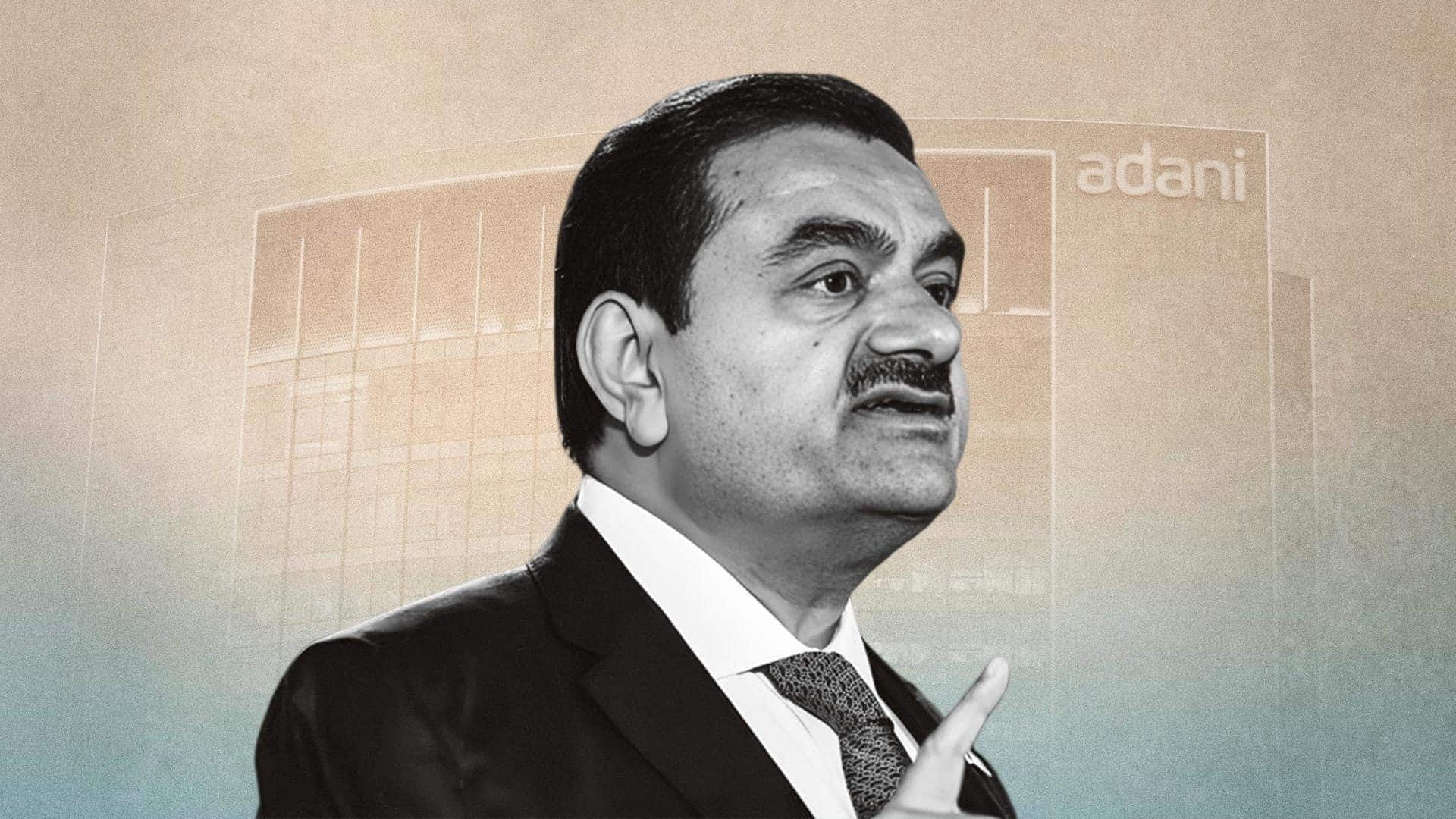

Switzerland freezes $310M in Adani accounts amid money laundering investigation

What's the story

Swiss authorities have reportedly frozen over $310 million across multiple bank accounts, linked to an ongoing investigation into the Adani Group.

This information was disclosed by US-based short seller Hindenburg Research in a social media post on September 12.

The investigation allegedly involves allegations of money laundering and securities forgery against the Indian multinational conglomerate, with roots tracing back to 2021.

Prior probe

Swiss media reveals pre-existing investigation into Adani Group

Hindenburg Research referenced a report by Swiss media outlet Gotham City, which revealed that the Federal Criminal Court (FCC) had ordered an investigation into the Adani Group's alleged misconduct.

This probe was initiated by the Geneva Public Prosecutor's office before Hindenburg Research leveled its first accusations against the conglomerate.

The report also disclosed that over $310 million, allegedly belonging to a frontman for billionaire Gautam Adani, was concealed in six Swiss banks.

Case transfer

Swiss Attorney General's office takes over investigation

Following the exposure of the case to the media, the Office of the Attorney General of Switzerland (OAG) assumed control of the investigation from Geneva's Public Prosecutor.

Hindenburg Research alleged that this frontman had invested in "opaque BVI/Mauritius & Bermuda funds" that primarily held Adani Group's stocks.

This claim was based on court records released by a Swiss criminal court and reported in local Swiss media.

Twitter Post

Take a look at Hindenburg's post

Swiss authorities have frozen more than $310 million in funds across multiple Swiss bank accounts as part of a money laundering and securities forgery investigation into Adani, dating back as early as 2021.

— Hindenburg Research (@HindenburgRes) September 12, 2024

Prosecutors detailed how an Adani frontman invested in opaque…