How to check your mutual fund portfolio on Paytm?

What's the story

Paytm, India's leading digital payments platform, lets users have a quick look at their entire mutual fund portfolio.

The feature is designed to keep investors updated about their investments and determine if they are in line with their financial goals and risk appetite.

The platform offers detailed reports with information like scheme name, type, benchmark index, manager, folio number, and Net Asset Value (NAV).

Here's how you can check your mutual fund portfolio on Paytm.

Report breakdown

Understanding the mutual fund report

The mutual fund report on Paytm gives a glimpse of every mutual fund scheme. It reveals the performance and portfolio details of the scheme, serving as a "report card" for investors.

The report contains basic details of the fund like scheme name, type, benchmark index, and fund manager.

It also gives a unique folio number to each investment for easy tracking.

Investment insights

Key metrics in the chart

The report on Paytm also details the Net Asset Value (NAV), which is the per-unit market value of a mutual fund's investments.

It indicates the number of units an investor holds in a particular scheme and computes their current value.

The total amount invested over time, either via lump sum investments or SIPs, is also revealed in this detailed report.

Report features

Some additional features

The mutual fund report on Paytm also further calculates the current market value of your investment and shows any gain/loss.

It gives a dividend history (if applicable) and information about the fund's portfolio composition.

The report also gives details on the annual operating costs of a mutual fund (in the form of an expense ratio) and any exit load applicable on redemption within a certain period.

Process

How to read mutual fund report on Paytm?

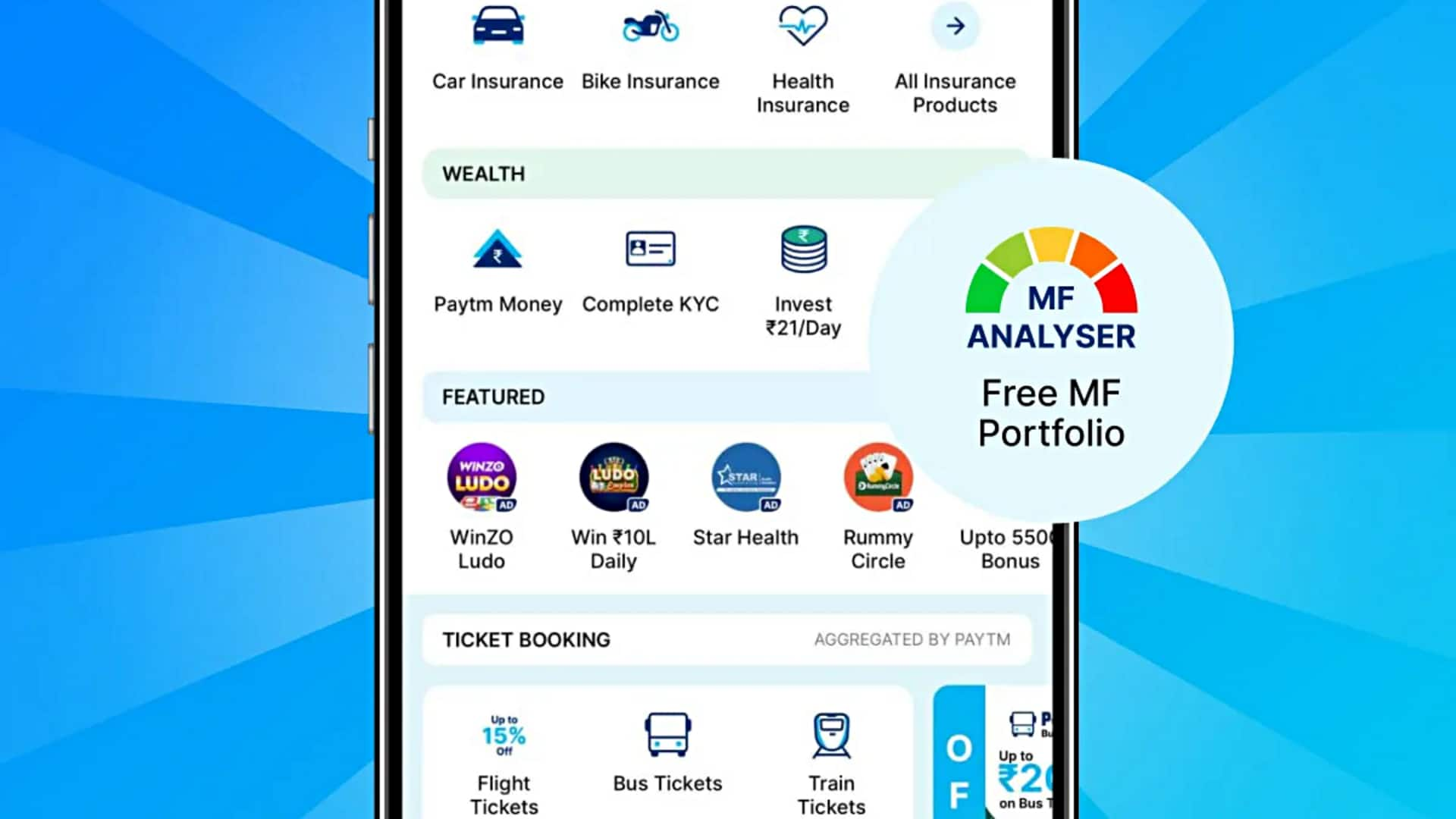

Open the Paytm app, scroll down the homepage, and navigate to the "Stocks and Mutual Funds" section.

Tap on "Free MF Portfolio." Enter your PAN number and select "Generate my free report."

Input the OTP sent via SMS. On the pop-up, click "View your all-in-one report."

Access a comprehensive view of your mutual fund investments and their associated risk levels.

Performance assessment

Importance of evaluating performance

Evaluating a mutual fund's performance is important to understand returns, compare them with benchmarks, and assess risk-adjusted returns.

This evaluation can help you make informed decisions about your investments.

Regularly monitoring fund performance allows you to optimize your portfolio and manage it continuously.

It also helps you track progress toward your financial goals, identify underperforming funds, rebalance your portfolio, and make tax-efficient investment decisions.