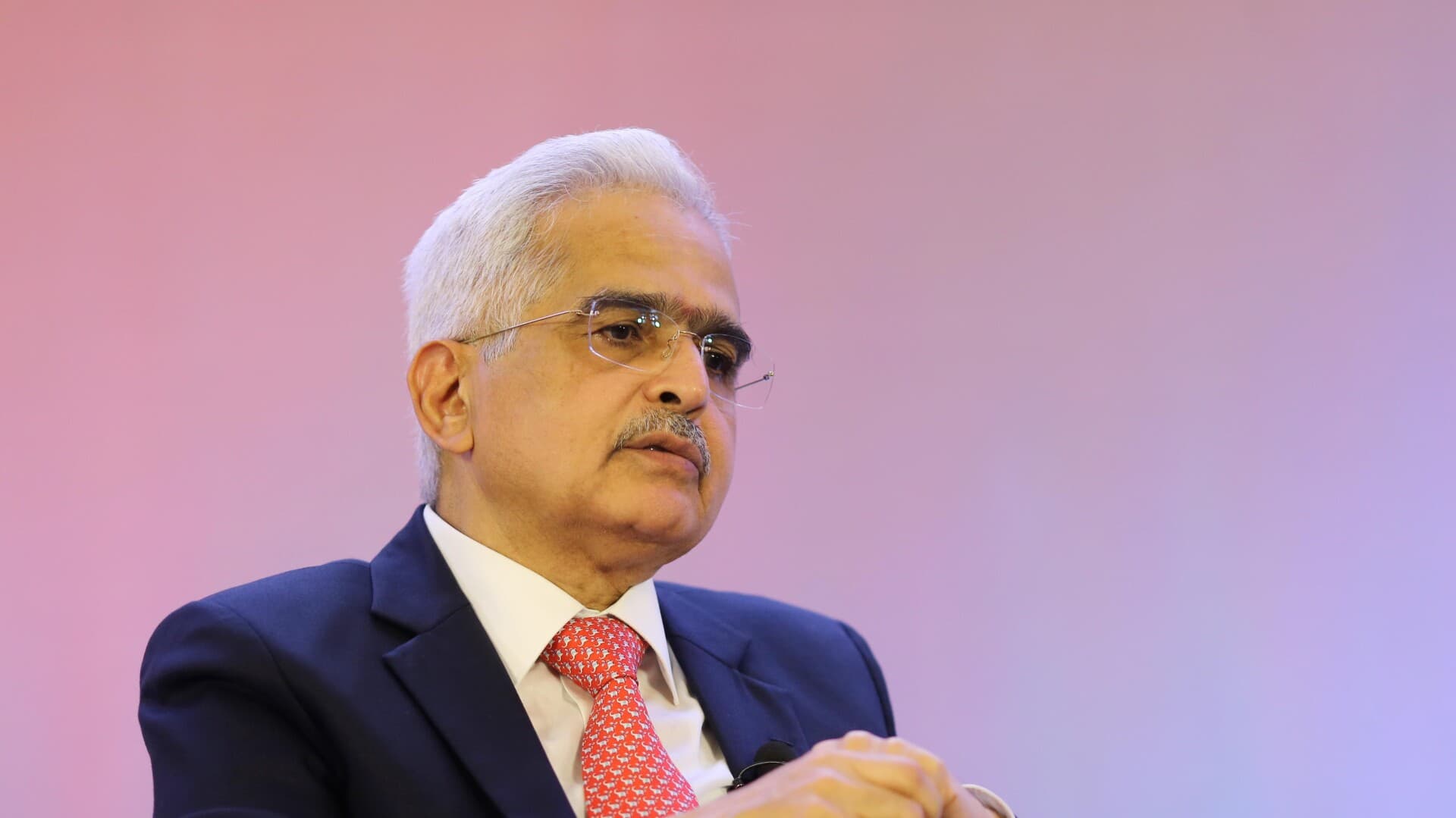

Is RBI Governor Shaktikanta Das staring at an exit?

What's the story

The future of Reserve Bank of India (RBI) Governor Shaktikanta Das is under the scanner amid one of the biggest GDP growth misses in recent Indian history.

Das's term ends next week and no extension has been announced yet.

The uncertainty comes after data showed the Indian economy expanded by 5.4% between July and September, much lower than the RBI's projected 7%.

Rate debate

Calls for interest rate cut intensify

Despite the uncertainty over Das's tenure, the Indian government has been pushing for an interest rate cut.

A poll showed that 36 of 43 economists expect the central bank to keep its benchmark repurchase rate unchanged at 6.5%—a level it has maintained for almost two years.

India's inflation had reached a 14-month high in October, mainly due to skyrocketing food prices.

Action call

Economists urge RBI to act following GDP miss

Radhika Piplani, an economist with DAM Capital Advisors Ltd., called the economic slowdown a "wake up call for the RBI."

She noted that the next rate decision would be watched closely given its effect on GDP.

Piplani cautioned that if the central bank doesn't ease now, it may have to make a bigger-than-expected cut in February.

Role scrutiny

Debate over RBI's role in supporting economy intensifies

The growth slump has further fueled conversations around the RBI's intervention to support India's economy, especially with core inflation remaining low.

Both Finance Minister Nirmala Sitharaman and Commerce Minister Piyush Goyal have been pushing for lower borrowing costs of late.

Some economists even believe that the RBI could do more to encourage lending and spur growth.

Rate stance

Das rules out immediate rate cut amid inflation risks

Despite adopting a neutral policy stance, Das ruled out an immediate rate cut last month.

He cited significant inflation risks from rising global commodity prices and ongoing geopolitical conflicts as reasons for this decision.

Following the release of the latest quarterly GDP figures, economists have revised their growth estimates for the year through March 2025.

Warning

Economists warn against delaying policy rate cuts

Economists are also warning against waiting too long to cut policy rates.

IDFC First Bank's Chief Economist Gaura Sen Gupta advised against waiting till February for such cuts because of transmission lags.

Deutsche Bank's Kaushik Das expects the RBI to first cut the cash reserve requirement to improve liquidity, ensuring a quick transmission once the repo rate is cut.

Tenure

Uncertainty surrounds RBI officials' tenure

It's unclear which of the three senior RBI officials in the six-member monetary policy committee will stay on in February, with Das's contract expiring on December 10.

Deputy Governor Michael Patra, a member of the rate-setting panel since its inception in 2016, also has his term ending next month.

This uncertainty adds to the challenges faced by the central bank at a time, when both growth and inflation have significantly deviated from their projected trajectory.