RBI, Bank of England sign MoU on Clearing Corporation cooperation

What's the story

The Reserve Bank of India (RBI) and the Bank of England (BoE) have joined forces by signing a Memorandum of Understanding (MoU).

This collaboration aims to exchange vital information regarding the Clearing Corporation of India Ltd (CCIL).

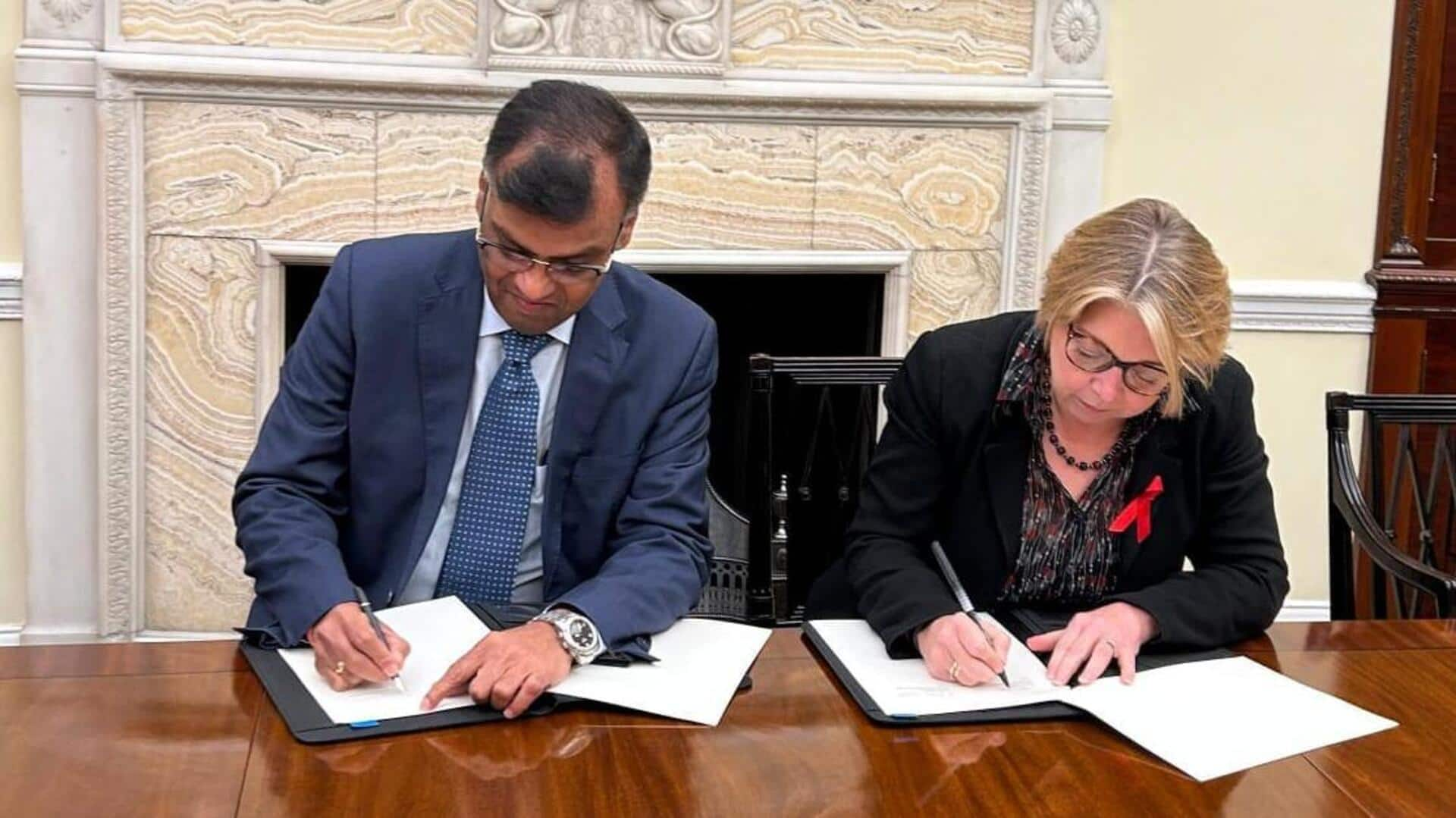

RBI Deputy Governor T Rabi Sankar and BoE Deputy Governor for Financial Stability Sarah Breeden signed the MoU in London, creating a strong foundation for cooperation between the two central banks.

Details

MoU enables BoE to rely on RBI's regulatory activities

This partnership enables BoE to depend on the regulatory and supervisory activities of the RBI, ensuring the stability of the UK's financial landscape.

The agreement emphasizes the significance of cross-border collaboration in promoting international clearing activities and demonstrates the BoE's dedication to respecting the regulatory regimes of other authorities.

The RBI stated in an official announcement, "This MoU confirms the interests of both the authorities in enhancing cooperation in line with their respective laws and regulations."

What Next?

MoU crucial for CCIL's recognition as third-country CCP

One key aspect of the MoU is its role in evaluating CCIL's application for recognition as a third-country central counterparty (CCP).

This recognition is essential for UK-based banks to participate in transactions cleared through CCIL.

The signing of this MoU strengthens the mutual interests of both authorities in improving cooperation.

This agreement allows the BoE to effectively assess CCIL's application.