China Evergrande, with $300B in debt, ordered to liquidate

What's the story

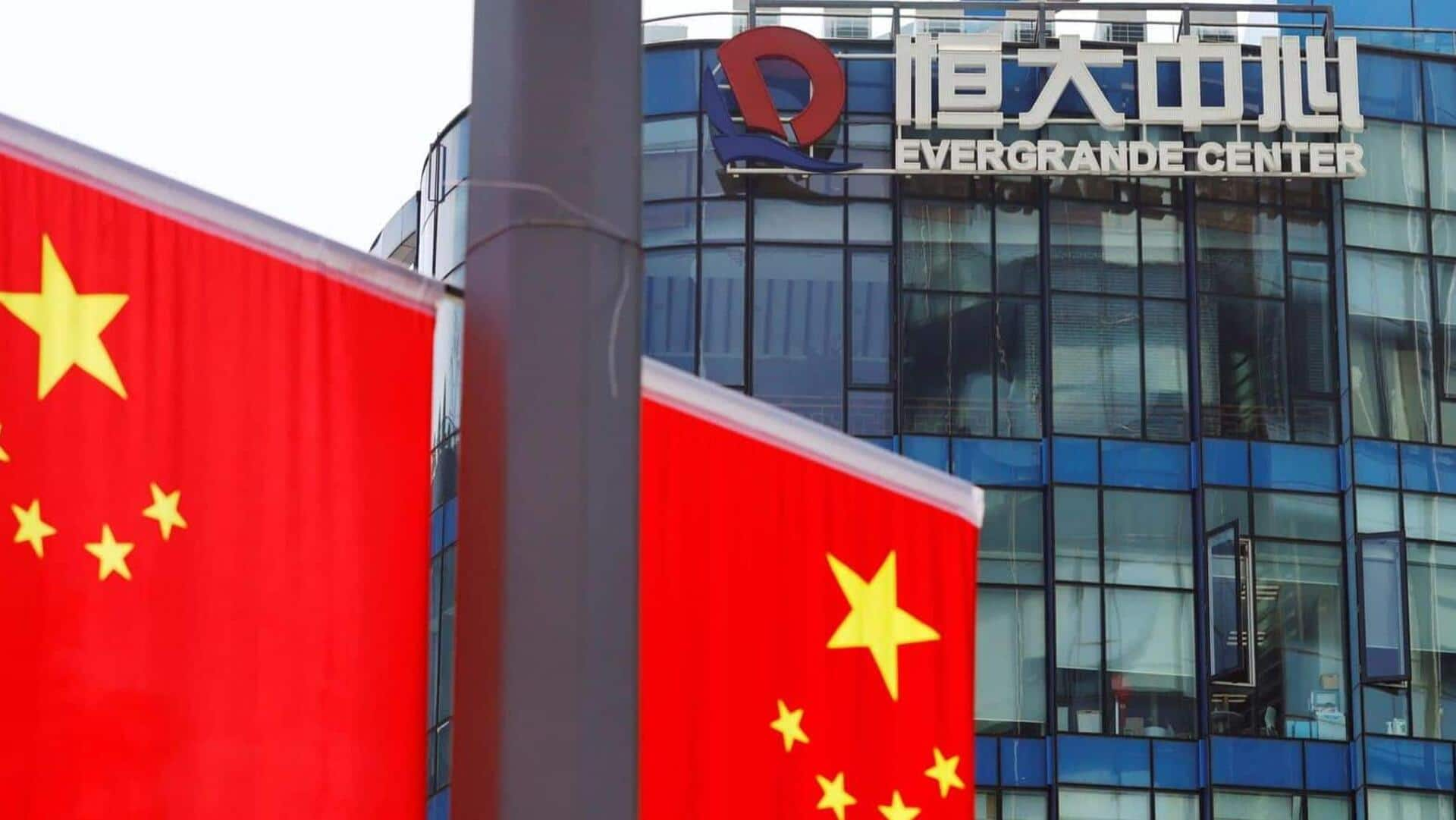

A Hong Kong court has ordered the liquidation of China Evergrande Group, the world's most indebted property developer with over $300 billion in liabilities. This decision could shake China's already unstable financial markets as officials rush to manage the escalating crisis. Evergrande's debt default in 2021 triggered a nationwide crisis in the property sector, leading to multiple company defaults and hindering economic growth.

Impact on China

Impact of Evergrande's liquidation on Chinese economy and property market

The liquidation of Evergrande, which possesses $240 billion in assets, might further impact the Chinese capital and property markets. China is currently dealing with a struggling economy, its worst property market in nine years, and a stock market near five-year lows. This additional strain on the markets could hinder policymakers' attempts to revive growth. However, Evergrande's liquidation process is not expected to immediately affect the company's operations, such as home construction projects.

Debt crisis looms

Evergrande failed to provide concrete restructuring plan

Evergrande's liquidation process might be complex due to political factors and involvement of multiple authorities. It could take months or years for the offshore liquidator appointed by creditors to gain control of subsidiaries across mainland China. Evergrande had been collaborating with an ad hoc bondholder group on a $23 billion debt revamp plan for nearly two years but failed to come up with something concrete. Since the mid-2021 debt crisis, at least three Chinese developers have been ordered to liquidate.