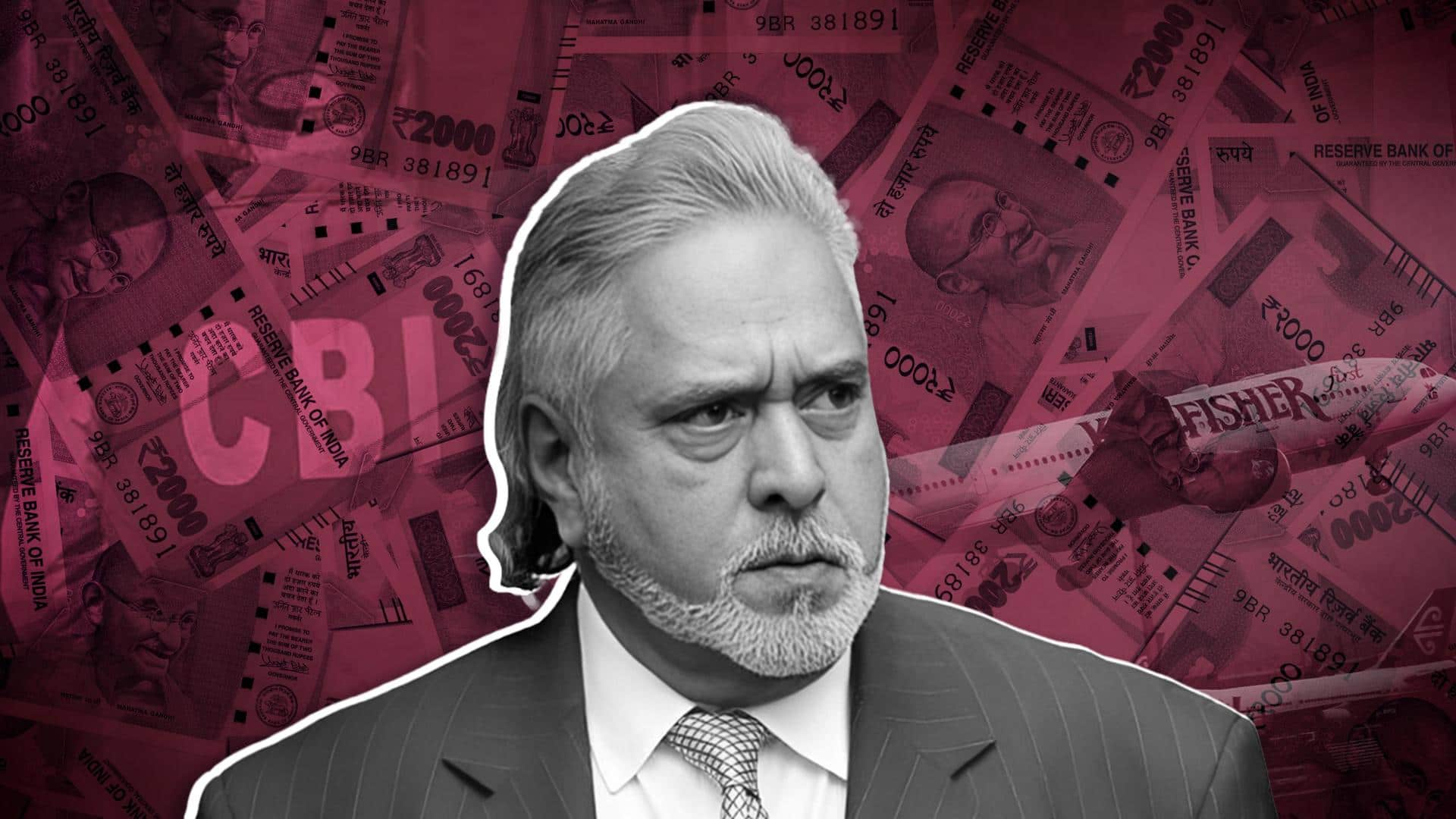

Mallya had Rs. 7,500 crore, enough to repay banks: CBI

What's the story

The multi-crore loan scam involving fugitive Indian businessman Vijay Mallya has taken a new turn. According to the Central Bureau of Investigation (CBI), Mallya had enough money—Rs. 7,500 crore—in August 2017, but instead of repaying banks, he purchased properties abroad before fleeing. In 2015, a year before resigning from Rajya Sabha, Mallya reportedly utilized his "MP status" to open accounts in a Swiss bank.

Context

Why does this story matter?

Mallya faces charges of money laundering and fraud in India, including loans to his now-defunct Kingfisher Airlines, which totaled Rs. 9,000 crore. He fled India in March 2016, and a Mumbai court declared him a fugitive economic offender (FEO) in 2019. Mallya is also fighting an extradition battle with the British government to halt his deportation to India for failing to repay debts.

Details

Vijay Mallya bought properties worth Rs. 330 crore abroad: CBI

The CBI in its third supplementary chargesheet, released last week, said that Mallya's net worth in August 2017 was about Rs. 7,500 crore. During 2015-16, the liquor baron reportedly set up about 44 entities in the United Kingdom (UK) and purchased properties worth Rs. 330 crore across Europe, it said, citing information from Compagnie Bancaire Helvétique Bank, a Swiss bank where Mallya had accounts.

Claims

How Mallya's Kingfisher Airlines ditched lenders, including IDBI Bank

Reportedly, Mallya promised lenders, including IDBI Bank, stock infusions in Kingfisher Airlines Limited (KAL). However, he ditched them and instead moved Rs. 2418.89 crore to accounts in the UK between 2008 and 2012, under the guise of paying office and operating expenditures, CBI claimed. The funds were allegedly routed to his racing team, Force India Formula One Team Limited, according to the agency.

Facts

Mallya misused MP status to open Swiss bank accounts

Notably, the CBI claimed in 2015, a year before Mallya resigned as a Rajya Sabha member, that he used his status as a "member of the Upper House" to open accounts in a Swiss bank. It was discovered after Swiss authorities responded to Indian courts about Mallya transferring loan funds in violation of agreements with IDBI and the State Bank of India (SBI).

Case

What do we know about the case?

Mallya is a suspect in the CBI's probe into the alleged Rs. 900 crore IDBI Bank-Kingfisher Airlines loan scam. Recently, CBI submitted a third supplemental chargesheet before a special CBI court in Mumbai, adding the name of former IDBI Bank general manager Buddhadev Dasgupta to the other 11 accused named in the previous chargesheets.

Allegations

Charges against former IDBI general manager

The CBI alleged that Dasgupta misused his official position by authorizing Rs. 150 crore short-term loan (STL) to Mallya in 2009. The loan had to be adjusted/repaid from the original Rs. 750 crore loan obtained by the airlines. However, Dasgupta altered the proposal to show that the credit committee considered this as a separate loan, which may/may not be adjusted/recovered from the aggregate loan.