Foreigners can now invest in Mecca and Medina's real estate

What's the story

In a major policy shift, Saudi Arabia has allowed foreign investors to invest in publicly-traded companies owning real estate in the holy cities of Mecca and Medina. Under the new policy, foreigners can purchase shares and convertible debt instruments in companies listed on the Saudi stock exchange. The companies must own public or private real estate within the city limits of Mecca and Medina, the Capital Market Authority (CMA) said.

Limitations

Restrictions on foreign ownership

However, the CMA has imposed certain restrictions on this new investment opportunity. Strategic foreign investors are not included in this policy and a cap has been imposed on foreign ownership, which cannot go beyond 49% of a company's listed shares. This move is a part of Saudi Arabia's larger plan to attract more overseas investment and diversify its economy under the Vision 2030 agenda.

Market reaction

Market response and impact on real estate firms

The announcement of this new policy has already affected the market. Shares of several real estate companies have surged after the news. Jabal Omar Development Co., for example, jumped as much as 10% at the opening in Saudi Arabia. Other companies that could benefit from this change include Dar Al Arkan Real Estate Development Co, Taiba Investments Co, Emaar Economic City, and Makkah Construction & Development Co.

Development goals

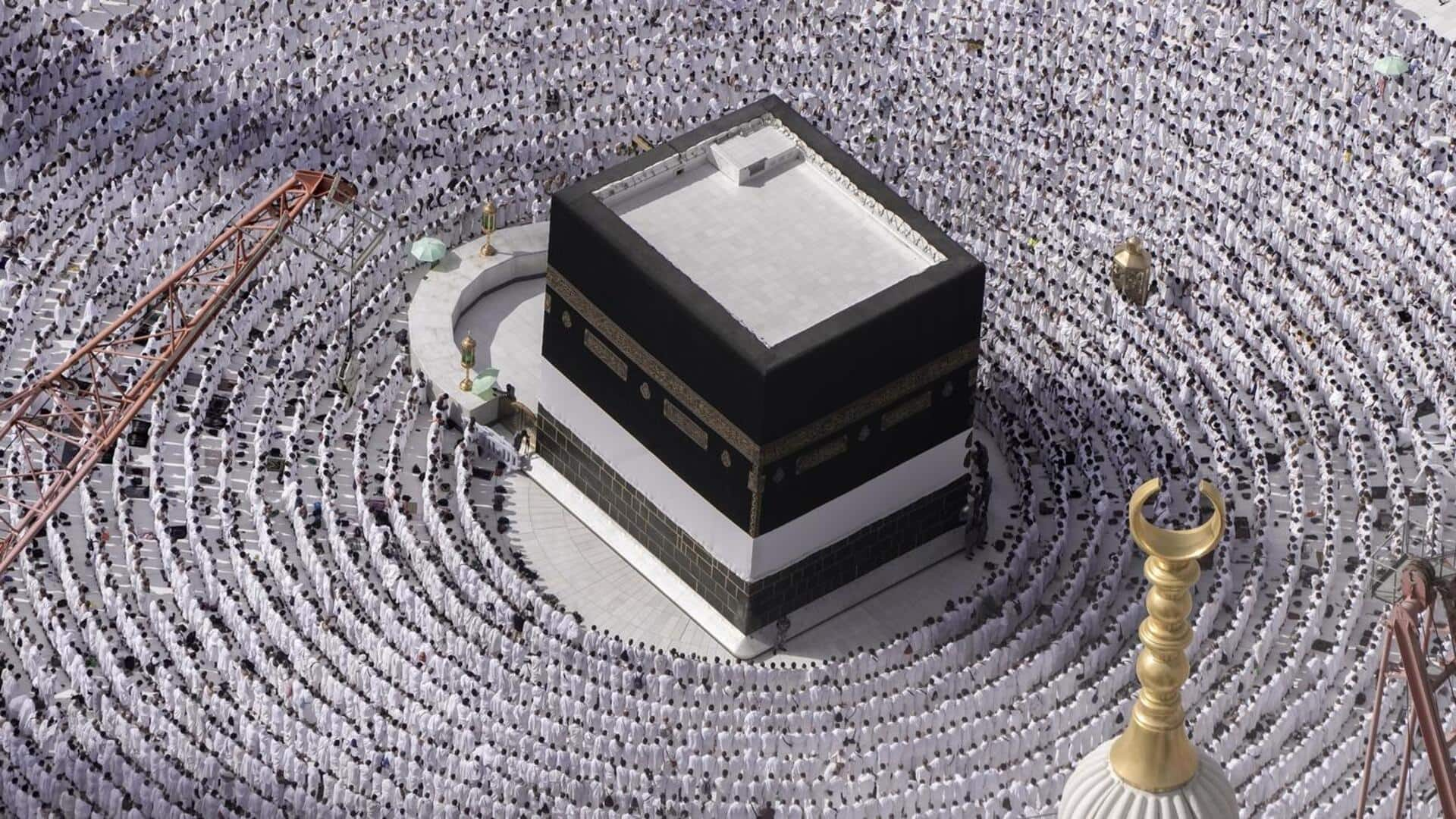

Saudi Arabia's Vision 2030 and expansion projects

Not just reforming investment laws, Saudi Arabia is also relaxing restrictions on foreign ownership in the stock market as part of its Vision 2030 agenda. The kingdom has ambitious expansion projects in Mecca and Medina, aiming to host 30 million foreign worshippers every year by 2030. This new policy is expected to boost investment and make the capital market more attractive while benefiting the local economy.