'Money, Explained' review: Enroll into Netflix's crash course on finance

What's the story

Netflix released a limited docuseries called Money, Explained in collaboration with Vox Media recently.

It is divided into five episodes of around 22 minutes each.

Each episode takes a deep dive into various facets of money or money-related instruments.

From scams and gambling to credit cards and student loans, this series will leave you feeling more financially confident and decisive.

Here, we review.

The series

Subtle background music and pleasing visuals make it approachable

The subtle background music and pleasing visuals make this limited docuseries very approachable, especially considering the subject matter discussed could be a bit heavy for many people.

Watching it truly feels like a crash course on basic but important finance subjects.

Stars who lent their voice for the episodes include Tiffany Haddish, Bobby Cannavale, Jane Lynch, Marcia Gay Harden, and Edie Falco.

Get Rich Quick

The Nigerian prince is not going to send you money

The first episode takes a look at scams and fake get-rich-quick schemes.

It untangles terms like con artists, Ponzi schemes, multi-level marketing, pump and dump, pyramid schemes, and coaching schemes.

All end up taking money from honest people.

Knowledge around these is more important than ever now in the world of the Internet.

Remember, if something seems too good to be true, be skeptical.

Credit Cards

Have credit cards really liberated us?

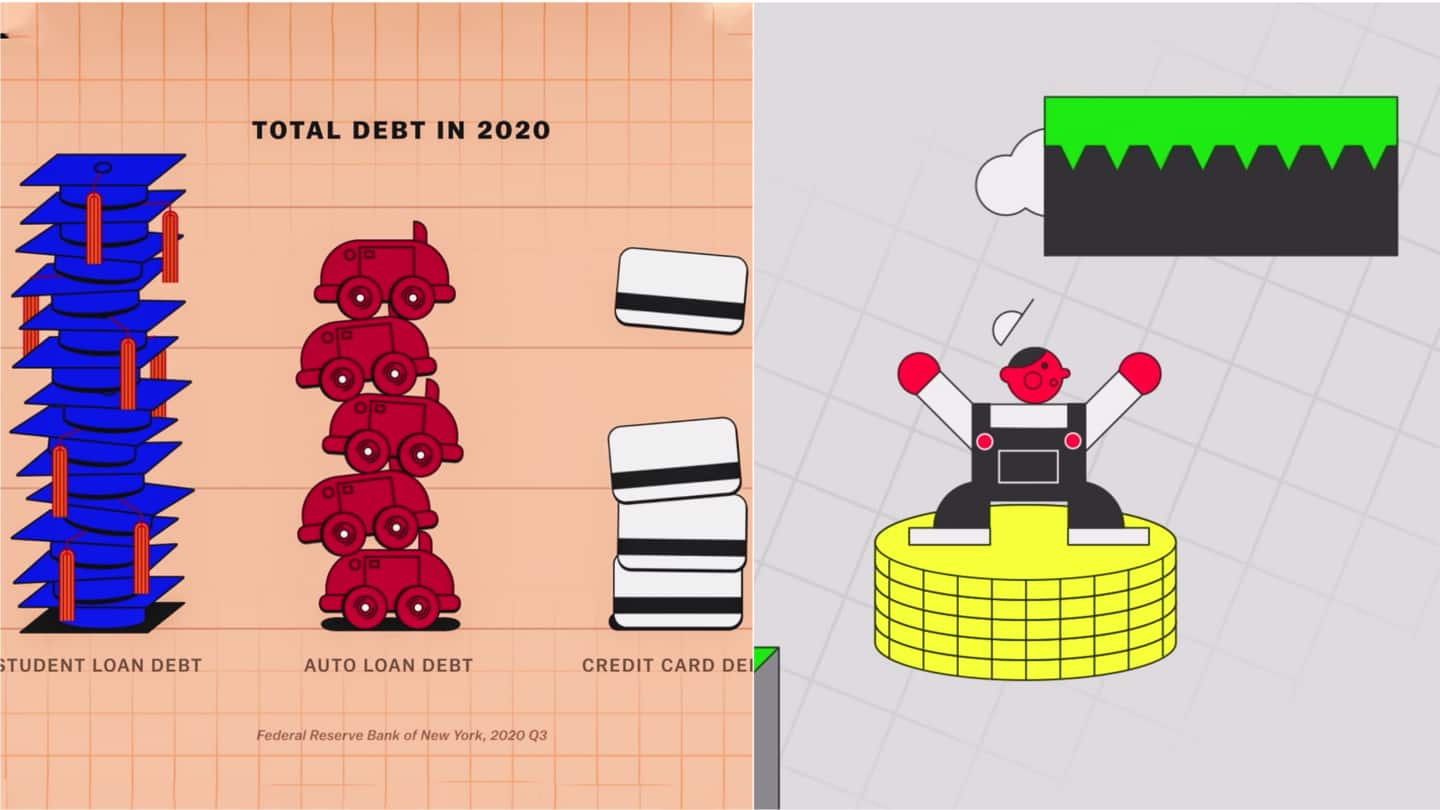

The second episode takes a deeper look into credit cards.

It shows that the convenience of plastic money can come at a price, and how the interest on non-payment of credit card debt can quickly spiral into massive numbers.

The episode concludes that the finance game is designed for the consumers to slip up.

So, pay your credit card bill in full each month.

Student Loans

The debt on students is ever-increasing

The third episode is titled Student Loans, which is a matter of big financial crisis in the US.

Americans have over $1.6 trillion in student debt, says a June 2020 CNBC report.

It shows how many for-profit and other schools take advantage of students and the need for an education system overhaul.

Not-so-fun fact: Student loans cannot be wiped off even by declaring bankruptcy!

Gambling

What's a 'social casino'?

The fourth episode looks into gambling and the psychology behind it.

It introduces the concept of social casinos that are games, apps, and websites, which resemble in many ways games at casinos and involves real financial risk.

What's crazy is that they generate around $6 billion in revenue, which is almost as high as the revenue of all of the Las Vegas casinos combined.

Retirement

Final episode deals with better tax structure; series gets 4/5

The final episode fittingly takes a look at retirement.

According to experts, the retirement savings crisis is easier to fix than much of our modern problems.

"Just tax rich people's earnings like everyone else, and so much money could flow into the system," a financial expert says in this episode.

For making the mundane subject of finance so easy, this series gets a 4/5.