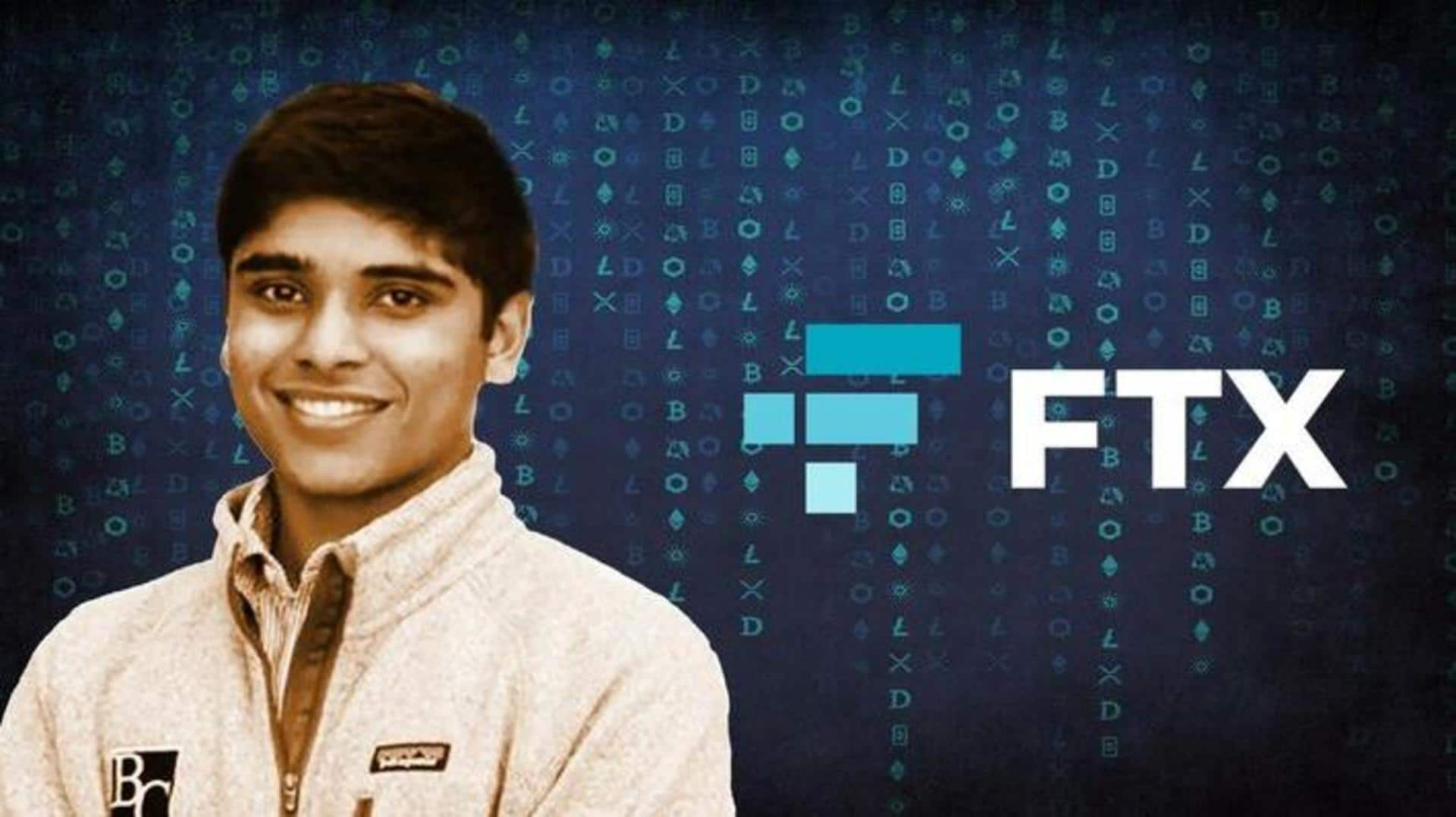

How Indian-origin techie Nishad Singh got involved in FTX storm

What's the story

The FTX story, as much a cautionary tale as it is, is also about dreams, friendship, and betrayal. Nishad Singh, the former director of engineering at FTX, has pleaded guilty to six fraud charges. He also agreed to help the government investigate the crypto exchange's collapse. He could take the stand against Sam Bankman-Fried, FTX co-founder and someone he has known since childhood.

Guilty

Singh pleaded guilty to six criminal counts

Singh pleaded guilty to six criminal counts during a hearing in a federal court in Manhattan. The charges include conspiracy to commit securities and commodities fraud. "I'm unbelievably sorry for my role in all of this and the harm that it has caused," Singh said in the court. He also pleaded guilty to making illegal donations to political-action committees and candidates using Alameda funds.

Beginning

Singh knew Bankman-Fried since childhood

Singh's relationship with Bankman-Fried began much before FTX. The son of Indian immigrant parents, Singh went to the same school as Bankman-Fried and was close friends with Gabriel Bankman-Fried, his younger brother. He joined Facebook after graduating from the University of California, Berkley. However, Singh left the company after discovering Bankman-Fried started a crypto-trading firm.

Alameda Research

He joined Alameda Research in 2017

Singh's professional relationship with Bankman-Fried began with Alameda Research in 2017, the same year Bankman-Fried founded the crypto hedge fund with Gary Wang. His role was to assist Bankman-Fried and Wang with engineering-related projects. Bankman-Fried described Singh as "an unfailing nice person, a good team player, good cultural influence, and relatively weak programmer" in a 2018 performance review.

FTX

Singh was one of the key architects of FTX

Over time, his technical proficiency improved, and so did his importance in the company. In 2019, he moved to Hong Kong to help Wang set up FTX. He was one of the key architects of the exchange, which later became the third-largest in the world. His growing responsibilities meant he soon became the head of engineering at both Alameda and FTX.

Singh's role

He was the most approachable member of the inner circle

At FTX, he was the most approachable member of the inner circle, which included Bankman-Fried, Wang, and Caroline Ellison, the former CEO of Alameda. He was also Bankman-Fried's go-to man to deal with tricky personnel issues. Singh owned a considerable portion of FTX before it fell, including 7.8% of the exchange's US arm and 10% of its ventures arm.

Testify

Wang and Ellison accepted plea bargains before Singh

Singh is the last of the inner circle to testify against Bankman-Fried. Wang and Ellison accepted plea bargains and admitted guilt in December last year. They pleaded guilty to similar offenses as Singh did. Bankman-Fried, on the other hand, has repeatedly maintained that he did not intentionally steal from customers. He has also refuted the fraud charges.

SEC

Sing created the code to facilitate diversion of funds: SEC

There are multiple parallel charges against Singh by different agencies. The Securities and Exchange Commission (SEC) charged Singh earlier this week for defrauding FTX's equity investors. The charges followed his guilty plea in the Manhattan courthouse. SEC accuses Singh of creating the code that allowed funds of FTX customers to be diverted to Alameda Research.

Parallel actions

There are multiple parallel actions against Singh

After SEC, the US Attorney's Office for the Southern District of New York and the Commodities Futures Trading Commission (CFTC) also announced charges against Singh. The CFTC accuses Singh of fraud by misappropriation and aiding/abetting fraud committed by Bankman-Fried. He did not contest his liability on CFTC's claims. He has also entered into a plea deal in the charges by the Attorney's Office.

Plea deal

Singh would do anything to make things right: Lawyers

Per Singh's plea deal, he has to testify in any trial if the federal prosecutors request him to do so. With SEC, he has entered into a settlement, according to which he would be barred from serving as an officer or director of a public company and pay a penalty. Singh's lawyers said he would do anything to make things right.