How Razorpay's 'Turbo UPI' differs from standard UPI payment solutions

What's the story

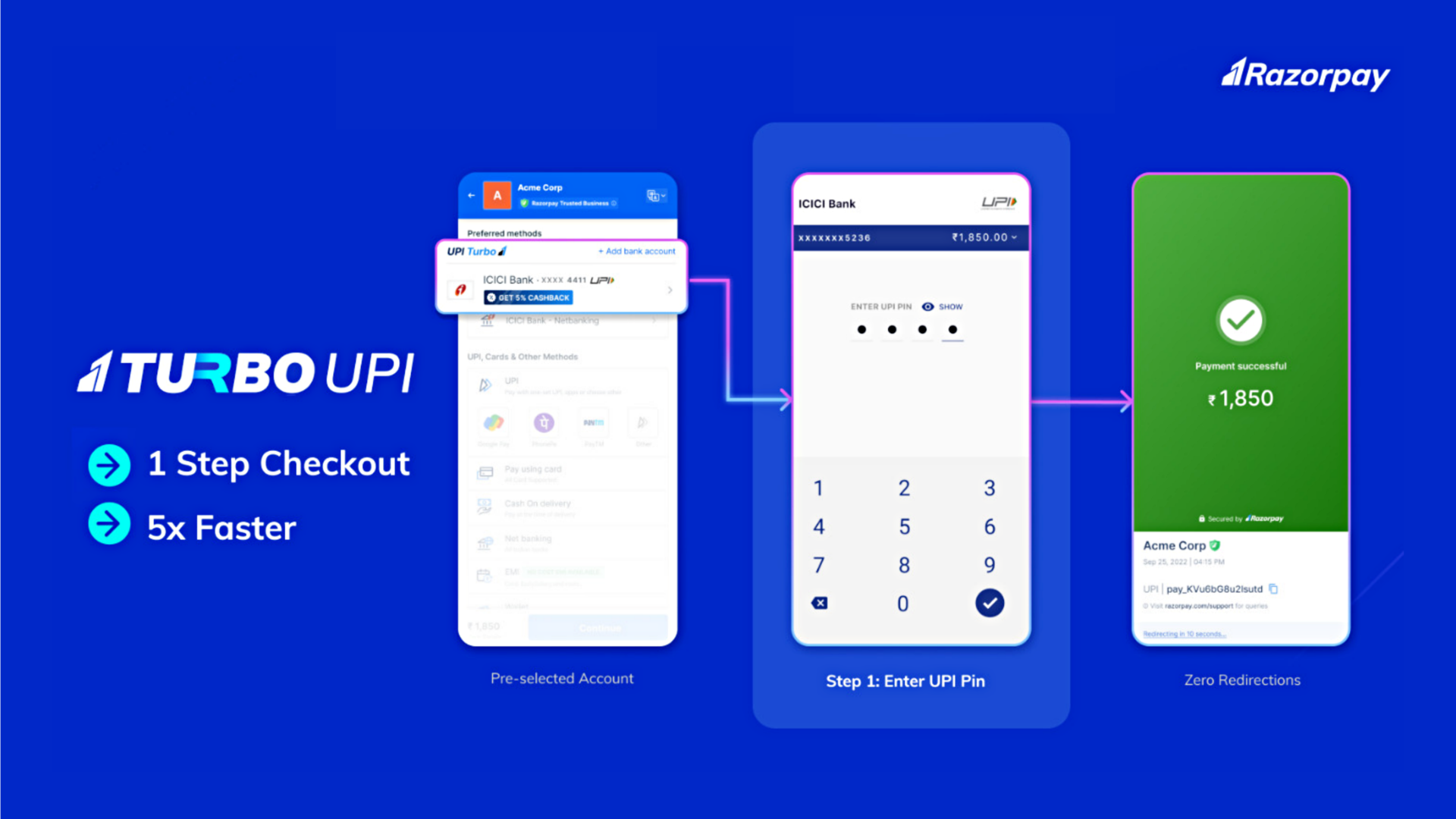

Razorpay has introduced 'Turbo UPI,' in collaboration with the National Payments Corporation of India (NPCI) and Axis Bank. Touted to be India's fastest one-step solution for UPI payments, it is targeted at businesses for seamless transactions. According to Razorpay, the service will allow customers to make payments without being redirected to a third-party app during the checkout process.

Context

Why does this story matter?

Days after Paytm launched the UPI SDK (Software Development Kit), fintech unicorn Razorpay has introduced the 'Turbo UPI,' which is a one-step payment solution for the UPI network. This will help businesses achieve a better success rate for UPI payments by around 10%. Razorpay asserted that Turbo UPI would provide a quicker payment experience, by preventing redirection to other payment apps.

Process

How does Turbo UPI differ from standard UPI payments?

Razorpay's Turbo UPI assures a single-step UPI payment experience for customers, in contrast to the five-step procedure followed by standard UPI payments. With Turbo UPI, the payment process is 5x faster, as you don't need to switch from the merchant app to UPI app, authorize the UPI app, select the account, enter UPI Pin, and then get redirected back to the merchant app.

More

Transactions can be done without leaving the app

With Turbo UPI, a pre-selected UPI account is already present in the app. You can simply enter the UPI Pin to authorize the transaction, without leaving the application. According to Razorpay, Turbo UPI provides 'granular' insights into the end-users drop-off pattern. It also gives retailers/merchants end-to-end control over the entire payment experience of their customers.

Official

'The scope of non-technical transaction errors is reduced'

Commenting on the launch, Shashank Kumar, co-founder and MD at Razorpay said, "We wanted to build a solution that not only made the end-users UPI payment experience fast/frictionless but will also help businesses with a significant increase in success rate by 10% for UPI transactions." "Turbo UPI reduces the scope of non-technical errors that can lead to drop-offs, and boosts UPI transactions," he added.

Scenario

Turbo UPI has already found a user base

While UPI is expected to take the lead as the most preferred digital payment solution, companies/businesses are still looking to lower their reliance on third-party apps and address the lack of visibility into customer drop-offs during the payment process. Turbo UPI is now being used by platforms such as Tata StarQuik, Ixigo, Trainman, Ferns N Petals, and Dhan, among others.