Food offered at religious places exempted from GST: Finance Ministry

What's the story

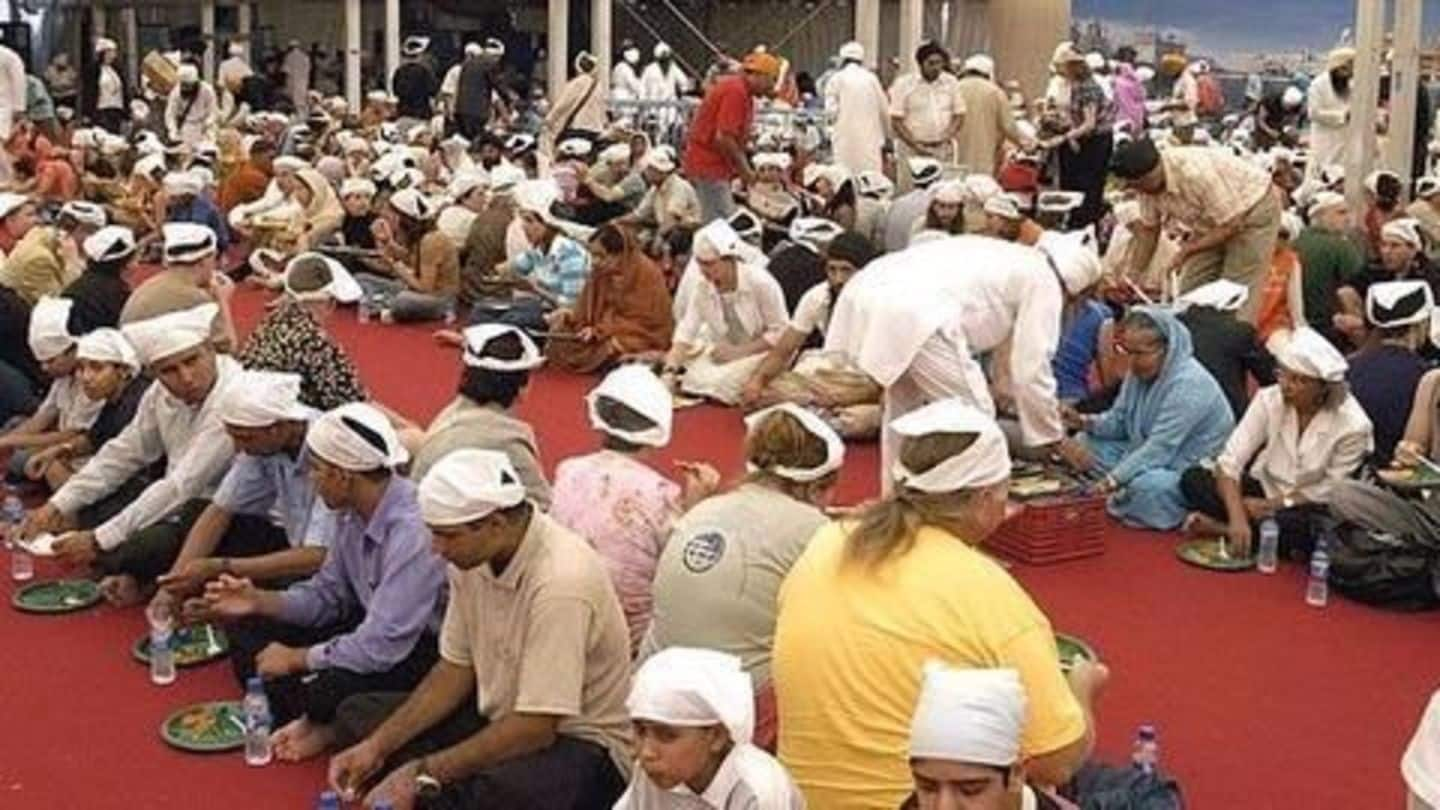

The Finance Ministry on Tuesday issued a clarification stating that free food offered at 'anna kshetras' was exempt from GST.

It further stated that prasadam distributed by any religious place of worship be it temples, mosques, churches, gurdwaras or dargahs, would not attract GST.

This statement came from the government after false media reports were doing rounds.

Information

No GST on anna kshetra's free food: Finance Ministry's statement

The Finance Ministry's statement read that media reports suggesting GST would be levied on free food served at religious places were "untrue". However, it also stated that it wasn't desirable to provide end use-based exemption for inputs for making prasadam.

Clarifications

End-use exemptions not possible

The government's stand on end-use exemptions were cleared when Union Food and Processing Minister Harsimrat Kaur Badal had urged Finance Minister Arun Jaitley to exempt all purchases made by the Shiromani Gurdwara Parbandhak Committee (SGPC) for service at the community kitchen, under the GST.

The government made it clear that end use-based exemptions are difficult to administer as GST was a multi-stage tax.

Fake news

Rumours surrounding GST

Since the inception of GST, number of misleading media reports have been making rounds.

Another fake news which came to light via a Whatsapp message was that GST would be levied twice, if utility bills for services like telephone, mobile, gas, electricity are paid through credit cards.

To put an end to rumours, Revenue Minister Hasmukh Adhia took to Twitter to clear the air.

Some myths busted

Misconceptions surrounding GST cleared

Although GST is a single tax regime but petrol, diesel are still outside GST's ambit and therefore, their tax rates vary significantly across states.

Under GST, manual billing can be done and Internet connectivity will be needed only at the time of filing monthly return.

GST entails only central and state taxes but levies charged by local bodies are still outside its ambit.