US: Indian-origin executives convicted on $1 billion corporate fraud charges

What's the story

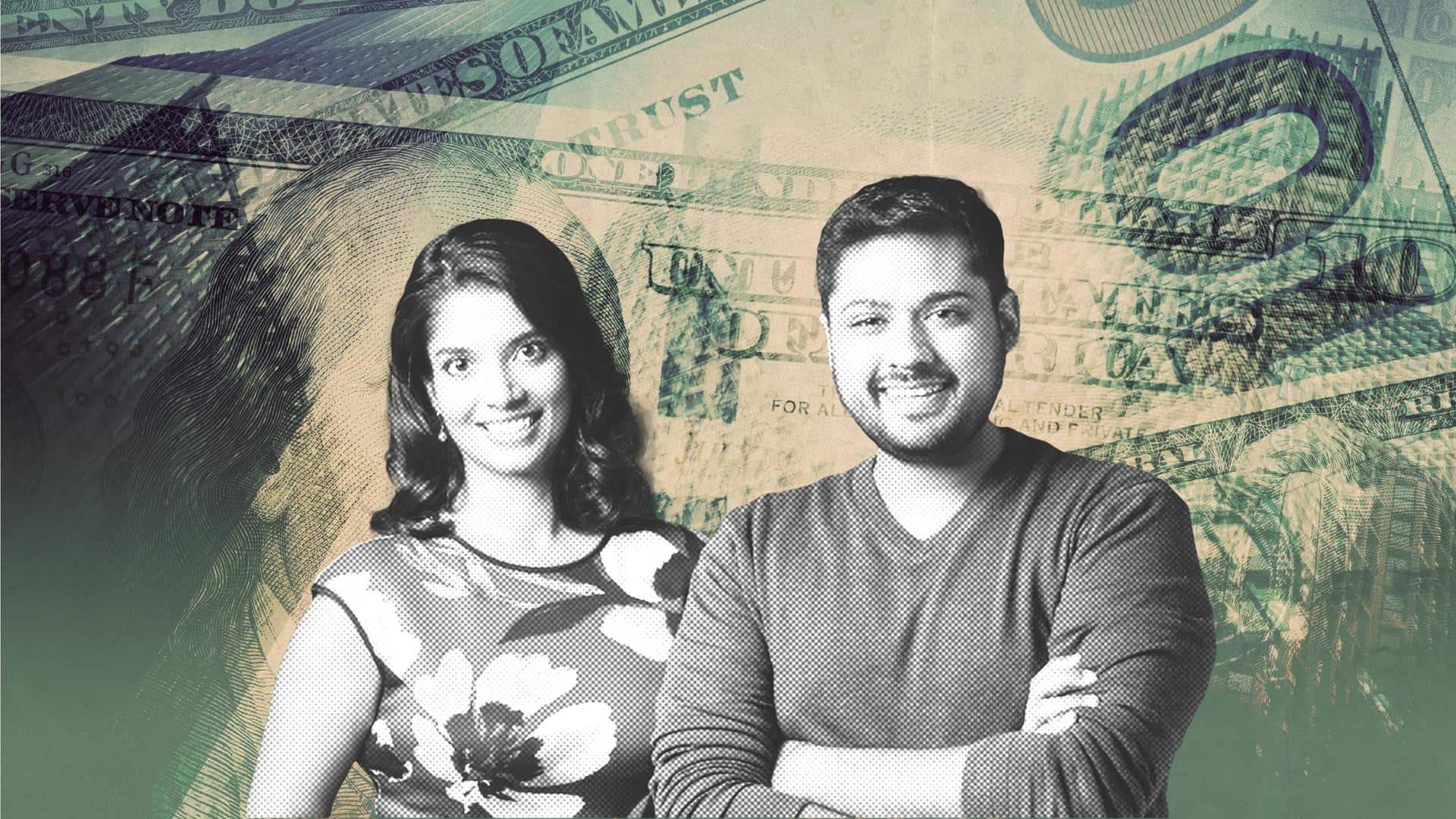

A federal jury in the United States convicted two Indian-origin executives of Outcome Health, a Chicago-based start-up, of running a $1 billion corporate fraud scheme that targeted clients, lenders, and investors. After a 10-week trial, jurors found co-founders Rishi Shah and Shradha Agarwal guilty on multiple counts, according to PTI. Brad Purdy, the company's former chief operating officer, was also convicted in the case.

Details

Three accused face up to 30 years imprisonment

According to sources, the accused, Shah, Agarwal, and Purdy, could face up to 30 years in jail for each act of bank fraud and 20 years for each case of wire and mail fraud. Shah may also reportedly face up to ten years in jail for each money laundering case. The sentencing hearing, however, will take place at a later date.

Company

Corporate fraud involved fake advertising campaign

The startup, Outcome Health, reportedly installed electronic devices in medical offices across the US and sold advertising space on those devices to customers, the majority of which were pharmaceutical corporations. However, the accused lacked and failed to deliver on the planned advertising initiatives. Regardless, they continued to bill consumers as though they had delivered in full.

Information

Accused fooled investors and lenders to cover up fraud

To cover up the under-delivery, they fooled customers by claiming that the company had delivered the content to the number of screens in the clients' contracts. Due to this illegal activity, the company's 2015 and 2016 revenue was overstated, and investors and lenders were duped.

Fraud

Trio raised over $970 million in debt financing

The trio was also accused of using inflated revenue figures in the company's audited financial statements for 2015 and 2016 to secure financing. They reportedly raised over $970 million in debt financing between 2016 and 2017 by deceiving investors and lenders by hiding their ongoing failure to deliver advertising campaigns for clients, resulting in a massive dividend for them.