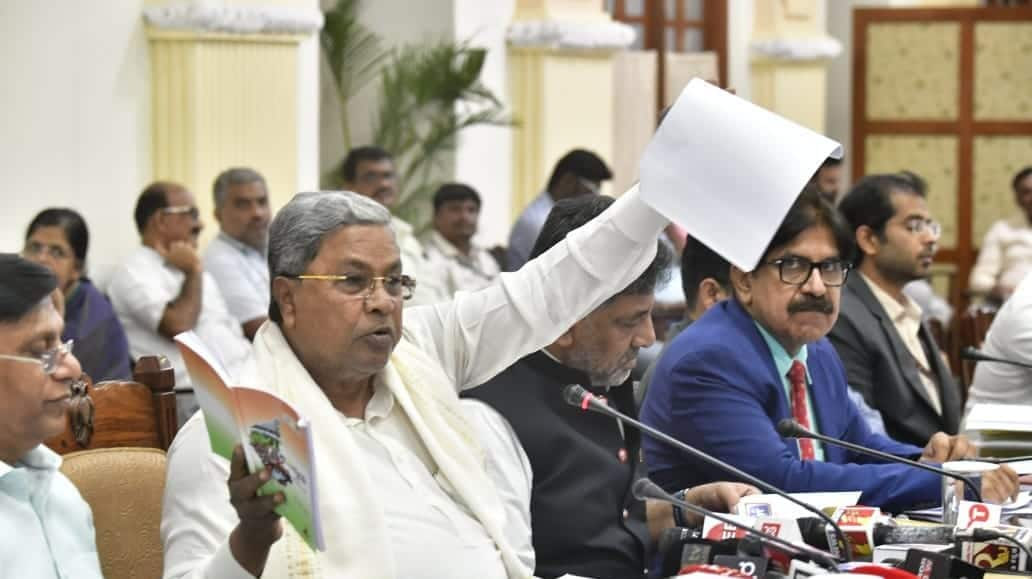

Karnataka lifts ban on SBI, PNB after recovering 'embezzled' funds

What's the story

The Karnataka government has rescinded a previous directive that prohibited its departments from conducting business with the State Bank of India (SBI) and Punjab National Bank (PNB). This decision comes after both banks repaid an 'embezzled amount of ₹22.67 crore,' along with a year's interest. The initial ban was imposed on August 12 by the state's finance department, which instructed all departments, boards, corporations, universities, local bodies and public sector undertakings to cut ties with these two banks.

Fund recovery

Repayment details and circular suspension

The Karnataka government had accused SBI and PNB of being uncooperative in recovering the embezzled ₹22 crore. However, just four days after the ban was enforced, it was temporarily suspended by the government. A government official confirmed that "SBI returned ₹9.67 crore, and PNB returned ₹13 crore, both with one year's interest, pending the outcome of court cases." This repayment led to the permanent withdrawal of the circular by the state government today.

Cases overview

Fraudulent transactions that led to ban

The circular was issued in response to two fraudulent transactions involving these banks. The first case dates back to September 14, 2011, when the Karnataka Industrial Area Development Board made a fixed deposit of ₹25 crore at PNB's Rajajinagar branch. Despite the deposit term expiring, PNB allegedly only released ₹13 crore and failed to provide a resolution for over a decade.

Misuse allegation

Second fraudulent transaction involving SBI

The second fraudulent transaction involved a ₹10 crore fixed deposit by the Karnataka State Pollution Control Board with the then-State Bank of Mysore, which later merged into SBI. The funds from this deposit were allegedly misused to settle a private company's loans using forged documents. These incidents had led to the initial ban on conducting business with SBI and PNB by the Karnataka government's departments.