Streaming players owned last year, as cinema halls bled poorly

What's the story

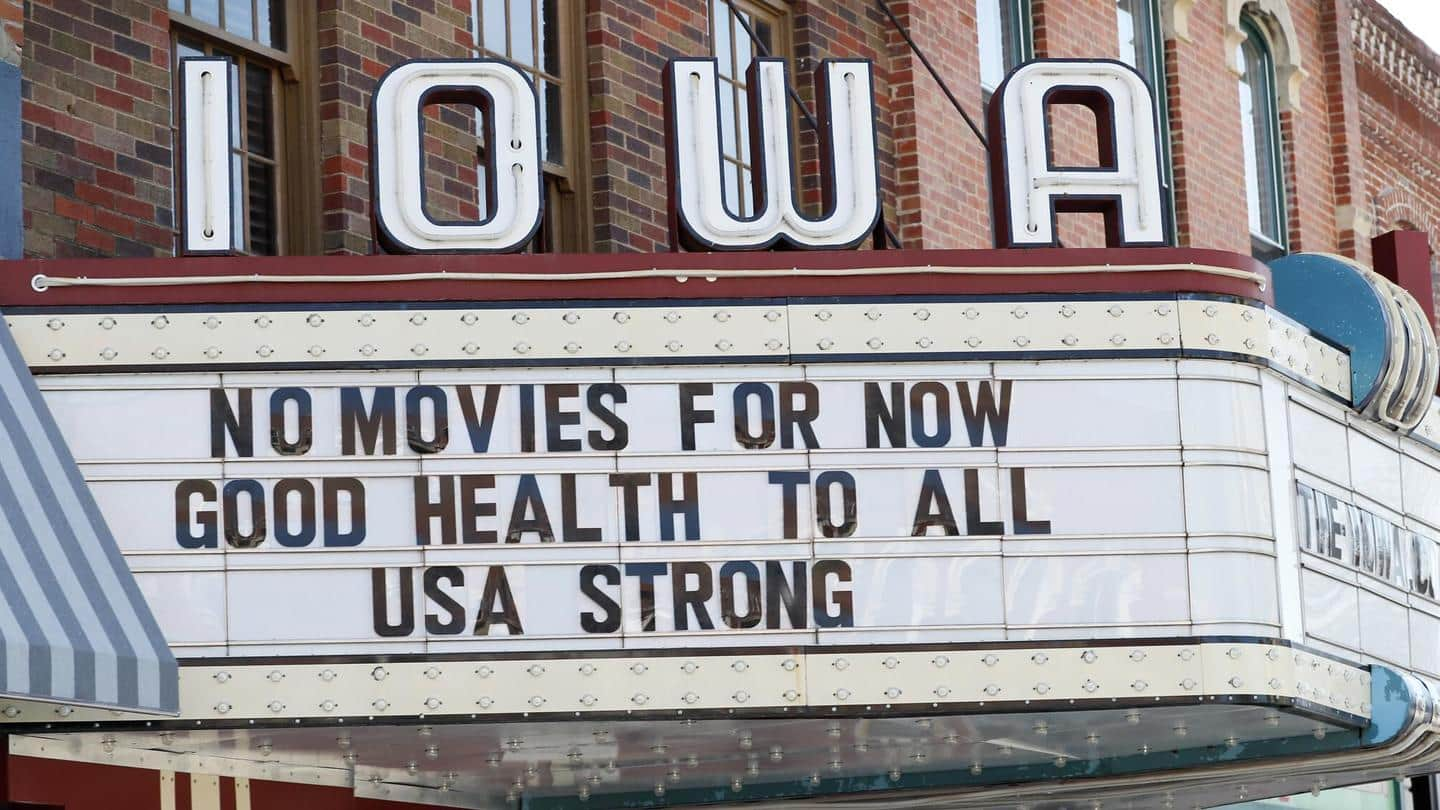

In 2020, cinema halls have been hit hard, thanks to the COVID-19 pandemic.

The safety norms in place made it mandatory for theater owners to keep shutters down for almost the entire year.

When some of those finally reopened, people were too scared to venture out of the homes, throng the theaters, and socialize.

That's where the alternatives came in and started ruling business.

Details

Stocks on Wall Street reflect the pathos of cinema brands

Stocks on Wall Street show an extremely bleak future of some of the world's top theater distribution brands such as Cinemark, Cineworld, and AMC Theatres.

As of December 30, 2020, stocks of AMC Theatres, which may be cash-strapped soon, are down 67% to $2.15, while AMC Networks has its shares down 12% to $35.47.

Similarly, Cinemark has its stock price down 48.7% to $17.78.

Reopening soon

Vaccine response: Cineworld may open in March this year

Cineworld, which closed operations in the US and the UK on October 7, has its shares fallen 70% to $1.20.

The brand has announced that it will reopen in Q1 2021 in response to the early arrival of the COVID-19 vaccine.

In their recent announcement in response to WB's 2021 film slate, Cineworld expressed hope for "an agreement about the proper window and terms."

Alternative

Streaming platforms lapped up big releases, owned 2020 royally

Do note that even though theaters were closed, audiences still watched new releases.

How? Enter streaming platforms.

Crowd pullers such as Russell Crowe's Unhinged have gone to Zeeplex after a brief pandemic theater run, while George Clooney's The Midnight Sky and Viola Davis's Ma Rainey's Black Bottom are Netflix products.

To better understand their dominance this year, check their stunningly surging stock prices.

OTT mantra

Surging stock prices of streamers proved their dominance this year

Netflix had its stock up 61.3% on December 30, while digital streaming hardware brand Roku and music streamer Spotify had their shares rising 143% and 108% to $338.74 and $319.35, respectively.

Walt Disney Co., which had a meteoric rise of its streamer Disney+ from a modest start in November 2019 to 73.7mn subscribers by Q4 of 2020, had shares up 24.3% to $181.75.

Quote

'No streaming war, there's been streaming coexistence and parallel growth'

"Instead of a streaming war, there's been streaming coexistence and parallel growth," pointed out Dritan Nesho, chief executive, HarrisX, a market-research firm, noting Disney+, a relatively new player, grew exponentially without putting any dent in the authority enjoyed by seasoned players like Netflix and Hulu.