Uber launches "No-Fee" credit card, offering a lot of perks!

What's the story

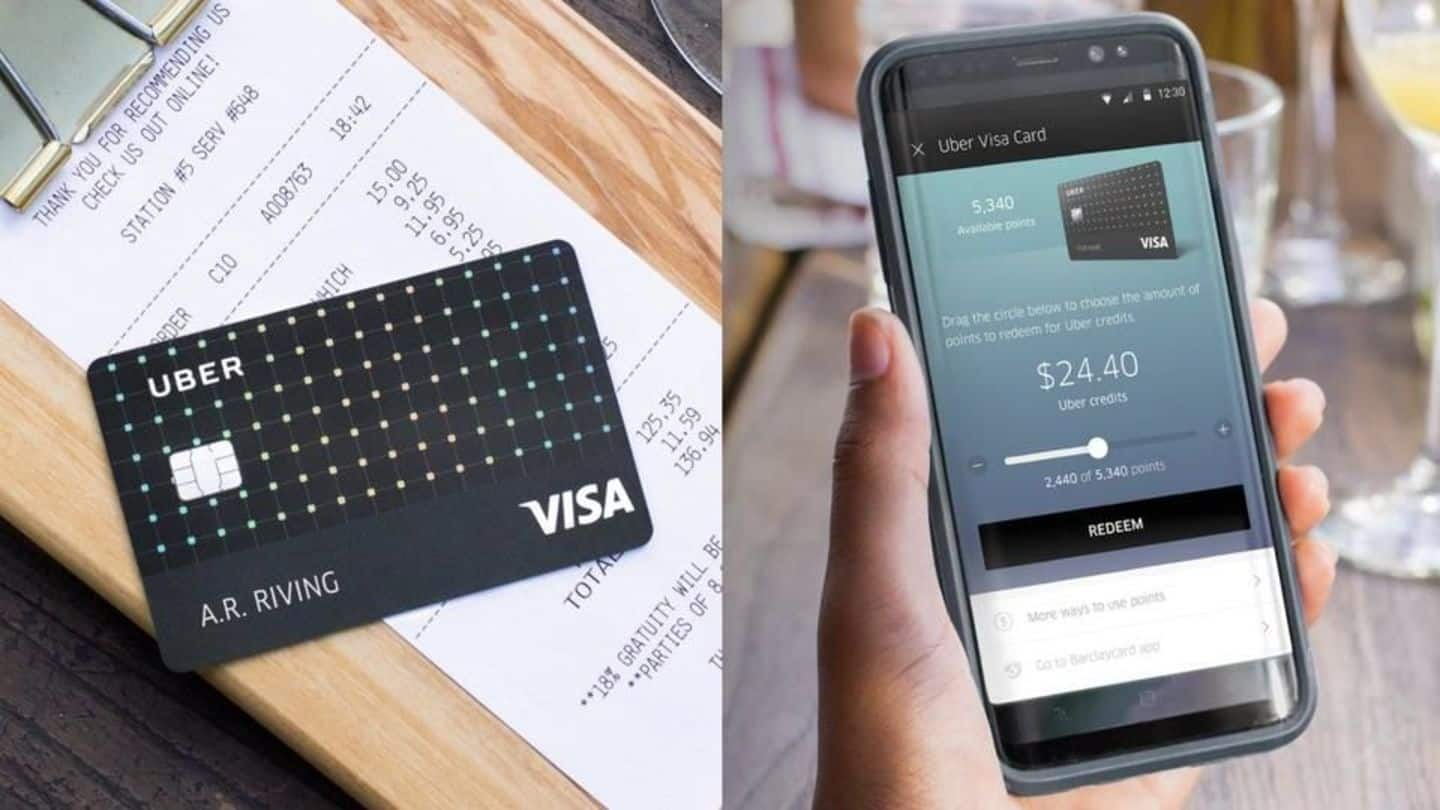

Ride-hailing giant Uber announced its foray into the credit card business in the US in partnership with British bank Barclays and Visa at Money2020 summit in Las Vegas.

The "No Annual Fee" Uber Visa Card, bundled with many offers, can be used for Uber rides, online-shopping, dining, music/video streaming services, etc.

Applications for the card start on 2 November on Uber's app/website.

Know more!

Uber Visa Card

Uber, the first ride-hailing service, to introduce own credit card

Uber Visa Card gives the transportation tech company an opportunity to have a prominent role in online as well as offline business.

Following a successful application, users can use the card on Uber and UberEats; the physical card would reach customers in a week or so.

As of now, there is no word on the global launch of the card.

Quote

Simple, seamless experience

Barclays's US Partnerships Head, Denny Nealon, said: "The Uber Visa Card is one of the richest no-annual-fee card programs available in the US. Our deep integration with the Uber app enables us to provide the simple and seamless experience customers are looking for."

Offers, Rewards

Slew of offers! Users can avail bonus, discounts, cashbacks

Uber's credit card gives users a $100 bonus after spending $500 within the first 90 days.

It offers cashbacks of 4% at restaurants/bars/take-outs, 3% on airfares and hotel/Airbnb/short-stay-rentals, 2% on online purchases, and 1% on everything else.

Other perks include a $50-credit for online-subscriptions (if users spend $5,000/year) and up to $600 phone-insurance for those using the card to pay monthly phone bills.

Information

Earn rewards with every purchase

Customers using Uber Visa Card can earn points with every online/offline purchase they make. They can track and redeem these for Uber credits, cashbacks, or gift cards. Card users also receive special invites to exclusive events and offers.

User Privacy

Uber can access "incredibly valuable" user information

Uber's latest move gives it access to a lot of customer data. But, Uber's user privacy issues in the past may stop people from getting the Uber Visa Card.

Uber's "God View" tool allowed its employees anonymously trace Uber riders' movements in real-time with almost no restrictions.

It also had a feature to track user locations even after the end of a ride.

Information

User data would be kept safe: Uber

Uber's Global Head of Business and Corporate Development, David Richter, assured they wouldn't sell any of the collected user data to third-parties. He said their idea is to ensure Uber Visa Card "becomes the credit card customers use for recurring payments" and establish loyalty.