Modi's cryptocurrency meet: Caution over terror financing; 'progressive' steps promised

What's the story

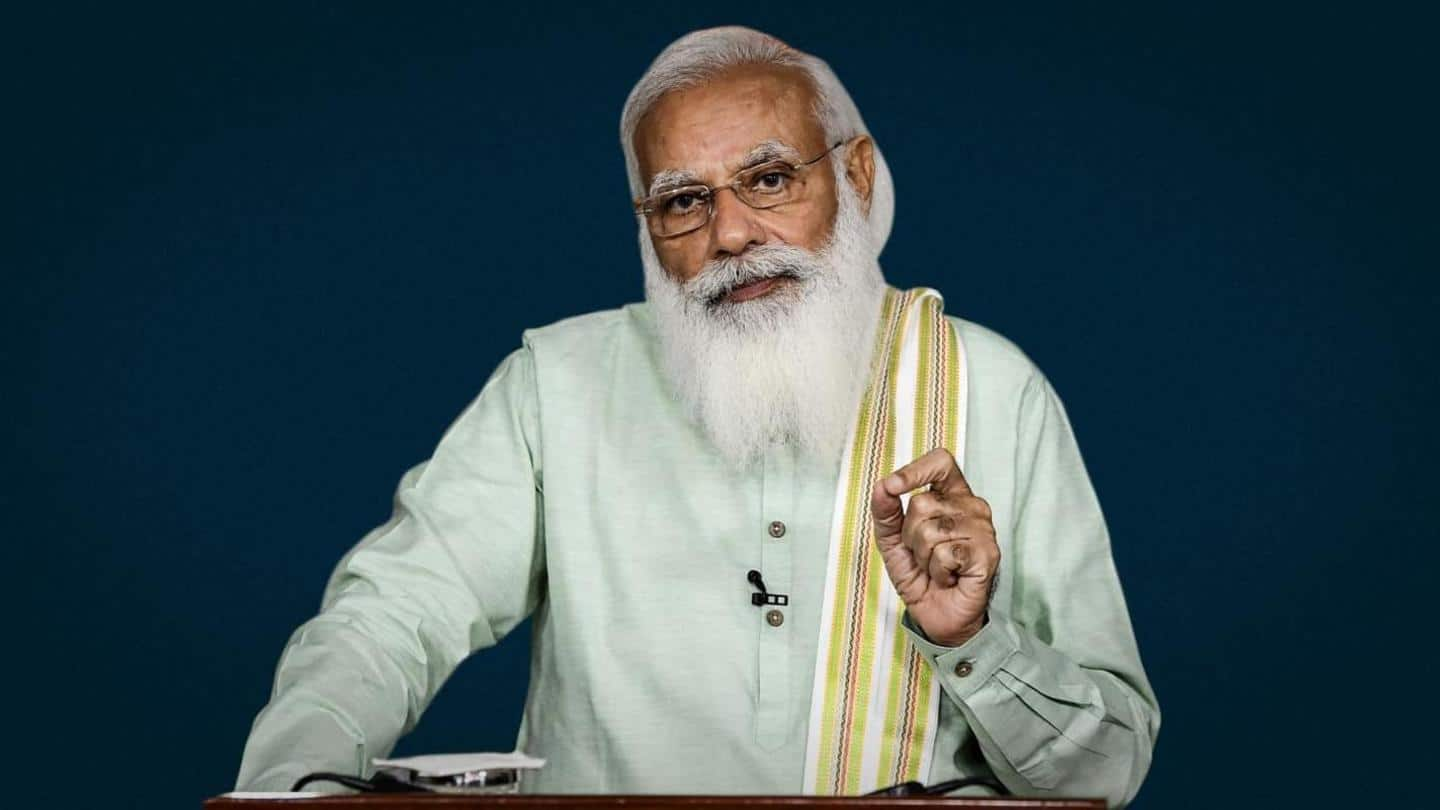

Prime Minister Narendra Modi on Saturday chaired a key meeting on the cryptocurrency sector.

The meeting arrived at a consensus that the government needs to take "progressive and forward-looking" steps while ensuring that an unregulated market does not open avenues for "money laundering and terror financing."

Officials from the Reserve Bank of India, the Finance Ministry, the market regulator SEBI attended the meeting.

Context

Why does it matter?

Industry leaders claim that Indians have over Rs. 6 lakh crore invested in cryptocurrencies.

The government's stand on the issue will decide the fate of crypto markets, that have remained unregulated so far.

The government's moves so far indicate that tough regulatory measures will be taken.

Earlier, the RBI had said that it intended to release an official digital currency.

Details

What was discussed in the meeting?

Concerns about misleading advertisements on cryptocurrencies were raised during the meeting.

These were viewed as "attempts to mislead the youth through over-promising" and "non-transparent advertising," sources told The Indian Express.

Reportedly, the government might initiate regulatory measures to curb the same.

A regulatory framework on cryptocurrencies is reportedly being formulated.

The government reportedly believes a long-term policy would require "global partnerships and collective strategies."

Global

Global crypto regulations discussed

The government also reviewed global examples of regulations on cryptocurrencies.

It took note of China's ban on cryptocurrency transactions and also El Salvador's decision to make Bitcoin a legal tender.

Meanwhile, the United States on Friday rejected changes in regulations that would have permitted the listing and trading of the VanEck Bitcoin exchange-traded fund (ETF).

Information

India's massive crypto market

Crores of Indians have invested over Rs. 6 lakh crore in crypto assets, according to an advertisement by a group of 13 crypto-dealing companies. The group includes the Internet and Mobile Association of India, Blockchain & Crypto Assets Council (BACC), and other companies.

Government

Crypto bill in the offing

The Centre is reportedly set to introduce a comprehensive cryptocurrency bill in the upcoming Winter Session of Parliament

The Parliamentary Standing Committee on Finance has invited cryptocurrency associations and industry experts to hold discussions on cryptocurrency assets on Monday.

The RBI has expressed concerns about these unregulated assets, even instituting a complete ban, which was reversed by the Supreme Court in March 2020.

SEBI

Crypto: Currency, commodity, or security?

Market regulator Securities and Exchange Board of India (SEBI) has also expressed concerns over regulating cryptocurrencies as a financial asset.

Whether cryptocurrencies are a currency, commodity, or security would first need to be clarified.

The SEBI has no control over the "clearing and settlement" of cryptocurrencies and it cannot offer counter-party guarantees as it does with stocks.