Maintaining disinflationary monetary policy a must: RBI Governor

What's the story

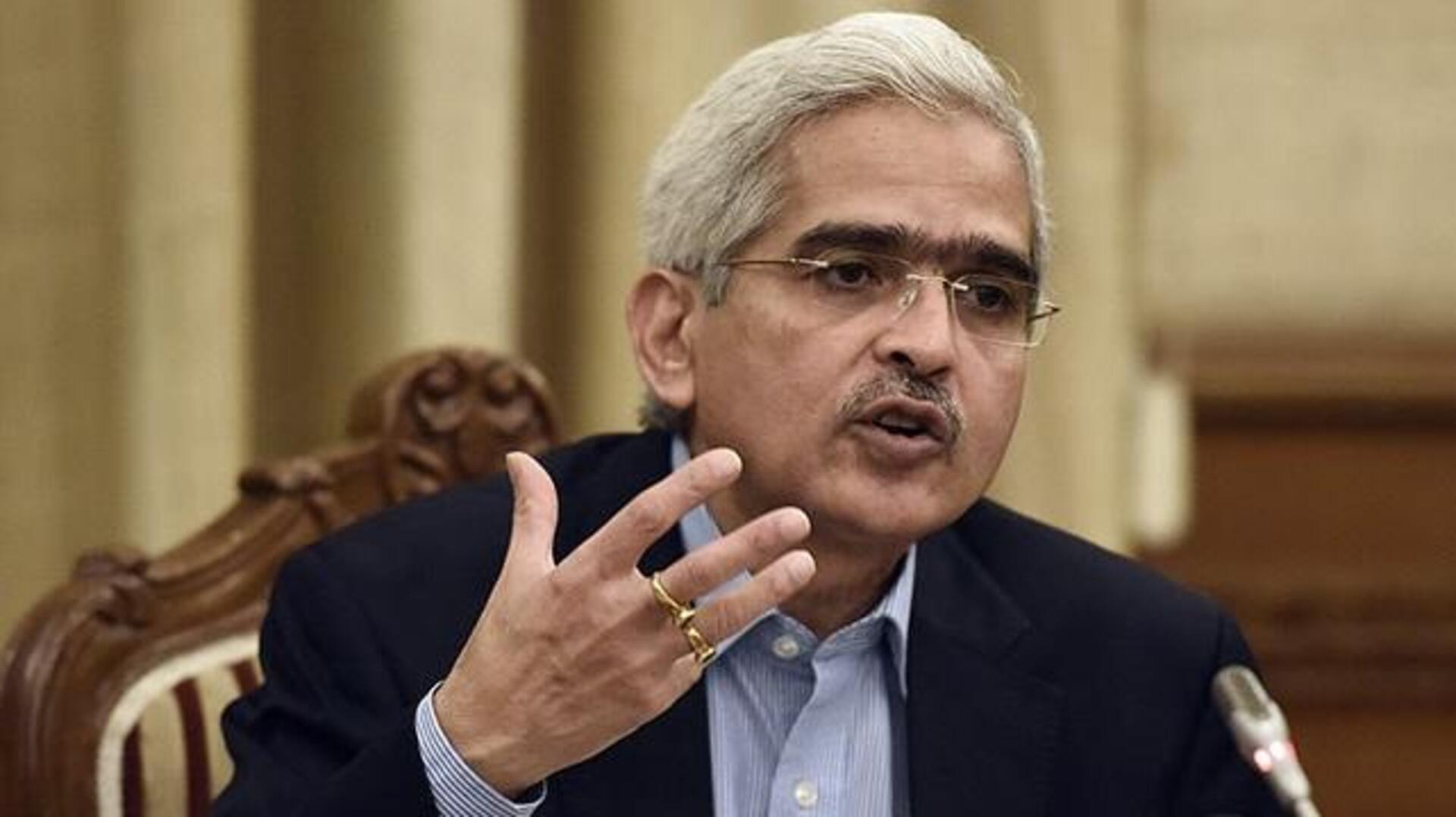

At the recent Kautilya Economic Conclave 2023, Reserve Bank of India (RBI) Governor Shaktikanta Das emphasized that the monetary policy must remain actively disinflationary to ensure that the decline in inflation from its peak of 7.44% in July continues smoothly. Das also discussed global economic challenges, such as inflation, slowing growth, and threats to financial stability. He stressed that monetary policy must not be complacent and that price stability and financial stability go hand in hand.

Details

Retail inflation declined to a three-month low in September

In September, India's retail inflation dipped to a three-month low of 5.02% annually, mainly due to lower vegetable and fuel prices. This decrease brought inflation back within the RBI's comfort zone. The Consumer Price Index (CPI)-based inflation was 6.83% in August this year and 7.41% in September last year. To curb inflation, the RBI has increased the repo rate by 250 basis points since May 2022 but paused rate hikes in February this year.

What Next?

Indian banks' ability to maintain capital requirements

During his speech at the conclave, Das expressed confidence in Indian banks' ability to maintain minimum capital requirements even under stress. He said that India's microeconomic fundamentals and financial sector remain robust despite global challenges and uncertainties. This strength puts India in a good position for sustained growth and stability amid external pressures.

Insights

India's GDP growth projection for current fiscal year

Das shared his optimism for India's economic growth, stating that the country is set to become a new engine of global growth. He expects India to achieve a 6.5% GDP growth rate in the current fiscal year, ending March 2024. In his speech, the Governor also said the global economy is now facing a triad of challenges — inflation, slowing growth and risks to financial stability.