GST Council announces relief for exporters, small traders

What's the story

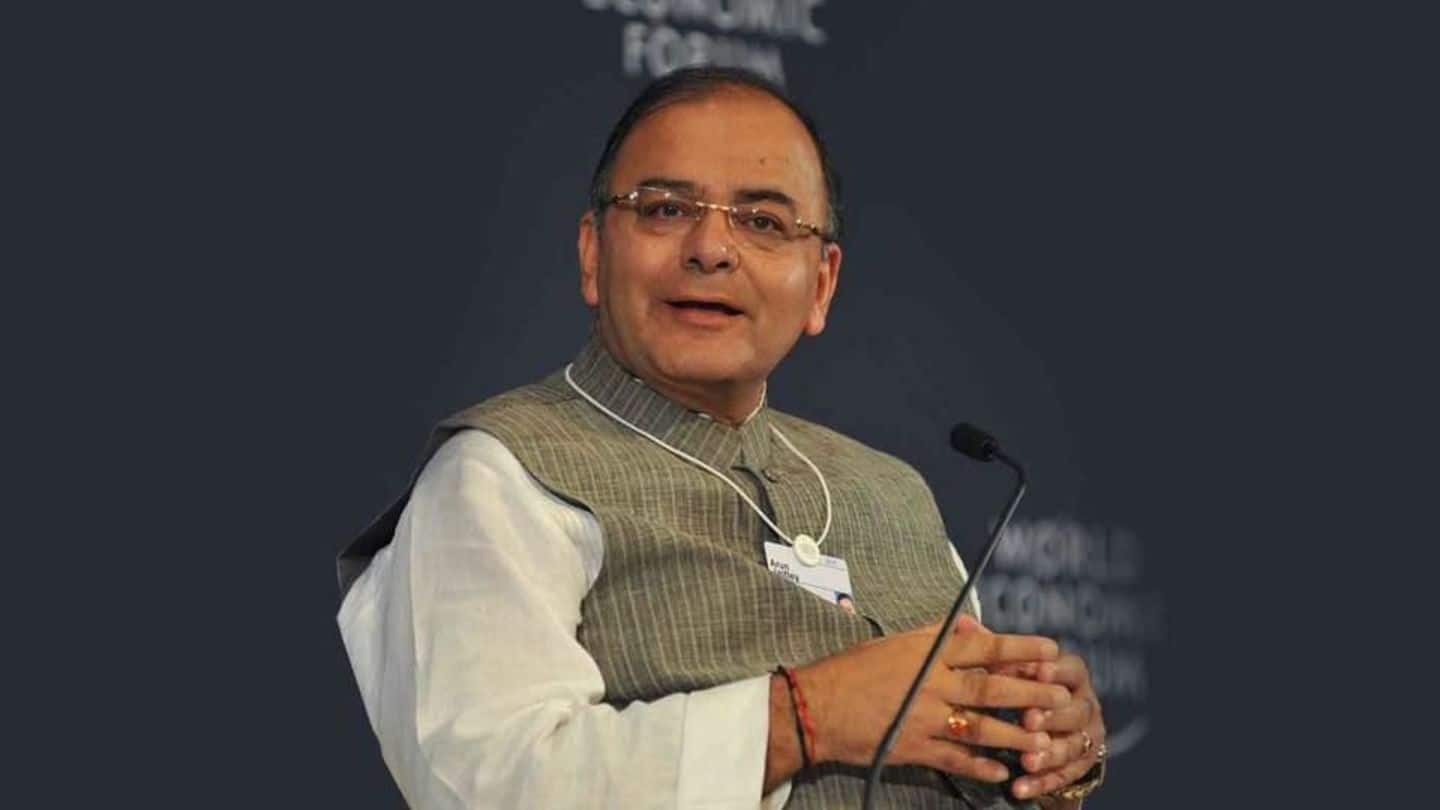

Addressing media after the GST Council's 22nd meeting, Finance Minister Arun Jaitley announced several reforms in India's new tax regime.

Relief was announced for exporters and small traders: "heavy" compliance burden has been addressed and exporters will get tax refunds starting October 10.

The changes came after widespread criticism over poor implementation of the GST.

Read on to know all details.

Details

Relief to businesses under composition scheme

To ease burden on traders, the composition scheme net has been increased to taxpayers with turnover of upto Rs. 1cr. 1% tax will be applicable.

Non-composition scheme taxpayers with turnovers below Rs. 1.5cr have been allowed to file returns quarterly; businesses earning above that have to continue filing monthly.

Manufacturers will be levied 2% tax under composition scheme. For restaurants, it will be 5%.

Information

New quarterly calendar will apply only from October 1

The quarterly filing calendar will start from the cycle starting October 1, Jaitley clarified. For July, August and September, small businesses will also have to file monthly returns.

Exporters

Exporters to get tax refunds this month, e-wallets next year

All exporters will get an e-wallet from April 2018, Jaitley announced. There will be a notional amount for credit. The eventual refund will be offset from that amount.

Moreover, exporters will get tax refunds starting October 10. Currently, thousands of crores in refunds are stuck in the system.

A nominal 0.1% GST will be levied on exports.

Tax rates

What's costlier, what's not

The GST Council reviewed tax rates of 26 items. Among daily use items, GST on khakra and unbranded namkeen is down from 12% to 5%.

Clothes with zari work and unbranded ayurved medicines will also cost less with 5% tax, down from 12%.

GST on some diesel engine parts has also been brought down to 18% from 28%.

Others

More changes likely in the coming days and months

A group of ministers will review taxes on AC restaurants, though it has in-principle agreed to reducing GST from 18% to 12%.

J&K Finance Minister Haseeb Drabu said the GST Council might consider other modalities instead of e-wallets, like direct subsidies.

GST on government work contracts has been reduced from 12% to 5%.

Meanwhile, petroleum products still remain outside the ambit of GST.

Criticism

The events that led to the meeting

Earlier this week, the RBI had said "teething problems" with GST had hit manufacturing; it suggested simplifying provisions.

Industry bodies last week sought quicker refunds of taxes and deferment of filing returns, among others.

Amid widespread criticism, the government had assured solution to problems.

"We've seen what's working and what's not…If something needs to be done, we'll do it," PM Narendra Modi had said.