NPCI delays rules that aim to break PhonePe-Google Pay duopoly

What's the story

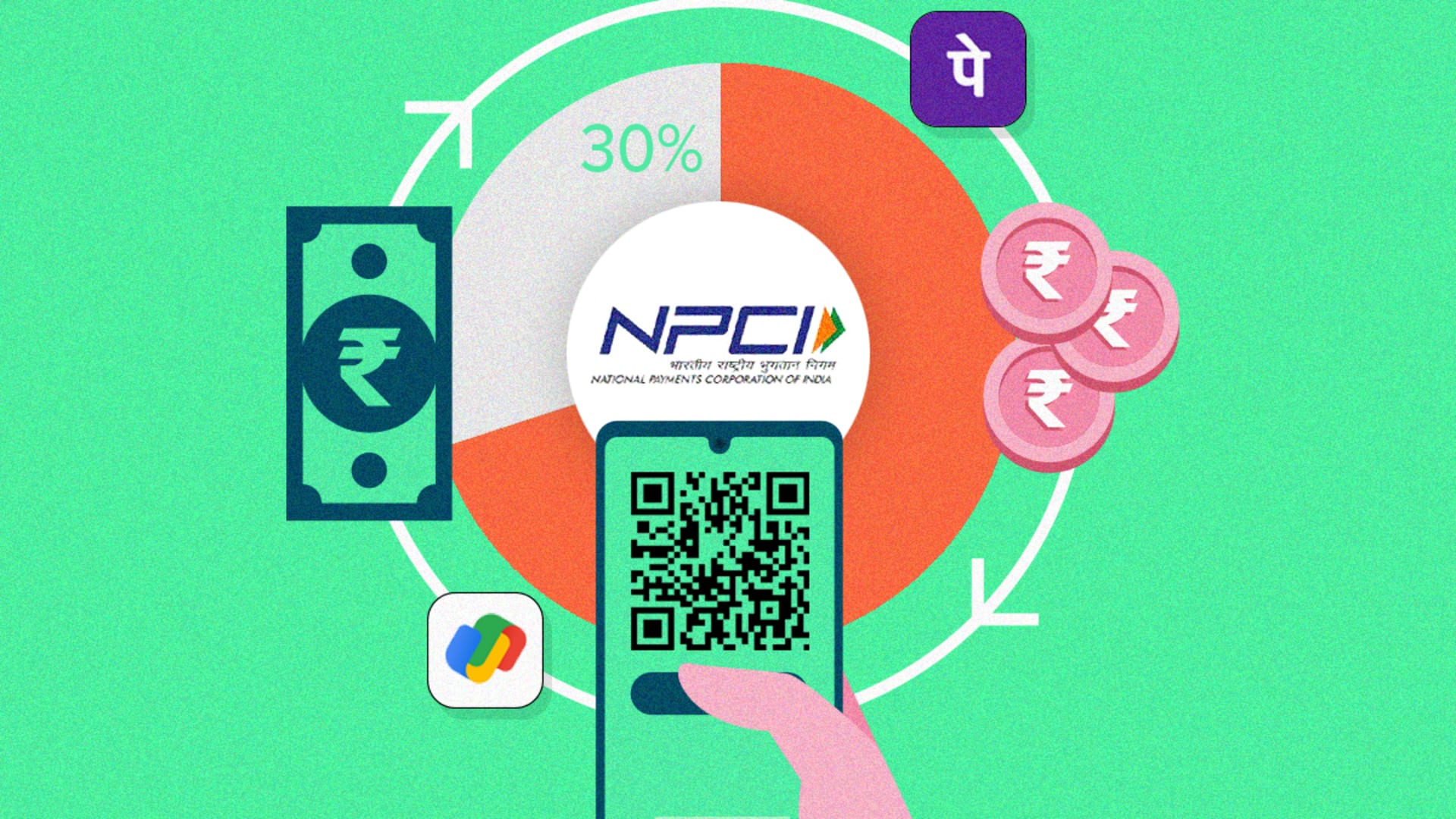

The National Payments Corporation of India (NPCI) has deferred the enforcement of 30% cap on individual app transactions through the Unified Payments Interface (UPI), until December 31, 2026.

The move comes as a temporary relief for industry giants like PhonePe and Google Pay, which currently account for over 85% of UPI transactions.

The delay extends a phase of regulatory uncertainty that has been plaguing the sector for years.

Market impact

UPI: A significant player in India's digital economy

UPI, a digital payments network that handles over 13 billion transactions every month, has become an essential component of India's digital economy since its launch eight years ago.

The NPCI works under the Reserve Bank of India's supervision and is backed by over 50 retail banks.

However, it has struggled to implement market share restrictions without impacting services for millions of Indians using these payment apps daily.

Regulatory journey

A brief history of the market share limits

The idea of market share limits was first proposed in 2020, with an initial deadline later extended to 2025.

The latest decision comes as another delay in India's efforts to rein in the growing clout of global tech giants in its fast-growing digital economy.

For PhonePe, which commands nearly half of India's digital payments market, the extension offers critical clarity as it mulls plans for an initial public offering (IPO).