Reliance's 1:1 bonus issue: Last day to double your shares

What's the story

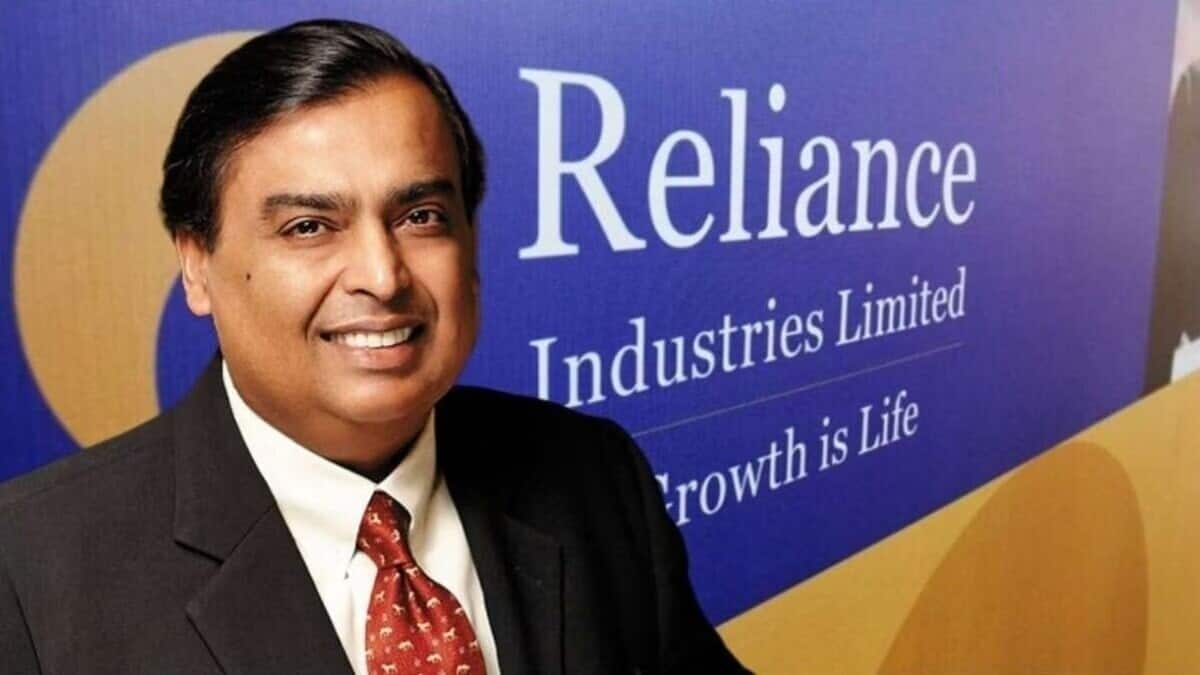

Reliance Industries, led by Mukesh Ambani, announced a 1:1 bonus share issue in September. This early Diwali gift, as Ambani described it, was met with enthusiasm from investors. The record date for the bonus share issue was later set for October 28. So, retail investors can buy RIL shares and qualify for this bonus till today, October 25.

Record date

Bonus issue's record date and eligibility criteria

To qualify for the bonus shares, investors must hold RIL shares at least a day before the record date i.e October 28. Given India's T+1 settlement cycle, shares purchased on the record date won't be eligible for the bonus allocation. Hence, investors are advised to grab their shares before today's market close.

Share dynamics

Bonus issue's impact on share quantity and value

Post the bonus issue, an investor holding 100 RIL shares will get another 100 shares, bringing the total to 200 shares. However, it's worth noting that while the number of shares will increase, the overall value of the investment remains unchanged. This is because the share price adjusts to reflect the increased number of outstanding shares. This move gives investors a way to increase their holdings without putting in more money.

Market performance

RIL's market performance and investor sentiment

Earlier today, RIL's scrip had declined 1.33% to ₹2,644 apiece but later trimmed losses to trade 1.30% lower at ₹2,644.65 apiece. This is against a 0.86% decline on the Nifty 50 Index. The company's share price has dropped 11% in the last month but has risen 17.13% in the past year.