Manage your finances better with these apps

What's the story

We all know how daunting it can be to manage finances, but thanks to digital tools, it has never been easier.

These tools help simplify budgeting, expense tracking, and investment management.

Using technology, you can take better control of your money without having to deal with complex spreadsheets or manual calculations.

Here are four digital tools that'll make finance management simpler, more efficient.

Budgeting tool

Budgeting made easy

Budgeting apps let you set financial goals and track your spending in real-time.

They automatically categorize your expenses, giving you insights into your spending habits.

You can set limits for different categories, such as groceries or entertainment, and get alerts when you're approaching them.

This way, you can maintain discipline and ensure that your spending is in line with your financial goals.

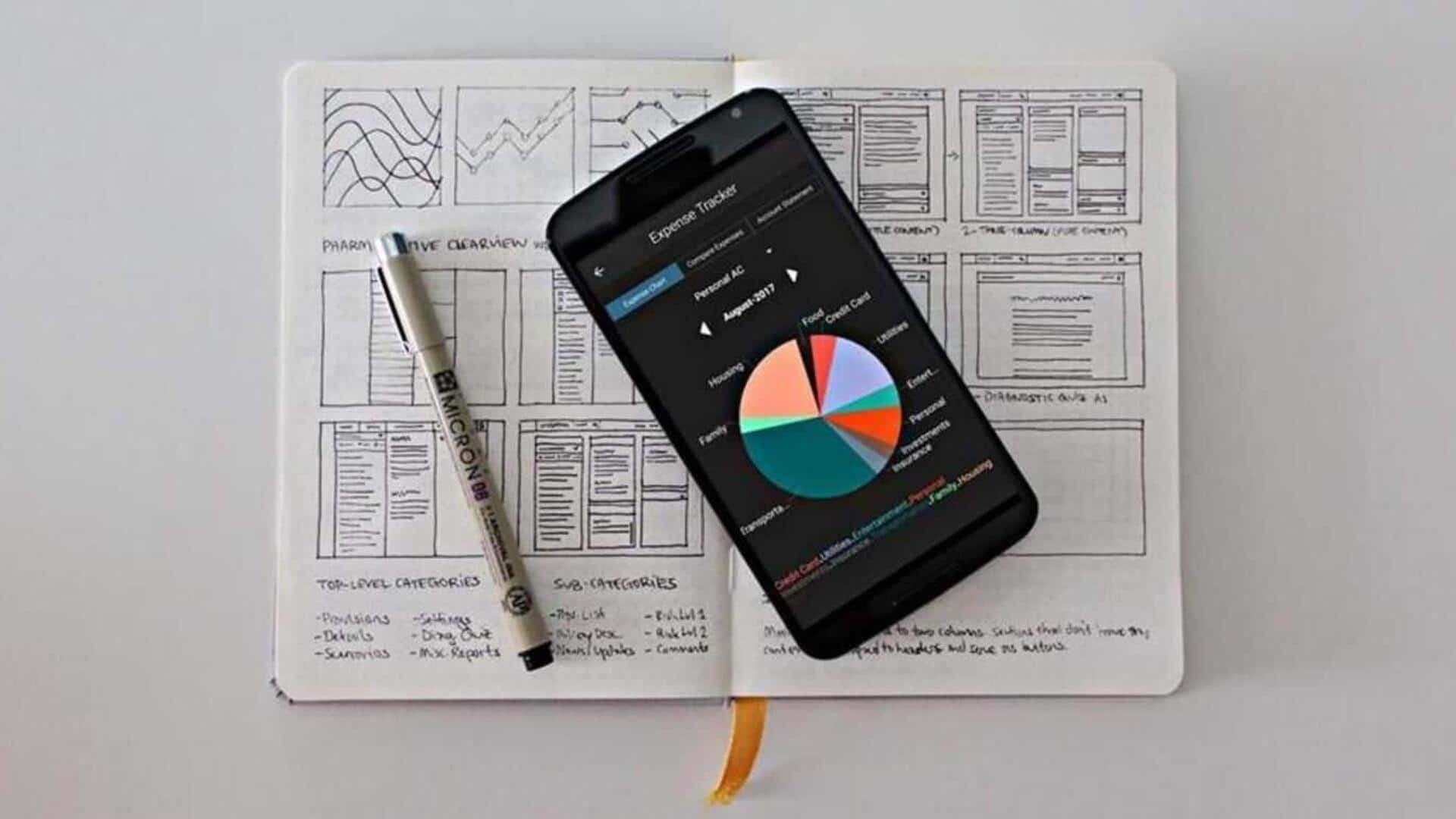

Expense tracker

Track expenses effortlessly

Expense tracking apps sync with bank accounts to provide a clear picture of everything you are spending on.

They come with features such as receipt scanning and category or merchant-based expense categorization.

This way, you can quickly determine where you're overspending and make necessary changes.

Plus, with detailed reports available at a glance, you can make smart decisions about your money.

Investment tool

Investment management simplified

Investment management platforms provide tools for tracking portfolios across different asset classes like stocks, bonds, or mutual funds.

They provide real-time updates on market trends and performance metrics of individual investments.

Users can also access educational resources to improve their understanding of investment strategies, helping them make the right decisions about how to grow their wealth.

Savings automation

Automate savings goals

Automated savings apps take the hassle out of saving money by putting aside small amounts from checking accounts into savings accounts at regular intervals.

These transfers are made according to rules defined by the user, like rounding up purchases, or setting a certain amount weekly or monthly.

The automation reinforces saving habits without requiring the user to pay constant attention.