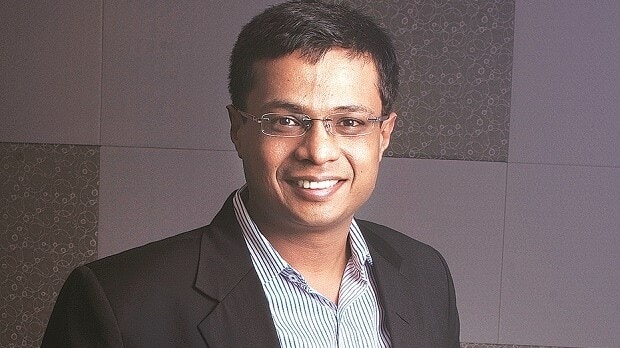

Flipkart co-founder Sachin Bansal to sell $100M Ola stake: Report

What's the story

Flipkart co-founder Sachin Bansal is said to be mulling over the sale of his $100 million stake in ride-hailing service Ola.

According to The Economic Times, talks are already on with private investors and family offices.

The deal's finalization depends on Ola's valuation, which Bansal expects to be around $4 billion.

This potential sale comes after Bansal's recent divestment from electric scooter-maker Ather Energy.

Investment details

Bansal's investment history and discussions with Ola's founder

Bansal had invested $100 million in Ola back in 2019, his biggest personal start-up investment to date. At the time, Ola was valued at about $3 billion. However, the exact valuation wasn't publicly disclosed.

Bansal has been in talks with Bhavish Aggarwal, Ola's founder, over the likely stake sale.

Both entrepreneurs have a history of building ventures that take on US giants like Amazon and Uber in India.

Strategic shift

Bansal shifts focus to Navi amid regulatory challenges

Bansal's decision to sell his Ola stake also comes in line with his rising focus on Navi, his fintech venture.

Over the last year, he has been pouring resources into Navi and looking for external funding for the start-up.

The money raised from Ola's stake sale could be used to strengthen Navi's financial position.

This pivot comes as Navi faces regulatory challenges, including a temporary lending ban by the Reserve Bank of India on its non-banking financial arm, Navi Finserv.

Funding prospects

Navi's funding journey and Ola's upcoming IPO

Despite regulatory challenges, Bansal has discussed raising funds at a $2 billion valuation for Navi in April 2024.

He already invested a big portion of his personal wealth into the fintech start-up after earning $1 billion from his Flipkart exit in 2018.

Meanwhile, Ola is gearing up for an initial public offering (IPO) likely within the next financial year, ending March 2026.

Existing investors are negotiating with the company about selling shares during this public offering.

Business evolution

Ola's valuation and diversification efforts

Ola's valuation has taken a major hit in recent years.

As of August 2024, Vanguard valued the firm at $2 billion, a steep decline from its $7.3 billion high in 2021.

The decline is due to business issues during the pandemic and a rebranding attempt to make Ola a larger consumer internet company.

Despite the challenges, the firm posted a loss of ₹1,082 crore in FY23 but its revenue grew by 58% to ₹2,135 crore in the same period.