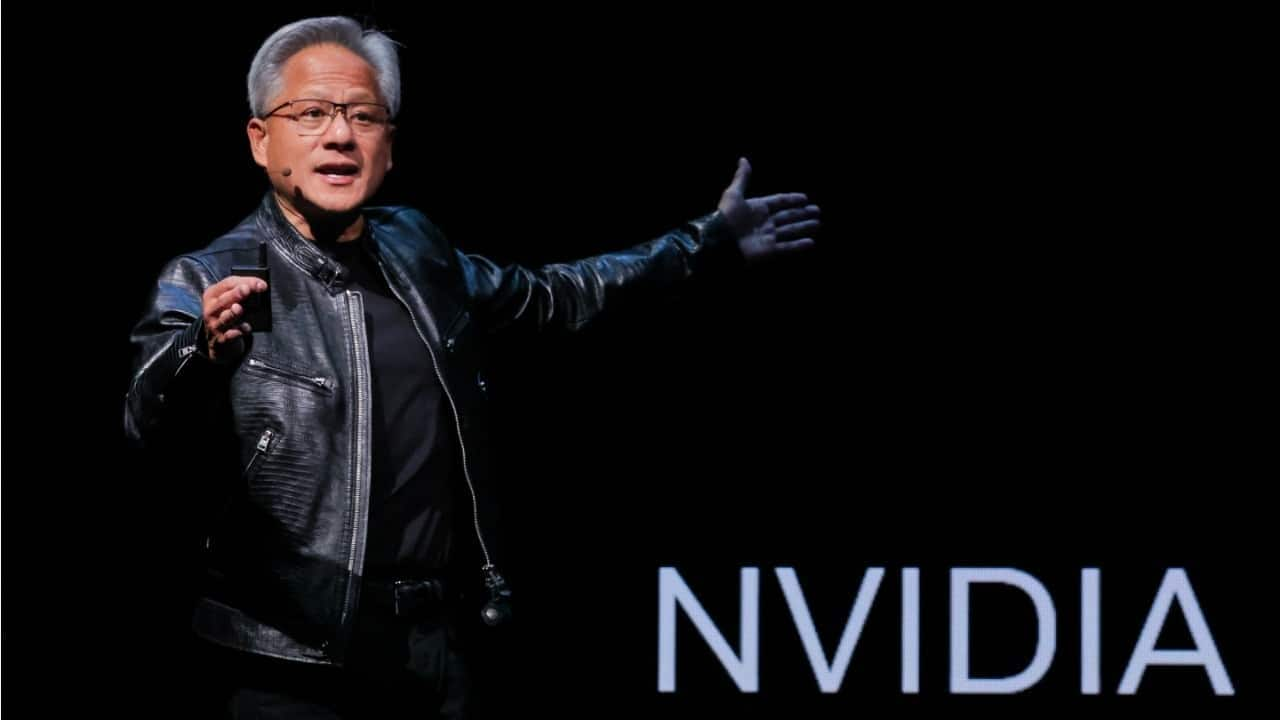

NVIDIA CEO loses $10 billion in biggest wealth wipeout

What's the story

Jensen Huang, the CEO of NVIDIA, has experienced a significant decrease in his net worth due to a slump in chip stocks and an ongoing antitrust investigation by the US Justice Department. On Tuesday, Huang's wealth dipped by approximately $10 billion to $94.9 billion. This marks his largest single-day dollar loss since Bloomberg Billionaires Index started tracking his wealth in 2016. The decline was triggered by a 9.5% fall in NVIDIA's share value.

Investigation deepens

US Justice Department intensifies antitrust probe into NVIDIA

The US Justice Department has intensified its antitrust investigation into NVIDIA, issuing subpoenas as part of the process. These legally binding requests require recipients to provide information related to the case. This move brings the government one step closer to filing a formal complaint against the tech giant. Antitrust officials are reportedly concerned that NVIDIA's business practices may be creating barriers for customers looking to switch suppliers and penalizing those who do not exclusively use its AI chips.

Wealth expansion

Huang's wealth growth and NVIDIA's market position

Despite Tuesday's significant loss, Huang remains the world's 18th richest person. His wealth has increased by $51 billion year-to-date, according to the Bloomberg Billionaires Index. Born in Taiwan and raised in Thailand before moving to the US, Huang co-founded NVIDIA in 1993. The company is currently the world's third-largest firm by market value ($2.65 trillion), behind Apple ($3.38 trillion) and Microsoft ($3.04 trillion).

Market impact

NVIDIA's market value and share price drop

On Tuesday, NVIDIA's shares dropped 9.5% to $108 each, resulting in a $279 billion loss in market capitalization. This marks the largest single-day decline in market value for a US company ever recorded. Since announcing earnings that fell short of high expectations, NVIDIA's shares have declined by 14% over three trading sessions. Despite recent losses, the stock is still up 118% year-to-date (YTD).

Record fall

NVIDIA's loss surpasses Meta Platforms's record decline

NVIDIA's record one-session loss in market capitalization surpassed the $232 billion decline experienced by Meta Platforms on February 3, 2022. Following NVIDIA's quarterly earnings report last week, analysts have revised their estimate for annual net income through January 2025 to $70.35 billion from approximately $68 billion. Despite increased earnings estimates and share price losses, NVIDIA is now trading at 34 times expected earnings, down from over 40 in June and aligning with its two-year average.

Market downturn

Broader market selloff impacts tech stocks

A broader market selloff also impacted other technology stocks on Tuesday, following disappointing economic data. The PHLX chip index saw a significant drop of 7.75%, marking its largest one-day fall since 2020. This decline in chip stocks coincided with broader declines on Wall Street, with the Nasdaq falling 3.3% and the S&P 500 down by 2.1%.s