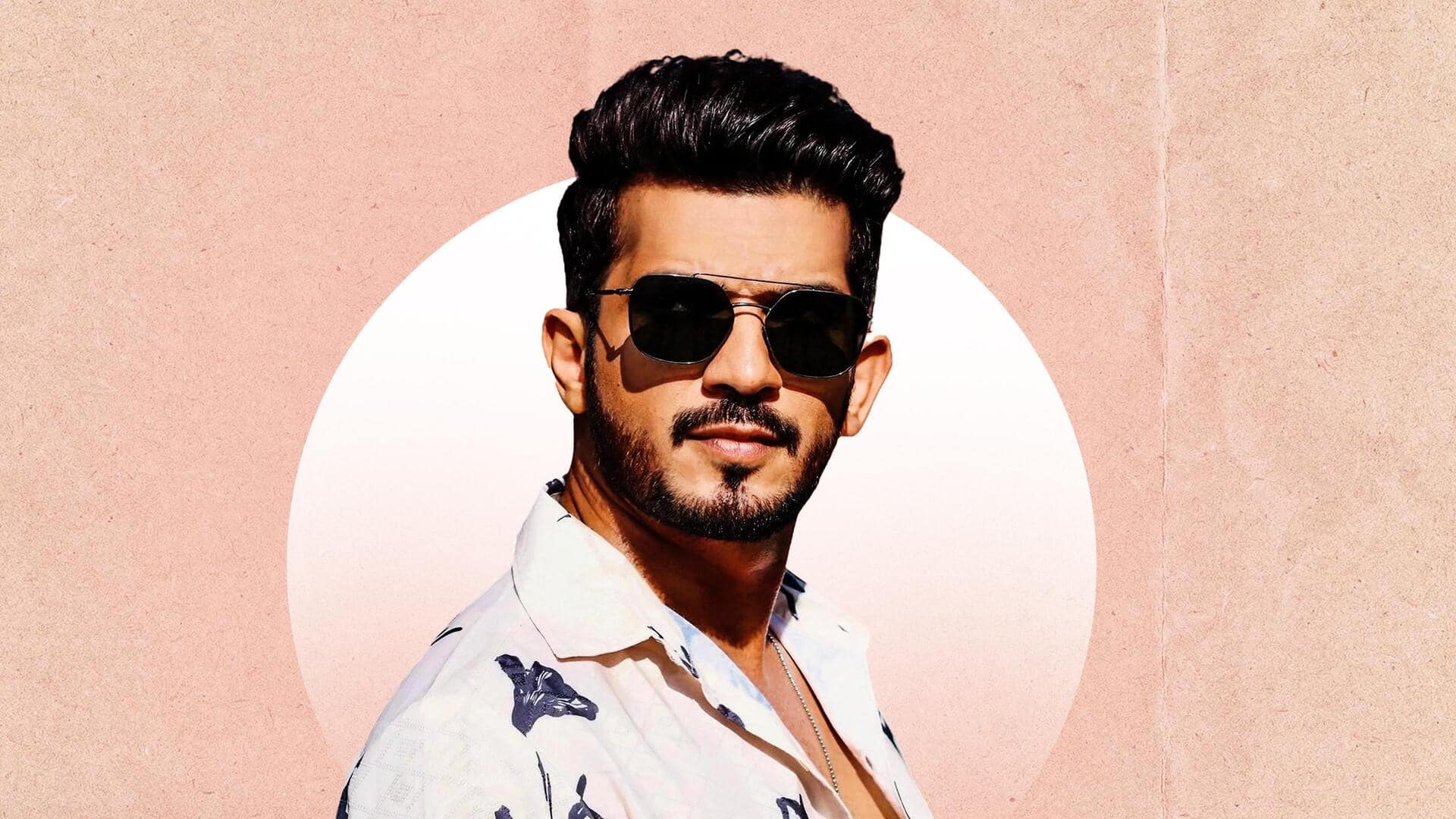

Arjun Bijlani loses ₹40K in cyberfraud case: 'No OTP received'

What's the story

Actor-host Arjun Bijlani recently became a victim of cyber fraud, losing ₹40K due to unauthorized transactions on his credit card.

Bijlani discovered the fraudulent activity while checking his phone during a gym session.

"My credit card was with me only and I was working out in the gym," the 41-year-old actor said, recounting how he received several messages about his credit card being swiped every minute.

Fraud

Here's what happened with Bijlani

During a quick break at the gym, Bijlani checked his phone and noticed several messages indicating his credit card was being swiped every minute for continuous transactions.

He told HT, "My wife also has a supplementary card, so I asked her, and that card was also with her. So, it was obvious that the details were leaked, and we are clueless as to how it happened."

Swift action

Bijlani's quick response prevented potential financial loss of ₹12 lakh

Bijlani's immediate response to the alarming bank messages helped prevent further financial loss.

He promptly blocked his card and reported the incident to the cybercrime cell.

"Luckily, I saw it and there were only seven to eight transactions that had happened till that point. Each transaction was for about 3K to 5K, and in total the card was used for ₹40K."

"My credit card has a limit of 10-12 lakh, so this situation could have gone much worse."

Security concerns

Bijlani puzzled over how transactions were completed without OTPs

Further, the actor expressed concern over the "lack of security measures" in digital transactions.

He noted that he did not receive any OTPs (One-Time Passwords) for the unauthorized transactions.

"There is a procedure that you get an OTP before any credit card transaction is done, but that's what I don't know," he stated, puzzled about how the transactions were successfully completed without him providing a single OTP.

Safety advice

'Going digital is great but this is very scary...'

In light of this incident, Bijlani emphasized the importance of vigilance and proactive measures in safeguarding personal finances in today's digital age.

He advised people to regularly change their credit cards as a precautionary measure against online fraud.

"Going digital is great but this is very scary; safety is equally important. I am definitely going to change my credit card every six months from now on," he declared.

Information

Scam alert: Weak security measures result in such cases

Bijlani isn't the first to fall for this scam; a dozen alarming cases have surfaced recently where individuals discovered unauthorized transactions on their credit cards without any prior notification. Officials attribute these incidents to insufficient security measures, such as the lack of two-step verification or the use of contactless debit or credit cards, which enable fraudsters to withdraw funds without needing an OTP.