India's smartphone market declines 10% YoY; Xiaomi remains the bestseller

What's the story

India's smartphone market has presented a grim picture yet again.

As per an IDC report, the companies shipped 43 million units between July and September, which is a 10% year-on-year (YoY) decline in Q3 2022.

Rising prices of the gadgets coupled with lowered demand led to the lowest third-quarter shipment since 2019. Notably, 5G-enabled handsets accounted for 36% of total shipments.

Context

Why does this story matter?

Due to rising input costs, the average selling price of smartphones in India has risen consistently for eight quarters in a row. Thus, despite the festivities, demand for new devices is not going up.

The Q4 of 2022 is also likely to witness muted sales, with a market decline of 8-9% YoY. The situation might improve in 2023, especially in mid-premium and above segments.

Top

Which brands were the bestsellers?

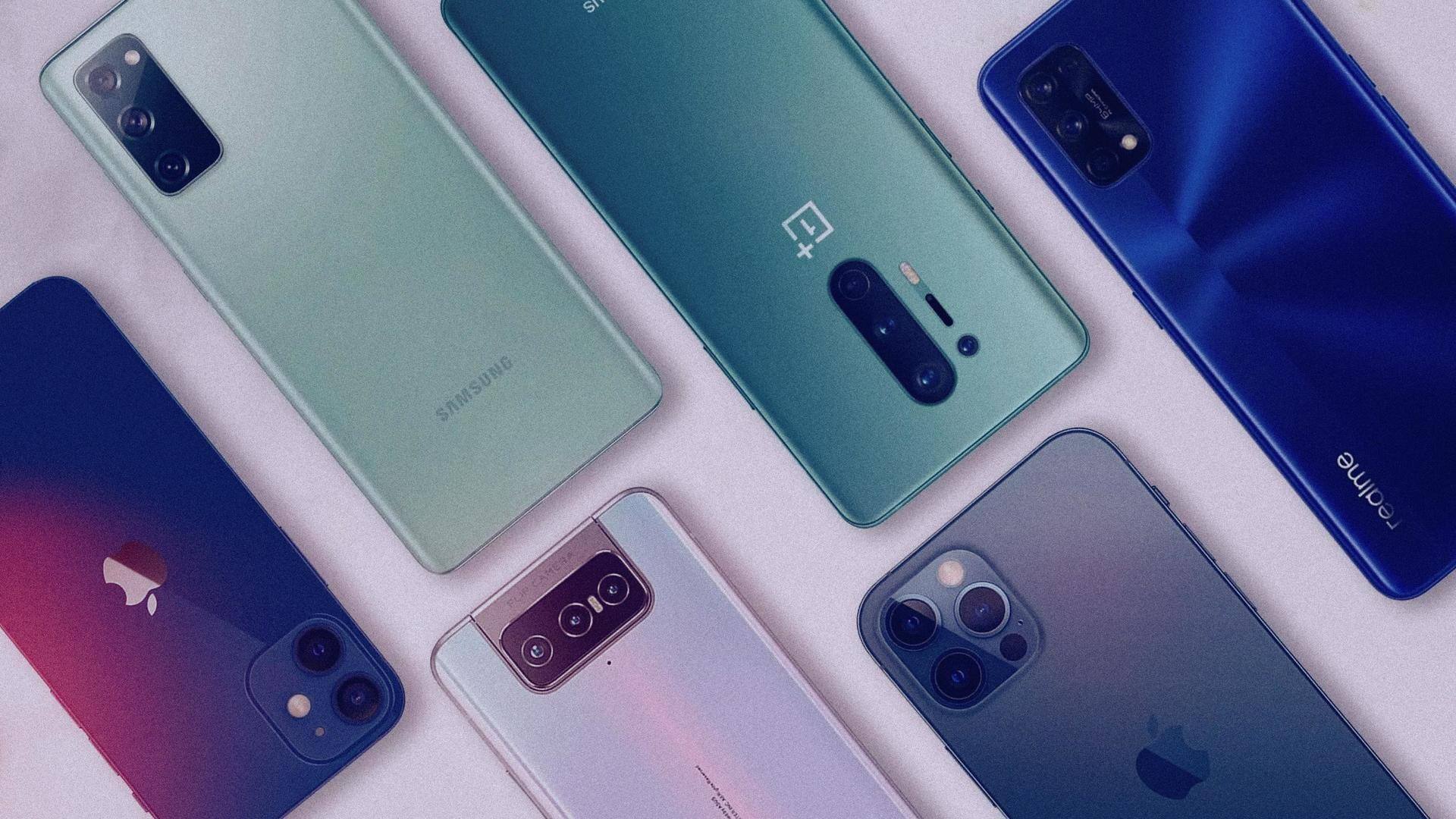

Xiaomi occupied the pole position with 18% fewer shipments YoY in 3Q22. Over, 70% of its shipments were via online channels.

Samsung came in second place with 8 million shipments in 3Q22. It led the 5G segment with a 27% share.

In the third position, Vivo saw a 20% YoY decline in shipments. Notably, 35% of its shipments were using the online mode.

Growth

OPPO witnessed a YoY growth

The fourth and fifth positions belonged to Realme and OPPO, respectively.

The former's shipments declined 18% YoY and two-thirds of its products went to online channels.

OPPO was the only brand in the top five with a 6% YoY shipment growth. Around 23% of its goods were shipped via online means. It is the market leader when it comes to offline market.

Figures

How did the market behave?

Online channels saw a flat YoY growth and shipped 25 million units to record a 58% market share.

Meanwhile, offline shipments went down by 20% YoY as they failed to compete with the web-based sellers.

In Q3 2022, the 5G devices accounted for 36% of total shipped ones. Between Q1 2020 and Q3 2022, India shipped 67 million 5G handsets.

Statistics

Demand for premium models grew by 8%

MediaTek-powered devices occupied 47% market share, followed by Qualcomm (25%) and UNISOC (15%).

The premium segment (Rs. 40,000+) had an 8% market share and registered a 64% YoY growth.

The segment leader was Apple (63% share), followed by Samsung (22%) and OnePlus (9%) taking second and third spots, respectively.

The sub Rs. 25,000 category declined 15% YoY. Its decline affected the entire Indian market.