World's wealthiest lose over $100B as DeepSeek rattles tech stocks

What's the story

The world's 500 richest people have lost a whopping $108 billion in a market downturn associated with Chinese AI start-up DeepSeek.

The bulk of the loss was shouldered by billionaires whose fortunes are tied to artificial intelligence (AI) technology.

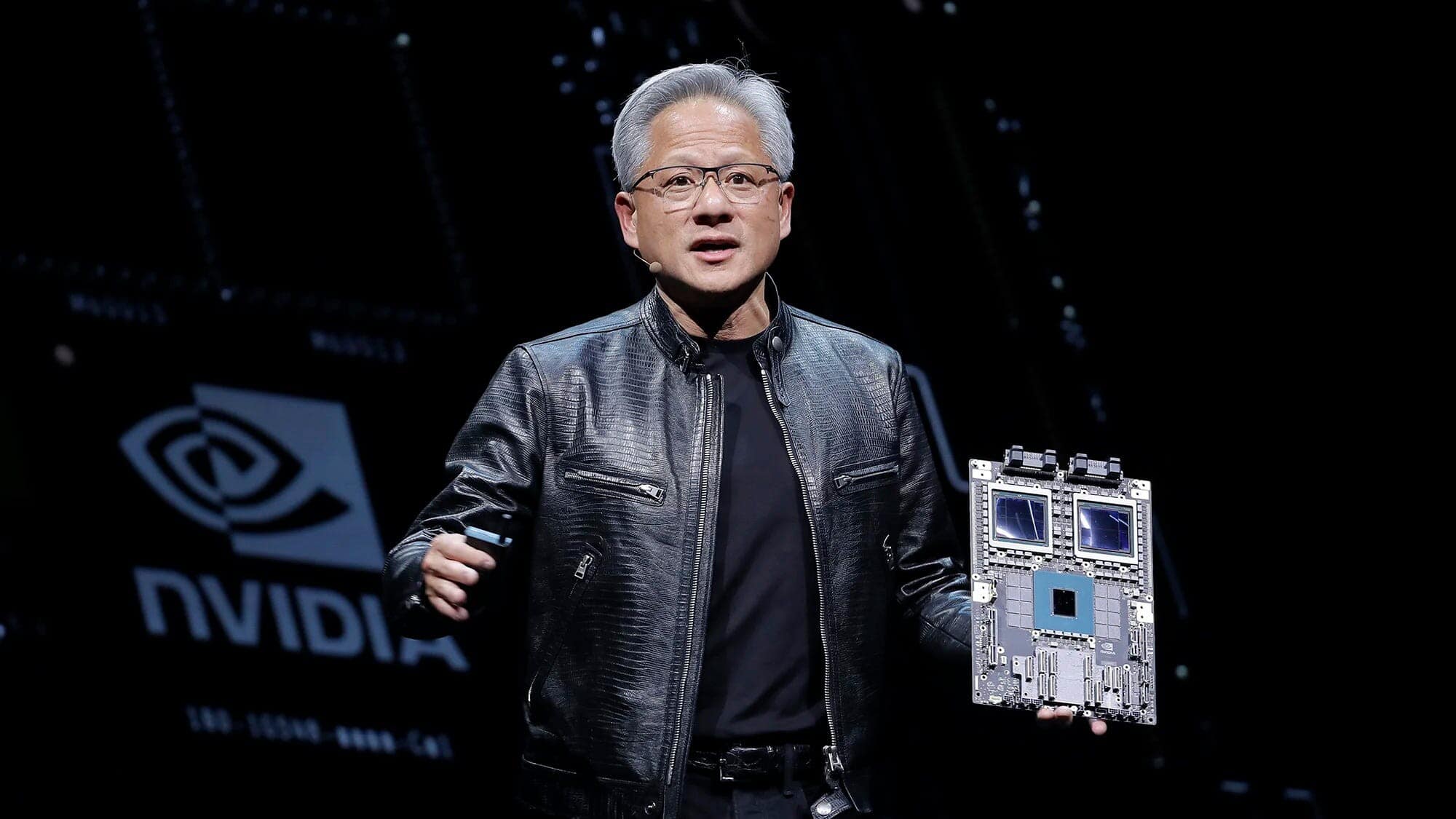

According to the Bloomberg Billionaires Index, NVIDIA co-founder Jensen Huang's wealth fell by $20.1 billion or 20% in a single day.

Oracle co-founder Larry Ellison suffered an even larger absolute loss of $22.6 billion, or 12% of his fortune.

Tech impact

Other tech billionaires also face significant losses

Other tech billionaires also suffered huge losses. Dell Inc.'s Michael Dell lost $13 billion, while Binance Holdings Ltd. co-founder Changpeng "CZ" Zhao's fortune fell by $12.1 billion.

Collectively, tech-sector tycoons lost $94 billion in wealth, which is roughly 85% of the total loss recorded by the Bloomberg index.

This came as the Nasdaq Composite Index fell 3.1% and S&P 500 index dropped 1.5% on Monday.

Market shift

DeepSeek's AI development challenges Silicon Valley's narrative

DeepSeek, a Hangzhou-based company that has been developing AI models since 2023, recently caught the eye of Western investors.

The company's free DeepSeek R1 chatbot app topped download charts worldwide over the weekend.

DeepSeek's entry into the AI race with a model that cost just $5.6 million to develop, challenges Silicon Valley's belief that significant capital expenditure is necessary for developing robust models.

AI disruption

DeepSeek's cost-effective approach disrupts AI market

DeepSeek's innovative approach to AI model development has impacted billionaires whose wealth is tied to the Western AI supply chain, which has been driving the equities market for the past two years.

The rise of these so-called "AI hyperscalers" like Meta Platforms Inc., Alphabet Inc., and Microsoft Corp., has generated billions in wealth for their owners since OpenAI unveiled ChatGPT in November 2022.

Spending surge

Big Tech's capital spending and market response

Big Tech firms, including Meta, have announced massive capital expenditure plans on AI-related projects this year.

Meta CEO Mark Zuckerberg unveiled plans to spend $60-65 billion on AI projects, exceeding Wall Street estimates.

A Bloomberg Intelligence report predicts total capital spending across all Big Tech firms will hit $200 billion in 2025.

Despite limited revenue returns from these investments, markets have responded positively by assigning record-high valuations to US tech stocks.

Wealth fluctuations

Wealth gains and losses amid AI boom

The AI boom has notably boosted the net worth of tech billionaires.

Huang's net worth has nearly grown eight-fold to $121 billion since early 2023, while Zuckerberg's fortune rose 385% to $229 billion during the same period.

Amazon.com Inc.'s Jeff Bezos also witnessed a whopping 133% jump in his wealth, which now stands at $254 billion.

Despite Monday's market slump, some tech billionaires, including Zuckerberg and Bezos, saw their fortunes rise by $4.3 billion and about $632 million respectively, as Meta rebounded from an early-session decline.