Repo rate untouched, 10.5% GDP growth predicted in 2021-22

What's the story

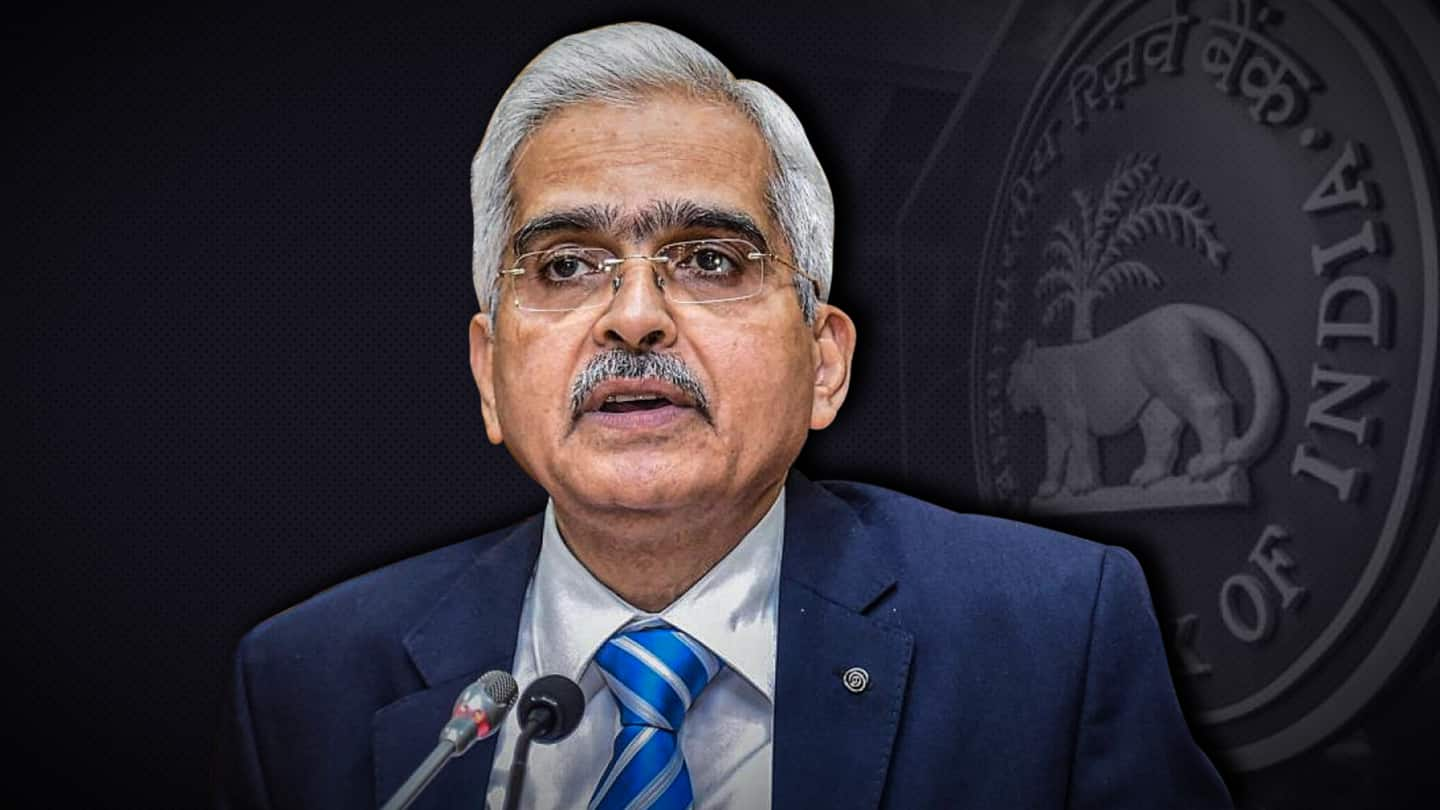

Reserve Bank of India (RBI) has decided to leave key rates unchanged, Governor Shaktikanta Das said on Friday, in his first address after the Union Budget was presented on Monday.

The repo rate remains the same at 4% and the reverse repo rate at 3.35%.

Das said RBI projected the GDP growth in 2021-22 at 10.5%.

Here are more details.

Statement

Monetary Policy Committee unanimously decided to let key rates be

Das, who heads the Monetary Policy Committee (MPC), said the body favored keeping the key rates as it is.

It also decided to maintain the accommodative policy stance.

It was in March 2020 that the nation's top bank slashed the repo rate by 115 basis points to help the economy, jolted by the outbreak of coronavirus and subsequent lockdown.

What he said

2020 tested our ability, 2021 begun on strong note: Das

In a bid to infuse optimism, Das claimed that 2021 begun on a strong note, adding that the consumer confidence is reviving, and the outlook on growth has improved.

"2020 tested our capability, 2021 is setting the tone for a new economic era. Inflation has eased below the tolerance level of 6 percent," he said.

The need of the hour is to support growth.

What he said

Surge in crude oil prices drove hike in petrol rates

Das disclosed that capacity utilization in the manufacturing sector increased to 63.3% in Q2 as opposed to 47.3% in Q1. He said foreign direct investment (FDI) also surged in recent times.

"Going forward, we see the Indian economy moving in only one direction i.e. upward," he stated.

For petrol and diesel becoming dearer, Das blamed the surge in crude oil prices.

Details

Retail investors poised to get direct access to G-Sec markets

Further, in what was dubbed as a major structural reform, RBI plans to give retail investors access to the government bond market, both primary and secondary.

Retail investors would be allowed to open these accounts directly with the central bank.

Das claimed India is one of the few nations to give such an access to retail investors. The road map will be revealed later.