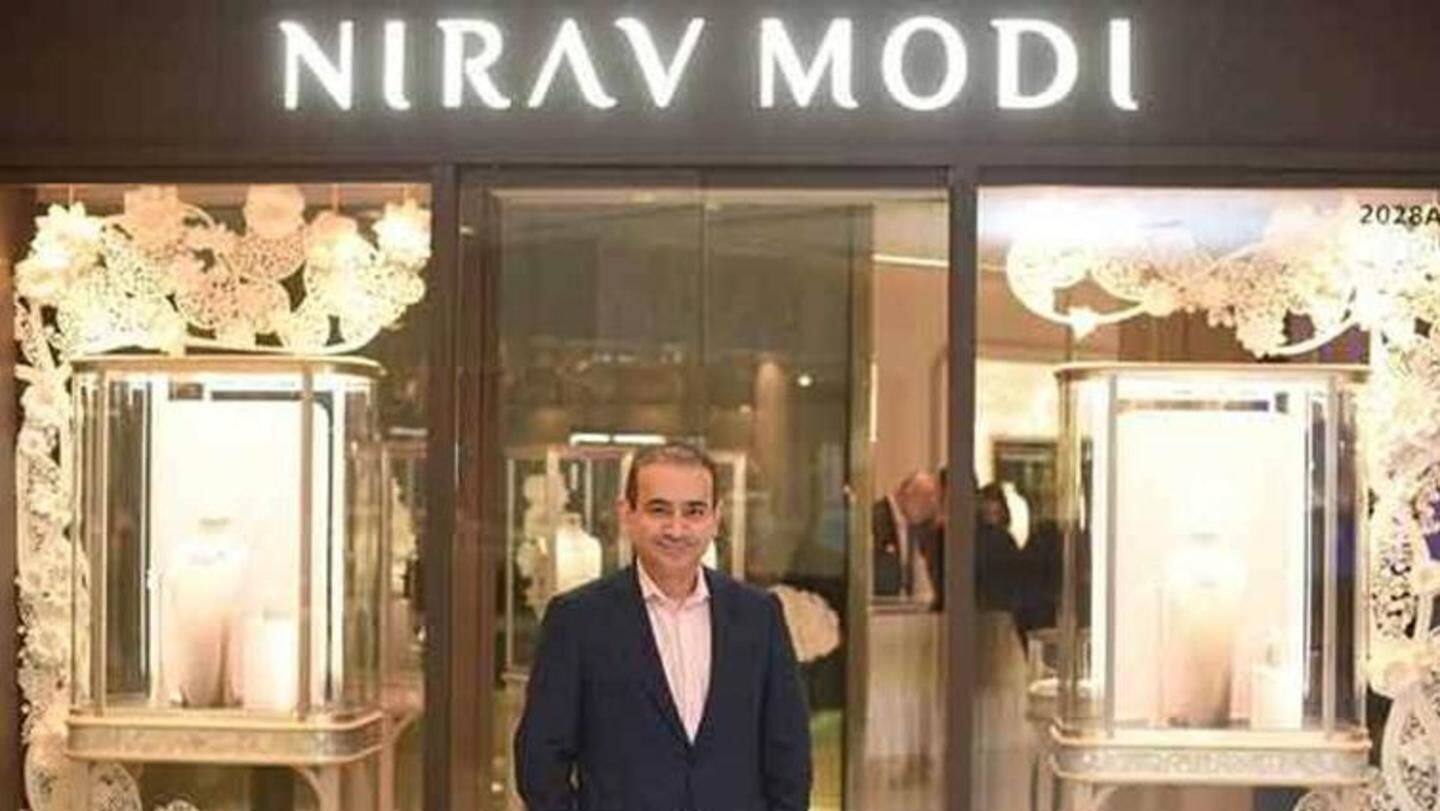

Is the net finally closing in around Nirav Modi?

What's the story

The Enforcement Directorate has provisionally attached Rs. 170cr worth of assets belonging to Nirav Modi in connection with the Rs. 13,400cr PNB scam. Meanwhile, the CBI is likely to approach Interpol for a red corner notice against Nirav Modi and Mehul Choksi for bringing them back to face trial. Modi was reportedly spotted in London on Monday. Is the net finally closing in around Modi?

Attached assets

Details of the assets provisionally attached by the Enforcement Directorate

The attached assets include four properties owned by Modi's firms in Mumbai and Surat, worth Rs. 76cr, including the HCL House in Andheri worth Rs. 63cr. The ED also attached 108 bank accounts worth Rs. 58cr belonging to Modi, his brother Neeshal Modi, and their firms. It further attached investments in shares of public companies worth Rs. 35cr belonging to Modi's firms.

Information

The Enforcement Directorate is turning the heat up on Modi

In March, the ED had attached Rs. 523cr worth of assets belonging to Modi. The agency will also file its first complaint against Modi this week, and is likely to move court seeking confiscation of Modi's assets under the Fugitive Economic Offenders Bill, 2017.

Interpol notice

Interpol notice can restrict Nirav Modi's globetrotting

Meanwhile, on Sunday, CBI said that it's likely to approach Interpol for red corner notices against Modi and Choksi. The issuance of a red corner notice will allow participant countries in the Interpol to issue arrest warrants for Modi and Choksi on their own soils. It's believed Modi is globetrotting - he was spotted in Dubai, Belgium, and Hong Kong prior to London.

Do you know?

Why an Interpol notice would pin Nirav Modi down

At present, 192 out of 195 nations in the world are part of Interpol's global network. Every member country maintains a National Central Bureau (NCB), staffed by national law enforcement officers, which works in tandem with other countries' NCBs to work on cross-border investigations.

Modi's associates

Involvement of PNB officials is becoming increasingly clear

The CBI also accused Usha Ananthasubramanian, MD & CEO of PNB from 2015-17, and other senior PNB officials for colluding with Modi, Choksi and associates. Following PNB's statement that SWIFT messages (which were used to indicate the LoUs which had been issued) could not be issued without proper authorization, the CBI concluded that officials were aware of the fraud, but misled the RBI.

Willful negligence?

PNB, under Ananthasubramanian, had ignored the RBI's warnings and directives

What the CBI was referring to is a 2016 fraud case where PNB Dubai extended $6.36mn in buyer's credit against Letters of Undertaking (LoUs) fraudulently issued by the Indian Overseas Bank, Chandigarh. Subsequently, in August 2016, the RBI had issued warning notices, and had asked all banks to report any such incidents. PNB had responded in February 2018, after the PNB scam was discovered.

Do you know?

RBI had sought specific clarification from PNB about LoU procedures

Notably, the RBI had also issued an urgent questionnaire to PNB, dated 27th August, 2016, asking the bank to specify SWIFT and operational procedures in place for issuing letters of undertaking/comfort and letters of credit, and how PNB reconciled SWIFT and core banking solutions (CBS).