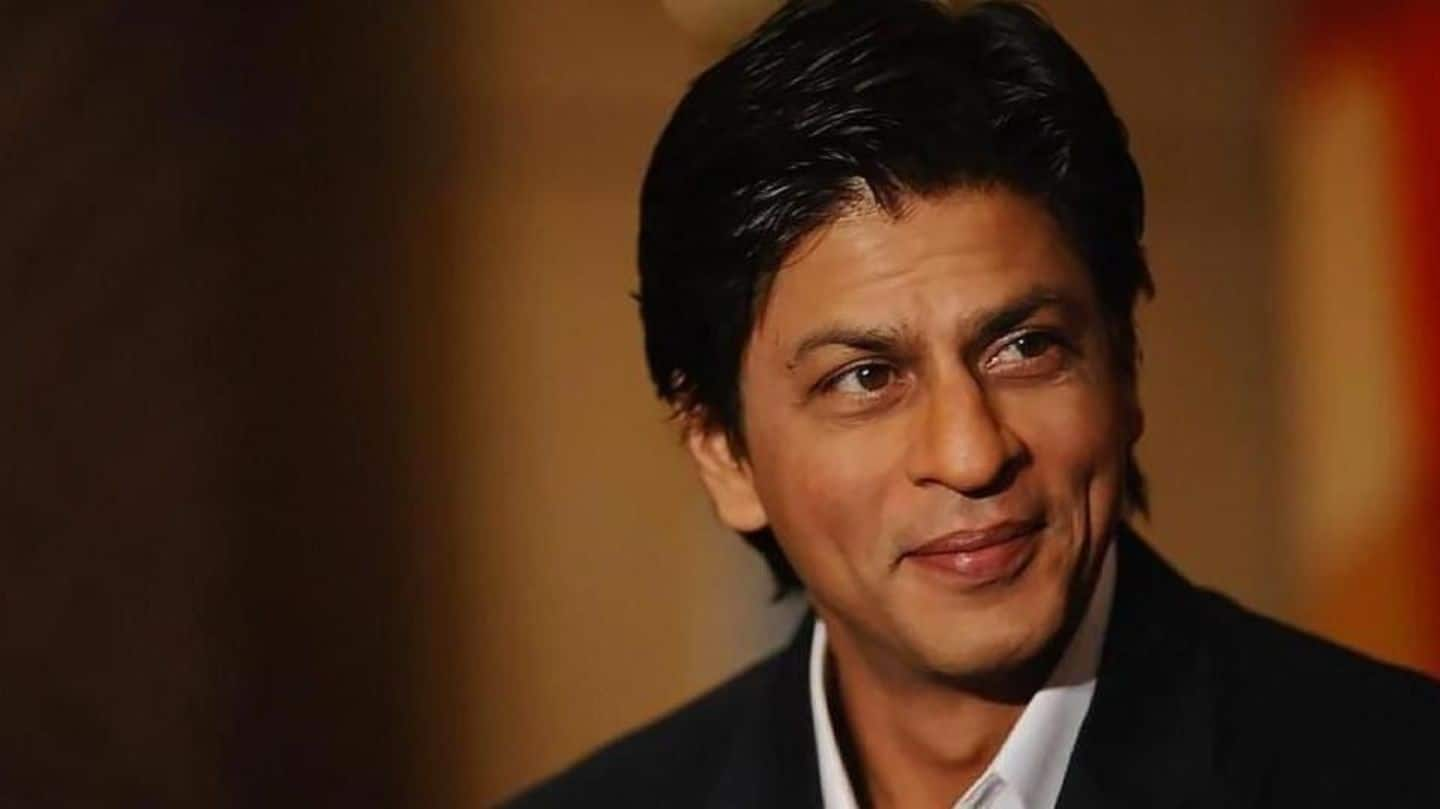

Relief to SRK in Dubai villa taxation case

What's the story

In relief to Shah Rukh Khan, the income-tax appellate tribunal (ITAT) has refused to include his earnings from his Dubai villa in his taxable income.

I-T authorities had argued the villa was a way to evade taxes. For 2007-08, they had added an additional Rs. 17.85cr to his declared Rs. 126.3cr as the property's value.

SRK had maintained it wasn't a profiteering venture.

Do you know?

Which villa are they talking about?

Nakheel PJSC, the Dubai-based company behind the famous Palm Projects, formally gifted the villa to SRK in 2007. Khan said the chairman, Sultan Ahmed Bin Sulayem, was a friend and gifted him without a motive of earning though it. RBI had approved the deal.

Case

How did the case pan out?

According to I-T, Nakheel's purpose was to use Brand SRK for making money. They viewed the villa as remuneration to the actor for utilizing his brand image and for his stage performances at the company's events.

SRK disagreed. He admitted to attending the company's annual day event, but only addressed employees and didn't perform on stage, thus there was no brand endorsement, he said.

Information

What went in favor of SRK?

The initial Rs. 17.85cr added to his declared income was eventually reduced to Rs. 14.7cr by the commissioner (appeals). However, the ITAT pointed out that for the year in question (2007-08), immovable property as gifts made without any consideration didn't fall under the tax ambit.