RBI keeps repo rate at 4%, cuts GDP growth projection

What's the story

The Reserve Bank of India (RBI) has once again kept the repo rate unchanged at 4 percent in an attempt to "support growth and keep inflation within the target" amid India's COVID-19 crisis.

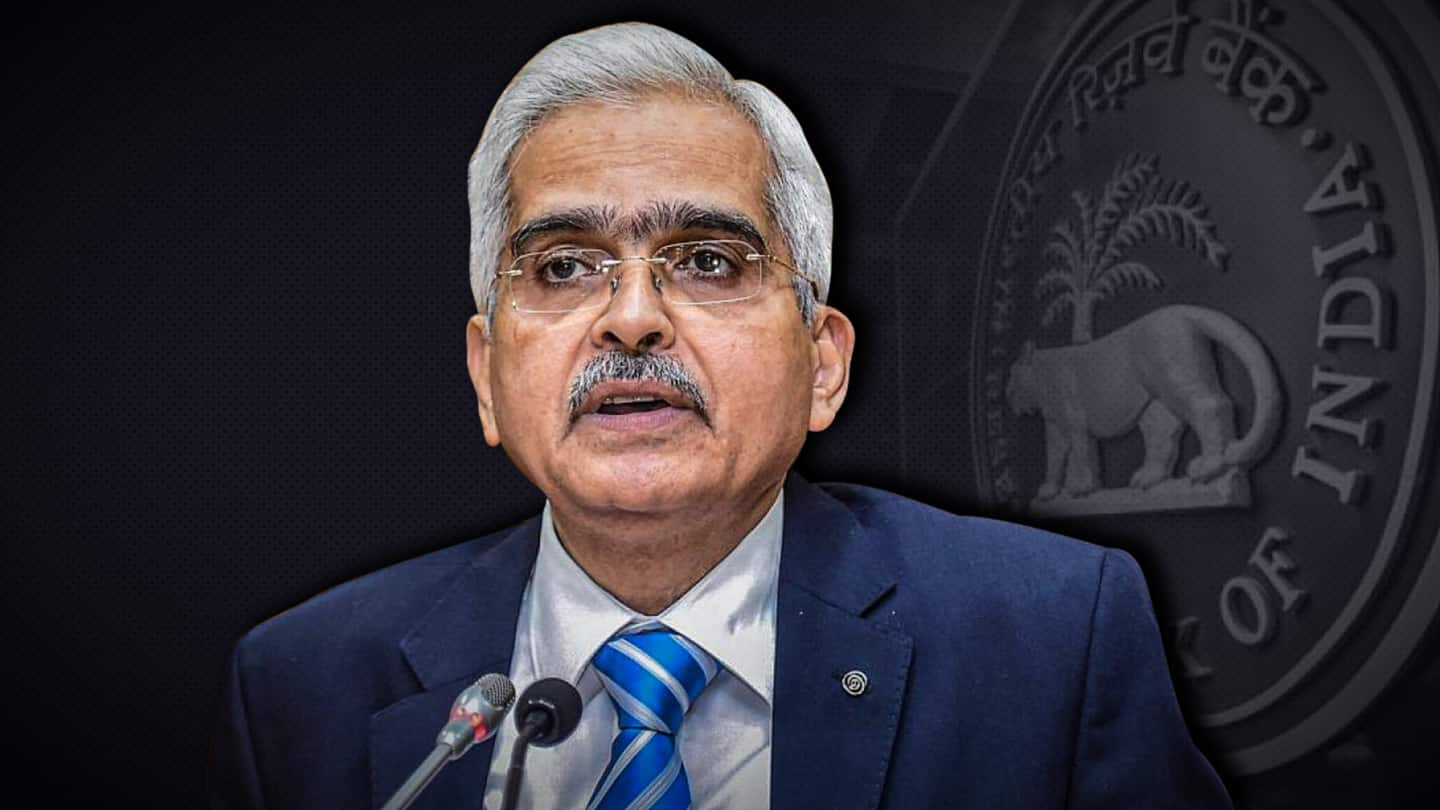

The reverse repo rate will also stay the same at 3.35 percent, RBI Governor Shaktikanta Das said today, after concluding a three-day meeting of the Monetary Policy Committee (MPC).

Details

RBI lowers growth forecast to 9.5%

Besides the key rates, the RBI has reduced the economic growth forecast for the current fiscal year (FY22) from the earlier 10.5 percent to 9.5 percent, considering the impact of the COVID-19 second wave, Das informed.

Meanwhile, the top bank has projected retail inflation at 5.1 percent for FY22.

Marginal Standing Facility (MSF) and Bank Rate are also unchanged at 4.25 percent.

Details

Forex reserves cross $600 billion, says RBI

This is notably the six straight time the repo rate has been kept untouched.

RBI today also said that foreign exchange reserves have breached the $600 billion mark.

Earlier this year, the Indian government had asked the apex bank to maintain retail inflation at 4 percent with a margin of 2 percent on the either side for the coming five-year period ending March 2026.

Context

Indian economy performed its worst in 4 decades

The Indian economy contracted by 7.3 percent in FY 2020-21 - its worst performance in more than 40 years.

Nonetheless, the agriculture sector saw a growth of 3.6 percent.

The final quarter of January-March brought a growth of 1.6% as COVID-19 infections were declining across India.

Officials and experts have now predicted an upward economic trajectory as the second COVID-19 wave is gradually diminishing.

Definition

What are the repo and reverse repo rates?

Repo stands for repurchase agreement.

It is the rate at which the Reserve Bank of India lends money to commercial banks across the country.

Separately, the reverse repo rate is the opposite of the repo rate - implying that it refers to the rate at which the RBI borrows funds from commercial banks in the country.

Both of these are short-term loans.