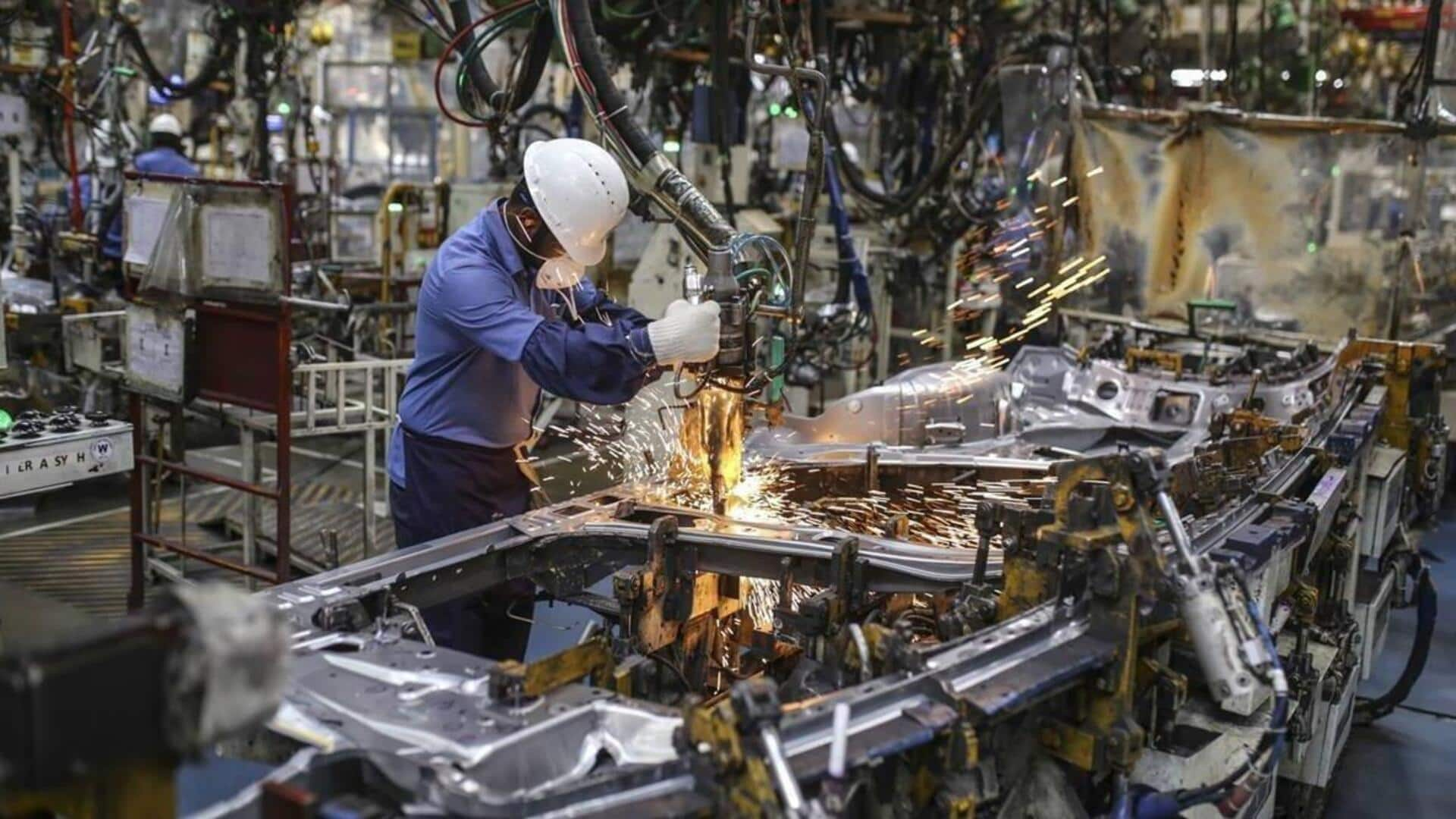

India's manufacturing sector growth falls to 14-month low in February

What's the story

India's manufacturing sector slowed down in February, recording the weakest growth in over a year.

The HSBC India Manufacturing Purchasing Managers' Index, compiled by S&P Global, dropped to 56.3 in February, down from January's 57.7.

This is the lowest reading since December 2023 and a decline from a preliminary estimate of 57.1. The deceleration was due to decrease in demand.

However, despite the dip, the index has stayed above the neutral mark of 50 for an impressive 44 consecutive months.

Demand trends

Domestic and international demand softens

Domestic demand softened with new orders and output sub-indexes hitting 14-month lows.

However, factories reported an increase in technology investment and the initiation of new projects.

International demand also softened last month from a record high seen in January.

Despite these changes, India's manufacturing sector maintained a broadly positive momentum in February, as per Pranjul Bhandari, Chief India Economist at HSBC.

Employment growth

Job creation continues despite slowdown

Manufacturers kept expanding their workforce, extending job creation to a year, albeit at a slightly slower pace than January.

Input costs rose at the slowest rate in 12 months, and the increase in prices charged eased to a five-month low—indicating some costs were passed on to clients.

Retail inflation slowed down to a five-month low in January, supporting expectations of another rate cut from the Reserve Bank of India (RBI).

Future prospects

Business outlook remains optimistic despite slowdown

Despite a slower expansion in goods production, the business outlook for the coming year remained largely unchanged from January and continued to be optimistic.

This positivity is underpinned by favorable demand trends, healthy customer numbers, and marketing efforts as per the survey.

RBI Monetary Policy Committee member Nagesh Kumar had previously stated weakness in manufacturing was a major factor in their decision to cut interest rates last month.