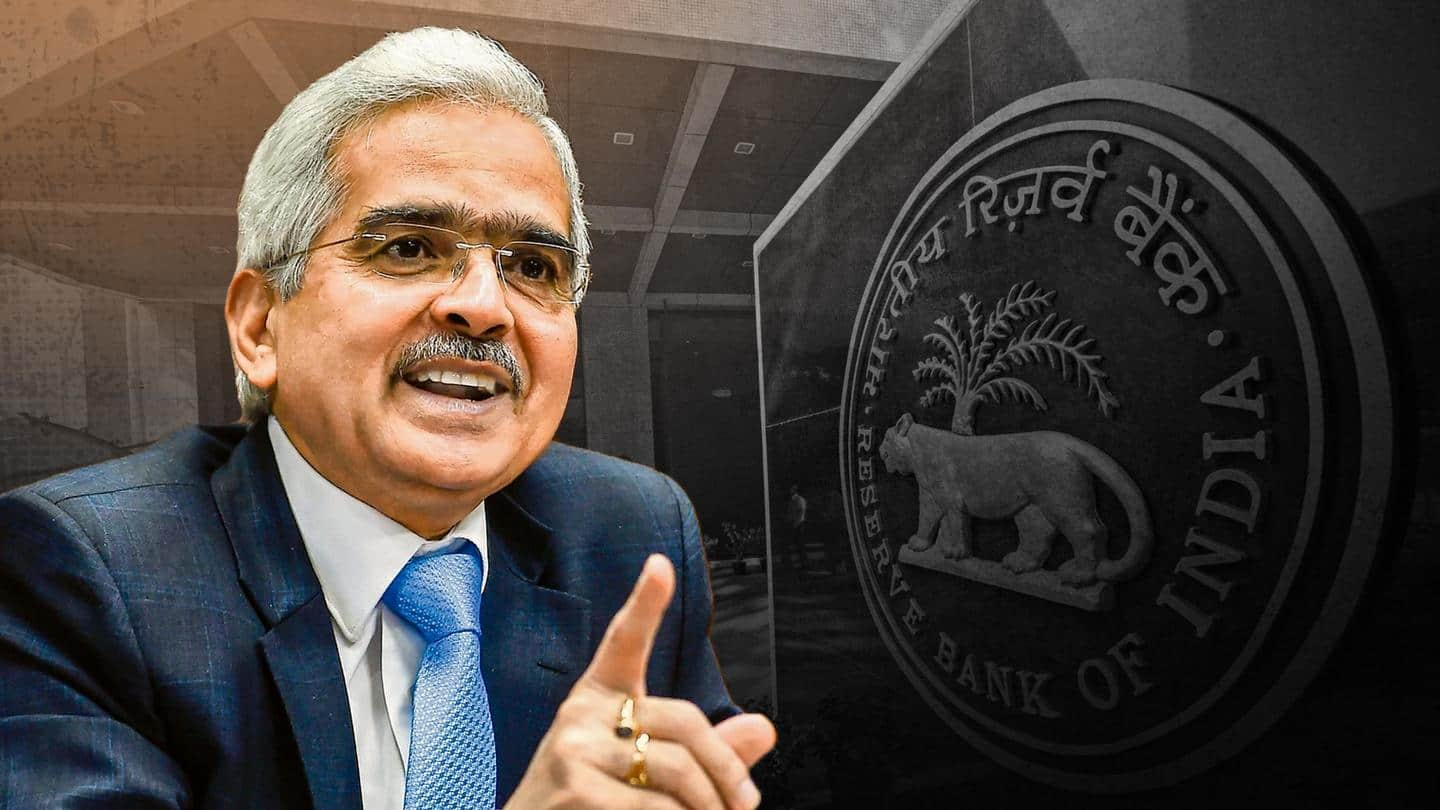

Monetary policy: RBI hikes repo rate by 50bps to 5.9%

What's the story

The Reserve Bank of India (RBI) hiked the repo rate by 50 basis points (bps) to 5.9% on Friday, Governor Shaktikanta Das announced.

The announcement comes only a month after the RBI hiked the lending rate by another 50bps. This is the fourth hike by the central bank this fiscal year.

India's economy is expected to grow at 7%, the governor added.

Context

Why does this story matter?

The RBI hiked the repo rate by 40 bps in May, and 50 bps in June and August.

The announcement puts the lending rate at a three-year high, amid a troubling time for our economy.

According to retail analytics platform Bizom, prices of India's daily grocery items have increased by 10-22% since January 2022. This, as the Rupee falls historically against the US Dollar.

Update

What did the RBI Governor say?

The 0.5% hike to 5.90% is driven by aggressive global central bank policies, elevated inflation, and financial markets' turmoil.

"All segments of the financial markets are in turmoil globally," Governor Das said, adding that US Dollar's hike, elevated energy and food prices, and debt distress pose challenges.

The governor, quoting Mahatma Gandhi in his address, said, "We are wakeful, ever vigilant, ever-striving."

Inflation

What are the inflation projections?

Inflation, currently at around 7%, is expected to remain around 6.7% in the second half of 2022.

He added, "If high inflation is allowed to linger, it triggers second order effects and unsettled expectations. The RBI will remain focused on withdrawal of accommodative monetary policy."

Further, he said, a slew of measures have been taken against daunting challenges arising due to geopolitical tensions.

Twitter Post

SDF, MSF rates adjusted

Standing Deposit Facility(SDF) rate stands adjusted to 5.65% MSF(Marginal Standing Facility) bank rate to 6.15%. Monetary Policy Committee(MPC) decided to remain focused on withdrawal of accommodation to ensure inflation remains within target going forward,supporting growth:RBI pic.twitter.com/UKt2znnpQg

— ANI (@ANI) September 30, 2022

GDP

What are RBI's GDP projections?

Notably, according to the RBI, India's Gross Domestic Product (GDP) grew by 13.5% in the first quarter of this year.

"This turned out to be lower than expectations...but perhaps the highest among the major global economies," Das said.

The real GDP for FY23 was pegged at 7%, lower than the August projection of 7.23%.

Quote

RBI Governor on Rupee depreciation

On the falling rupee, Governor Das said, "During the current FY upto Sept 28, the US dollar has appreciated by 14.5% against a basket of major currencies. The movement of the Indian Rupee has however been orderly compared to most other countries."

He added that the Indian Rupee has depreciated by 7.4% against the US Dollar.