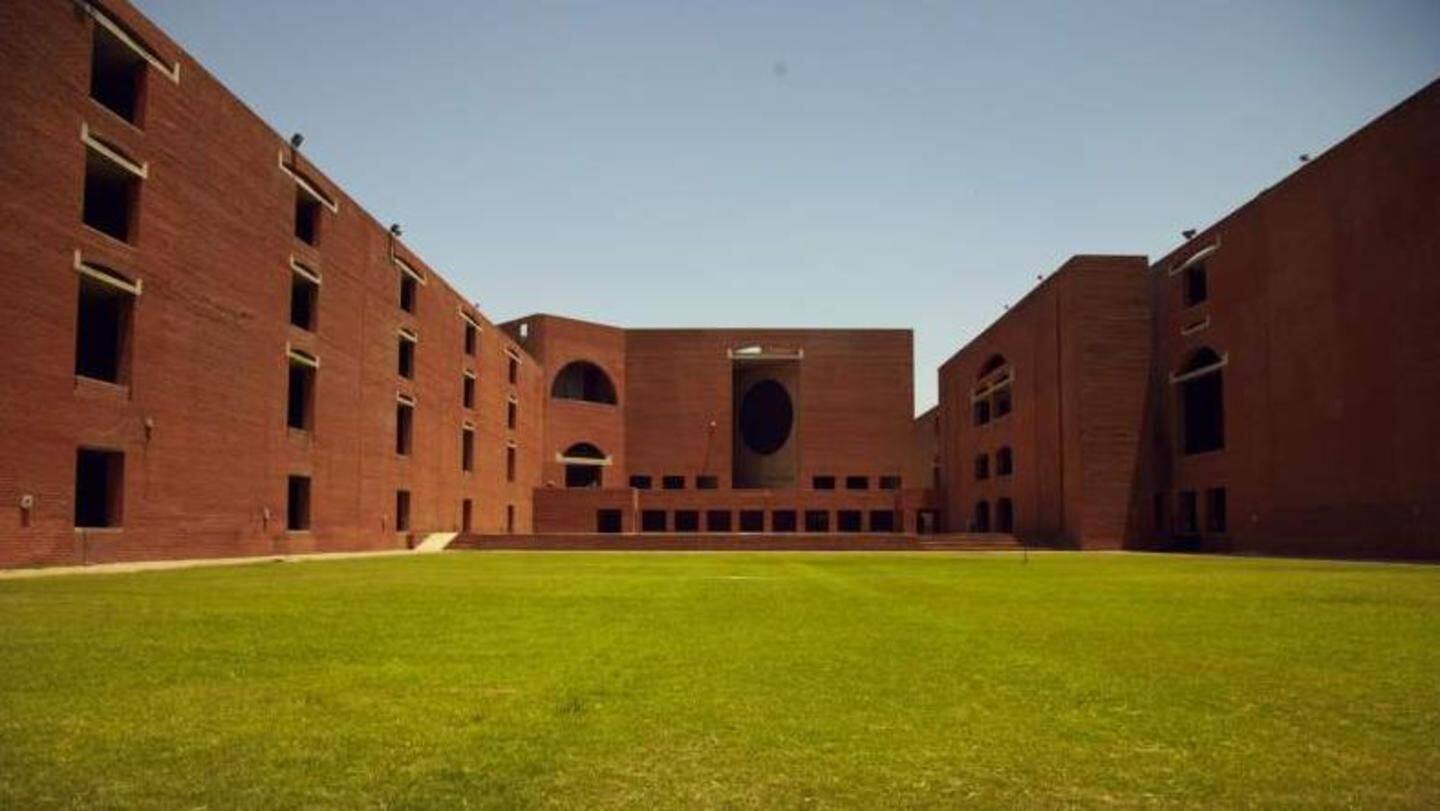

IIM-Ahmedabad gets a service tax bill of Rs. 52cr

What's the story

The IIM-Ahmedabad has been hit with a massive tax burden: authorities have demanded Rs. 52cr as service tax for the period between 2009-10 and 2014-15. But the amount is questionable, the institute has asserted. IIM isn't a "commercial coaching center," and a March'16 Finance Ministry notification categorically backs its case, it said. It has since written to the HRD seeking intervention.

Tax

How the Finance Ministry arrived at the amount

According to IE, the Department of Revenue has based its tax calculations on the two-year postgraduate program (PGP), the postgraduate program in food and agri-business management (PGP-FABM), the fellow program in management, and the one-year postgraduate program in management for executives (PGPX). Rs. 52cr was the tax burden on the fees received for these courses during the aforementioned period, the Department found.

Letter

'Writing to request your kind support': IIM-A tells HRD

IIM-A wrote to the HRD in January. It clarified it's an educational institute and not a "commercial coaching center," and has always been exempted from service tax. Moreover, the March'16 notification exempted the two-year full-time PGP, fellow program in management, and the five-year integrated program in management from service tax. "Given this background, I'm writing to request your kind support," wrote Director Errol D'Souza.

IIM-C

IIM-C has similar queries on GST, but problem unresolved

"As the Principal Commissioner of Central GST has passed an order, (IIM-A) has no option but to appeal to the Tribunal by paying Rs. 4.01cr as per deposit fee...which will block funds and strain resources," the letter states. Sources say IIM-Calcutta also wrote to the HRD, asking if GST can be levied on its courses after the IIM Act was passed. HRD has reportedly forwarded the query to Finance.