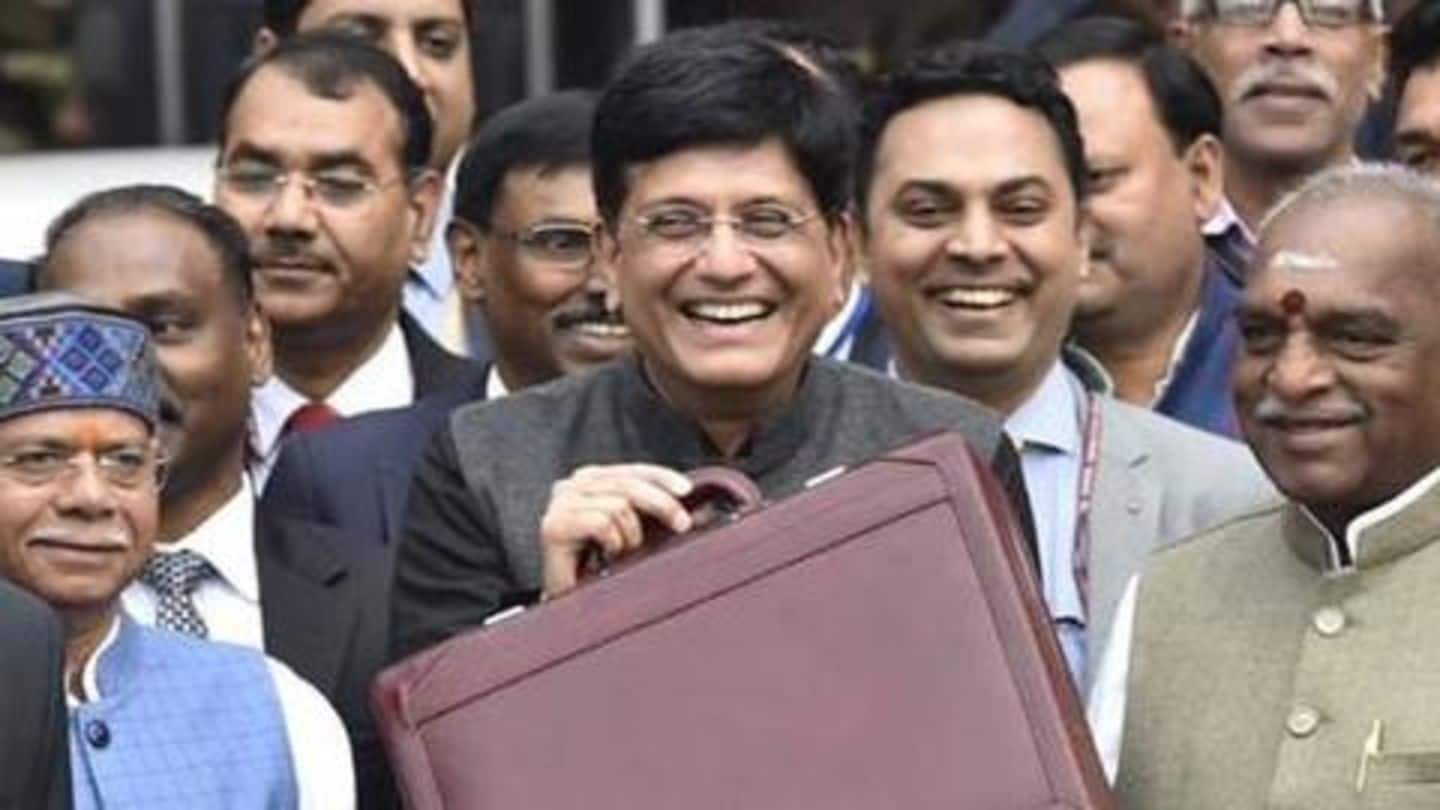

Ahead of the upcoming Lok Sabha elections, acting Finance Minister Piyush Goyal, while presenting the Interim Budget, proposed several changes to the tax structure to provide relief to the salaried middle class.

Goyal said individual taxpayers with an income of up to Rs. 5 lakh/annum need not pay tax as they will get a full tax rebate.

Here's more on the proposed tax changes.

Rates, Slabs

About the existing income tax rates and slabs

As per the tax slabs for FY 2018-19 (AY 2019-20), any individual with an income of up to Rs. 2.5 lakh/annum is exempt from personal income tax.

However, those with an income between Rs. 2.5-5 lakh/annum need to pay 5% tax.

Income between Rs. 5-10 lakh/annum is taxed at 20%. More than Rs. 10 lakh income/annum attracts 30% tax.

What changes

Are the existing tax rates and slabs going to change?

What Goyal announced during the Budget speech is only a tax rebate and not a slab change. He mentioned that existing tax rates would continue.

Though there are no changes in the slabs for FY 2019-20, individual taxpayers with an income of up to Rs. 5 lakh/annum will get a rebate.

So, those earning over Rs. 5 lakh/annum must pay tax on taxable income.

Details

People earning Rs. 6.5L/annum can save on tax. Here's how

The acting Finance Minister also hiked the standard deduction for salaried people from Rs. 40,000 to Rs. 50,000.

However, there are no changes in other deductions. Goyal said with the tax rebate for income less than Rs. 5 lakh along with deductions and investments in specified tax-saving instruments, those with an income of up to Rs. 6.5 lakh might not have to pay tax.

TDS thresholds

TDS slabs on interest income, rental income raised

For the benefit of people, especially pensioners, Goyal said the TDS threshold on interest on bank/post-office deposits would be raised from Rs. 10,000 to Rs. 40,000. This means, no tax would be deducted for interest income of up to Rs. 40,000.

Further, the TDS slab for income through rent is proposed to be raised to Rs. 2.4 lakh from the existing Rs. 1.8 lakh.

Information

Other changes proposed during the Budget speech

Other proposed changes include income tax exemption on notional rent on a second self-occupied residential house. Currently, tax on notional rent is collected if someone has more than one self-occupied house. Also, affordable housing tax benefit is proposed to be extended for one more year.

Twitter Post

Here's how those with upto Rs. 9.85L can pay zero-tax

Ok guys. Have made the excel. Pls see

— Ashu (@muglikar_) February 1, 2019

If you dnt have a home loan and earn about 7.85lacs then you can pay 0 tax (via Pic1)

If you have a home loan and earn about 9.85lacs then you can pay 0 tax (via pic 2)

If you earn above this or don't use deductions then no benefits. Check pic.twitter.com/px2QxUyMT8

Zero tax?

People earning over Rs. 6.5L/annum can pay zero-tax: Twitter user

Meanwhile, Twitter user Ashu (@muglikar_) explained how people earning up to Rs. 7.85 lakh/annum can pay zero tax.

After the Rs. 50,000 standard deduction, Rs. 1.5 lakh 80C deduction, Rs. 50,000 80CCD(1B) deduction, Rs. 25,000 80D deduction, Rs. 10,000 80TTA deduction, their taxable income comes down to Rs. 5 lakh. They can avail tax rebate and pay zero tax.

Information

What about people earning Rs. 9.85 lakh per annum?

Individuals earning upto Rs. 9.85 lakh/annum can also pay zero tax provided they have a home loan. Apart from the above-mentioned Rs. 2.85 lakh-worth deductions, they can avail Rs. 2 lakh deduction against home loan interest. So, their taxable income also becomes Rs. 5 lakh.