Ambani, Adani to turn competitors over green energy domination

What's the story

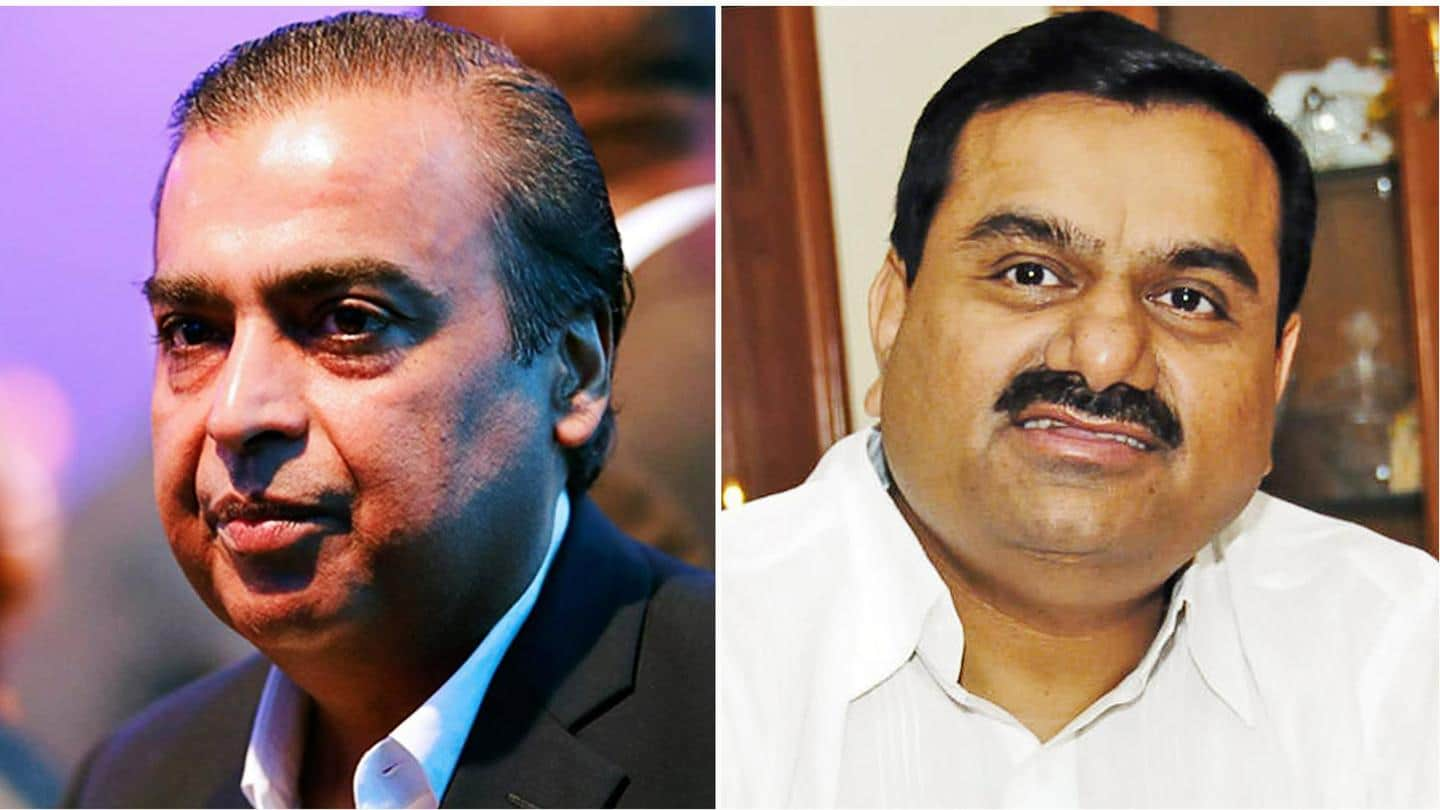

Reliance Industries Limited's renewed interest in green energy may lead to a high-profile corporate face-off between two of India's richest men: RIL's Mukesh Ambani and fellow billionaire Gautam Adani.

According to industry analysts, RIL's $10 billion investment in green energy may drive down solar tariffs in India—where tariffs are already among the world's lowest—and also start a bidding war between the two billionaires.

Reliance

Reliance plans 100 GW solar capacity by 2030

Last month, Ambani announced plans for RIL to build a 100 gigawatt (GW) solar energy capacity by 2030.

Notably, 60% of RIL's revenue currently comes from oil refining and petrochemicals.

Over the next three years, Reliance plans to invest $10 billion in building solar manufacturing units, a fuel cell factory, a battery factory for energy storage, and a unit dedicated to producing green hydrogen.

Adani

Adani to add 5 GW green energy a year

Three days after Ambani's announcement, Adani announced plans to add 5 GW green energy annually for a decade, up from 3.5 GW currently.

Unlike Ambani, Adani is already a prominent figure in the renewables domain through his Adani Green Energy venture.

It currently dominates India's renewable energy sector and its shares soared by 156% in the past year.

Information

India planning to augment 450 GW green energy by 2030

As India is eyeing an ambitious goal of augmenting green energy capacity in the country to 450 GW by 2030, analysts believe both giants are vying to be the frontrunner in this new renewable energy space.

Investors

Going green attractive to investors

Both Ambani and Adani are working to improve their clean-energy credentials since investors focus on the environmental impact of businesses.

Both billionaires have businesses involving fossil fuels (Ambani's refining complex at Jamnagar and Adani's coal-fired thermal stations).

While Reliance is aiming to become net carbon zero by 2035, Adani has not announced plans for any new thermal power plants.

Quote

'Adani has to walk the talk'

However, Adani has faced criticism for developing a coal mine in Australia, doing business with entities allegedly affiliated with Myanmar armed forces, and needs to improve his company's sustainability scores, Tim Buckley—director of energy finance studies at the Institute of Energy Economics and Financial Analysis—told Reuters.

"Financial markets are not agnostic to ESG, so he has to walk the talk," he said.

Tariffs

Tariffs to fall as competition increases

Further, Reliance is notorious for disrupting rival businesses, as evident from the success of its telecom venture Jio.

Industry experts say aggressive bidding wars to win projects between the two billionaires may drive down tariffs.

"I would expect by 2030 India's solar tariffs will probably touch Re. 1/kilowatt hour," said an industry expert. It is currently the world's lowest, at Rs. 2/KW hour.

Impact

Coal-based power may decline drastically

However, with Ambani and Adani's decision to go green, coal-based power generation in India may drop significantly, say analysts.

India is currently the world's third-biggest producer of greenhouse gases.

A senior analyst at consultancy Wood Mackenzie, Rishab Shrestha, told Reuters that India's coal generation share will likely drop from 70% currently to 50% by the early 2030s.