Patanjali in talks with investment banks to raise Rs. 1,000cr

What's the story

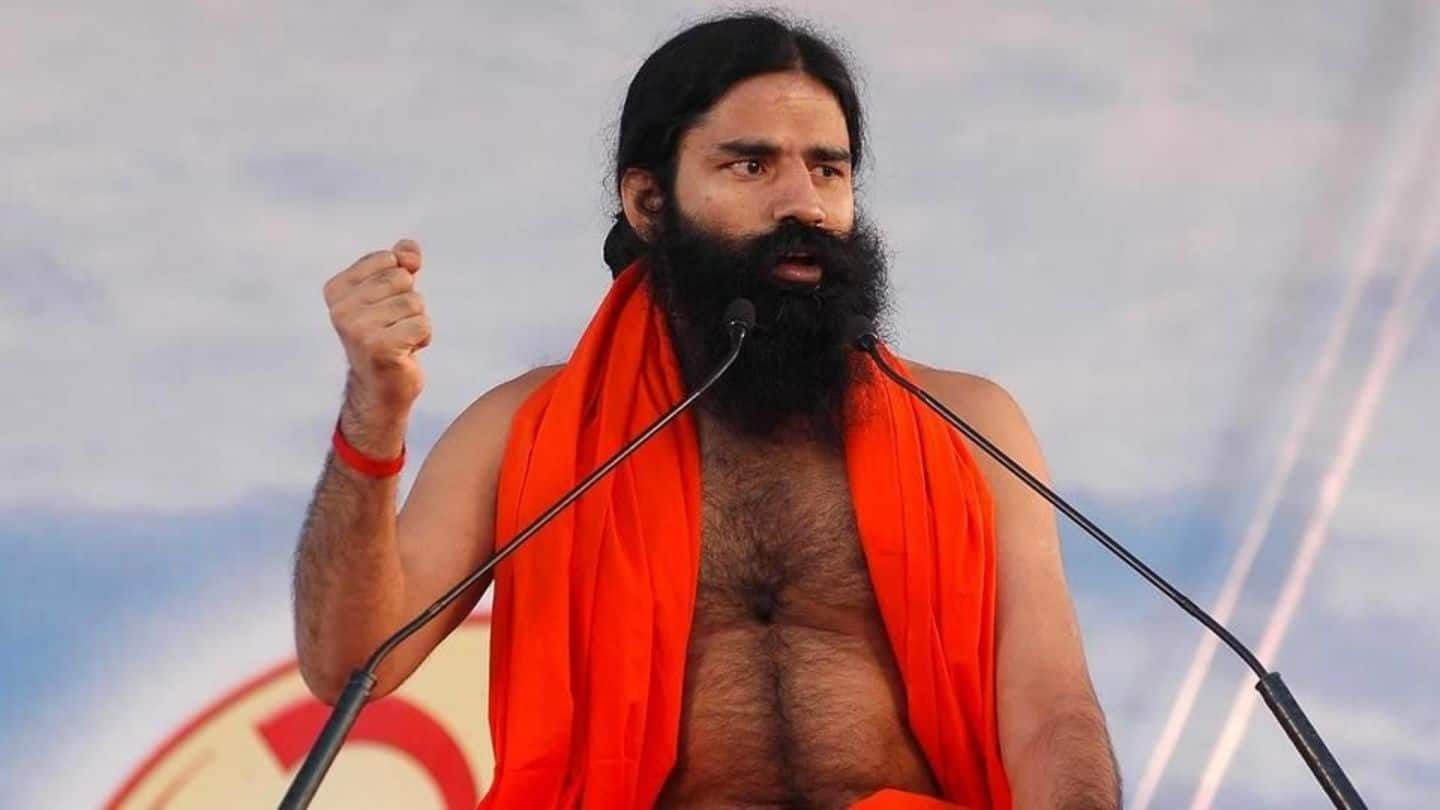

Baba Ramdev's Patanjali is in talks with different banks to raise structured credit of Rs. 1,000cr to expand its business. According to sources, this is significant as it is the first time Patanjali is exploring "an equity-linked fund-raise option". The banks have been asked to approach both domestic and foreign funds. Some have already sent over an initial proposal.

Information

With one major win, Patanjali lobbies for another

Patanjali is in the midst of intense action. In the last two months, it secured the rights to exclusively grow and fix the prices of ayurvedic plants in Uttarakhand; it is currently lobbying for UP's mid-day meal scheme contract worth Rs. 700cr.

Future

What's next for the multi-crore business?

Patanjali is planning to expand its range of products in the near future: among its planned new offerings are a 'swadeshi' line of clothes; and a restaurant chain to take on the likes of KFC and Subway It recently ventured into the Rs. 40,000cr private security business and launched Parakrami Suraksha Private Ltd. It also recently released packaged drinking water bottles, 'Divya Jal'.

Data

Patanjali is a rocketship on an upward trajectory right now

Last fiscal, Patanjali's turnover was Rs. 10,561cr; it is aiming to double it this year. Ad guru Gullu Sen estimates India's ayurvedic-and-yoga-market at $490bn, and Ramdev is ruling it. Brokerage firm IIFL Associates predicts Patanjali's revenue would touch $3bn by 2020.